Intro

Discover what is surcharge fee, extra charges, and additional costs that increase overall expenses, including payment processing fees, convenience fees, and service fees.

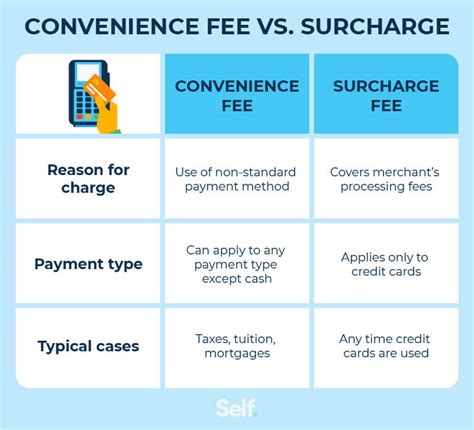

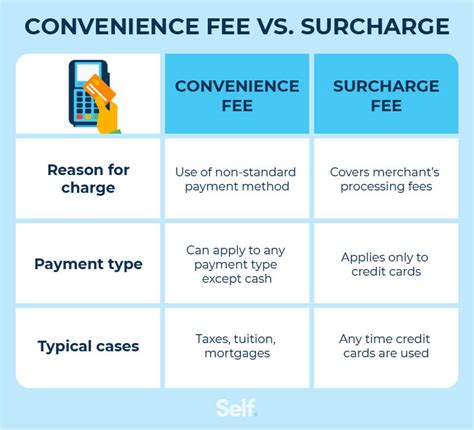

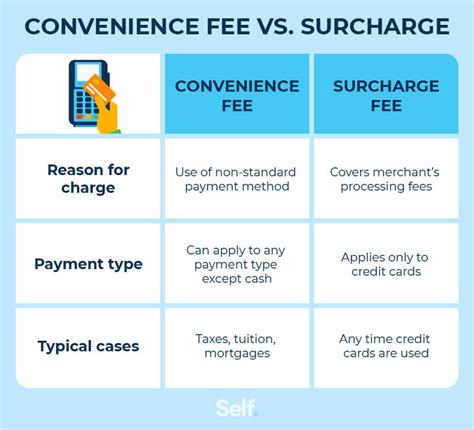

The surcharge fee is a type of fee that is added to the cost of a particular service or product. It is usually implemented to cover additional costs or expenses that are incurred by the provider of the service or product. Surcharges can be found in various industries, including finance, transportation, and hospitality. In this article, we will explore the concept of surcharge fees, their types, and their impact on consumers.

Surcharges are often used to offset increased costs or to generate additional revenue. For example, a credit card company may impose a surcharge on foreign transactions to cover the cost of processing international payments. Similarly, a taxi company may add a surcharge to fares during peak hours to account for increased demand and higher operating costs.

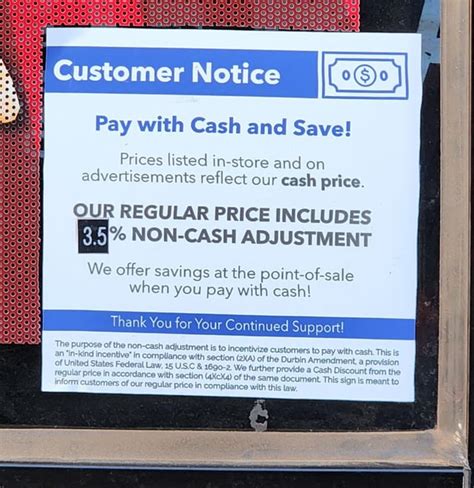

The surcharge fee can be a fixed amount or a percentage of the total cost. It can also be a one-time fee or a recurring fee, depending on the context. In some cases, surcharges may be avoidable, such as when a consumer chooses to use a different payment method or service provider. However, in other cases, surcharges may be unavoidable, such as when they are mandated by law or industry regulations.

Types of Surcharges

There are several types of surcharges that consumers may encounter. These include:

- Foreign transaction fees: These fees are imposed on credit card transactions that involve a foreign currency.

- Late payment fees: These fees are charged when a consumer fails to make a payment on time.

