Intro

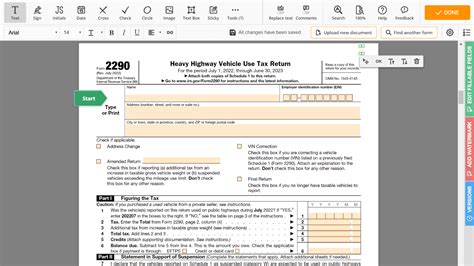

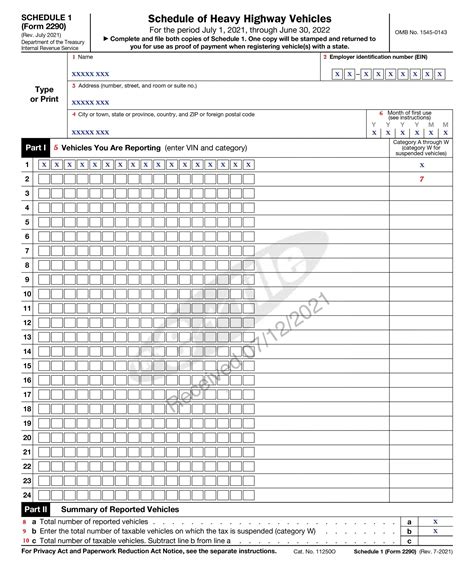

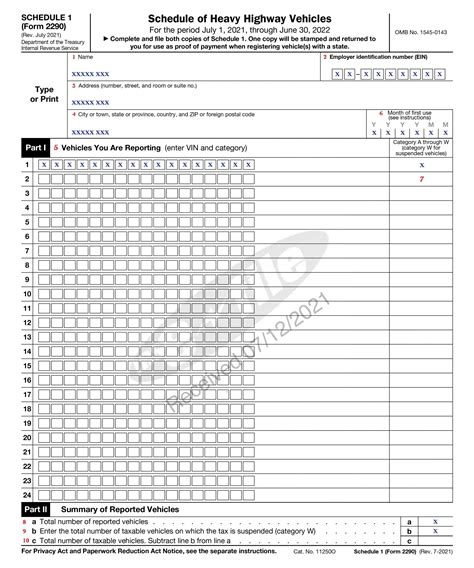

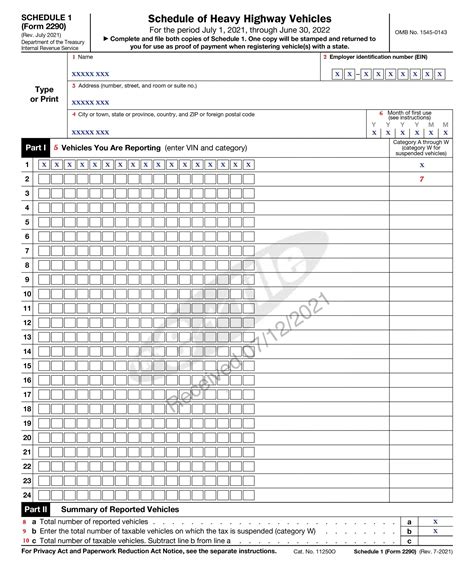

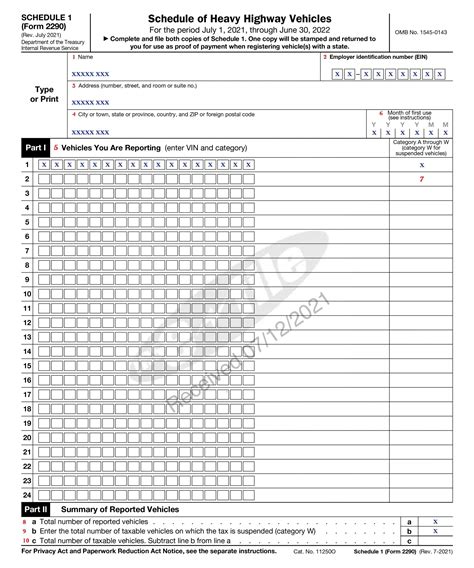

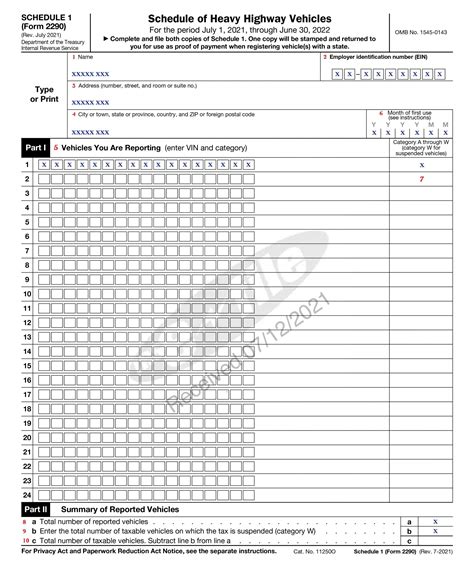

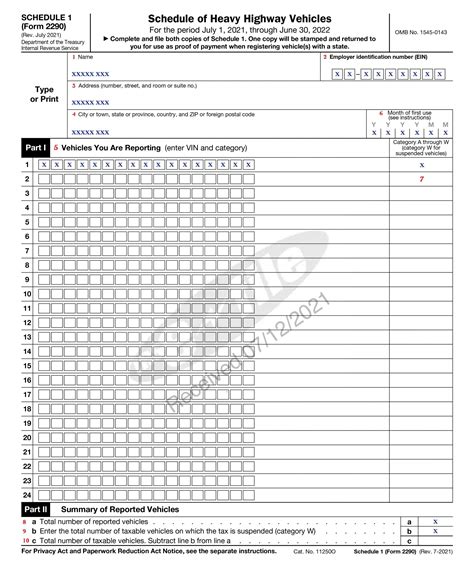

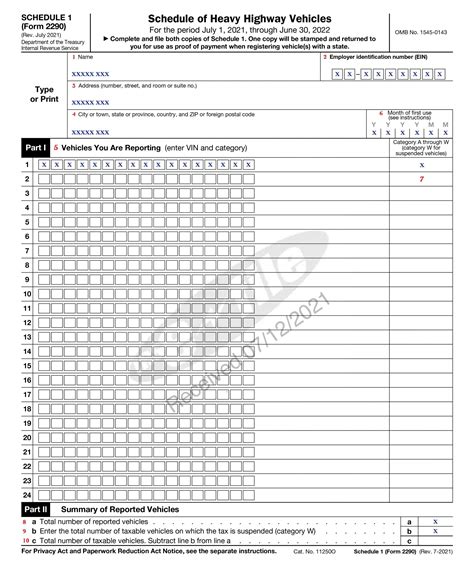

Download the IRS Printable 2290 Form for heavy vehicle use tax, including HVUT instructions and e-filing options for easy submission and schedule 1 documentation.

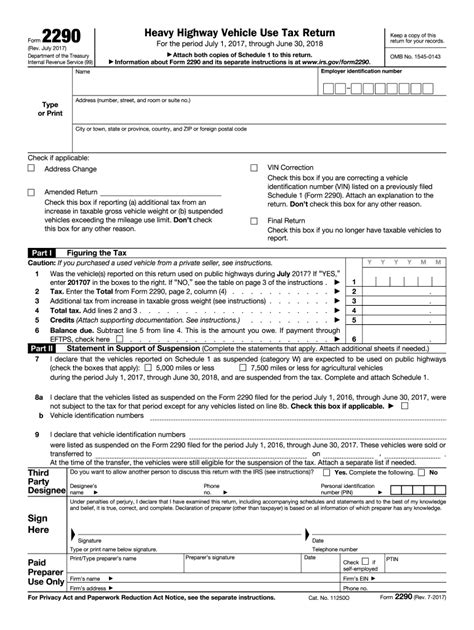

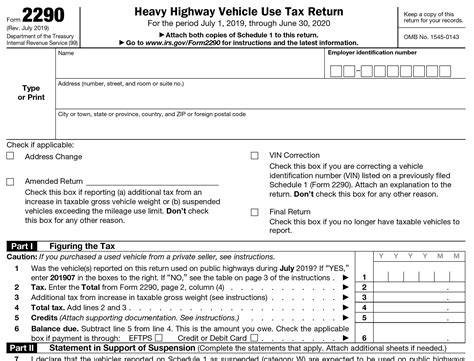

The importance of filing tax returns on time cannot be overstated, and for those who own and operate heavy vehicles, the Internal Revenue Service (IRS) requires the submission of Form 2290, also known as the Heavy Highway Vehicle Use Tax Return. This form is used to calculate and pay the heavy highway vehicle use tax, which is a federal tax imposed on vehicles with a gross weight of 55,000 pounds or more. The tax is used to fund the maintenance and improvement of the nation's highways. In this article, we will delve into the world of the printable 2290 form, exploring its significance, benefits, and the steps involved in filling it out.

The IRS has made it easier for taxpayers to file their returns by providing a printable version of the 2290 form, which can be downloaded from their official website. This has reduced the need to visit an IRS office or wait for the form to be mailed, making the process more efficient and convenient. With the printable 2290 form, taxpayers can fill out the required information, calculate their tax liability, and submit their return electronically, receiving a stamped schedule 1 within minutes.