- Overlimit fees: These fees are imposed when a consumer exceeds their credit limit.

- Balance transfer fees: These fees are charged when a consumer transfers a balance from one credit card to another.

- Cash advance fees: These fees are imposed when a consumer withdraws cash from an ATM using their credit card.

How Surcharges Work

Surcharges can be implemented in various ways, depending on the industry and the type of service or product being offered. In general, surcharges are added to the cost of the service or product, and the consumer is required to pay the surcharge in addition to the regular fee.

For example, a restaurant may add a surcharge to the cost of a meal to cover the cost of gratuities for the server. In this case, the surcharge would be added to the total cost of the meal, and the consumer would be required to pay the surcharge in addition to the cost of the meal.

Impact of Surcharges on Consumers

Surcharges can have a significant impact on consumers, particularly those who are on a tight budget. Surcharges can add up quickly, and they can increase the cost of a service or product by a significant amount.

For example, a consumer who uses a credit card to make a purchase may be charged a foreign transaction fee, a late payment fee, and an overlimit fee, in addition to the regular interest rate. These fees can add up quickly, and they can increase the cost of the purchase by a significant amount.

Benefits of Surcharges

While surcharges can be a burden for consumers, they can also have some benefits. For example, surcharges can help to offset the costs of providing a service or product, and they can help to generate additional revenue for the provider.

Surcharges can also help to encourage responsible behavior, such as making payments on time or staying within credit limits. Additionally, surcharges can help to cover the costs of additional services or features, such as insurance or warranties.

How to Avoid Surcharges

There are several ways that consumers can avoid surcharges. These include:

- Using a different payment method: Consumers can avoid foreign transaction fees by using a credit card that does not charge these fees.

- Making payments on time: Consumers can avoid late payment fees by making payments on time.

- Staying within credit limits: Consumers can avoid overlimit fees by staying within their credit limits.

- Transferring balances carefully: Consumers can avoid balance transfer fees by transferring balances carefully and only when necessary.

- Withdrawing cash wisely: Consumers can avoid cash advance fees by withdrawing cash wisely and only when necessary.

Regulations Surrounding Surcharges

There are regulations surrounding surcharges, particularly in the financial industry. For example, the Dodd-Frank Wall Street Reform and Consumer Protection Act prohibits credit card companies from charging excessive fees, including surcharges.

Additionally, the Credit Card Accountability Responsibility and Disclosure (CARD) Act requires credit card companies to disclose fees, including surcharges, in a clear and transparent manner.

Conclusion and Final Thoughts

In conclusion, surcharge fees are a type of fee that is added to the cost of a particular service or product. Surcharges can be found in various industries, including finance, transportation, and hospitality.

While surcharges can be a burden for consumers, they can also have some benefits, such as offsetting costs and generating additional revenue. Consumers can avoid surcharges by using different payment methods, making payments on time, staying within credit limits, transferring balances carefully, and withdrawing cash wisely.

Gallery of Surchage Fee

Surchage Fee Image Gallery

What is a surcharge fee?

+A surcharge fee is a type of fee that is added to the cost of a particular service or product.

What are the different types of surcharges?

+There are several types of surcharges, including foreign transaction fees, late payment fees, overlimit fees, balance transfer fees, and cash advance fees.

How can I avoid surcharges?

+Consumers can avoid surcharges by using different payment methods, making payments on time, staying within credit limits, transferring balances carefully, and withdrawing cash wisely.

What are the regulations surrounding surcharges?

+There are regulations surrounding surcharges, particularly in the financial industry. For example, the Dodd-Frank Wall Street Reform and Consumer Protection Act prohibits credit card companies from charging excessive fees, including surcharges.

What are the benefits of surcharges?

+Surcharges can help to offset costs and generate additional revenue for the provider. They can also help to encourage responsible behavior, such as making payments on time or staying within credit limits.

We hope this article has provided you with a comprehensive understanding of surcharge fees, their types, and their impact on consumers. If you have any further questions or would like to share your thoughts on the topic, please feel free to comment below. Additionally, if you found this article informative, please share it with others who may benefit from the information.