Filing the 2290 form is a straightforward process, but it requires attention to detail to avoid errors and potential penalties. The form requires information such as the vehicle's identification number, gross weight, and the number of miles it was driven on public highways during the tax period. Taxpayers must also calculate their tax liability based on the number of miles driven and the vehicle's gross weight. The IRS provides a table to help taxpayers determine their tax liability, making it easier to fill out the form accurately.

Introduction to the 2290 Form

The 2290 form is a critical document for owners and operators of heavy vehicles, as it serves as proof of payment for the heavy highway vehicle use tax. The form is typically filed on a annual basis, with the tax period beginning on July 1st and ending on June 30th of the following year. Taxpayers who are required to file the 2290 form must do so by the last day of the month following the month in which they first use their vehicle on a public highway. For example, if a taxpayer puts their vehicle on the road in September, they must file the 2290 form by October 31st.

Benefits of Filing the 2290 Form Electronically

The IRS encourages taxpayers to file their 2290 form electronically, as it provides several benefits, including faster processing times, reduced errors, and the ability to receive a stamped schedule 1 immediately. Electronic filing also reduces the risk of lost or misplaced forms, as the IRS receives the return directly. Additionally, electronic filing is more environmentally friendly, as it reduces the need for paper and ink.Some of the key benefits of filing the 2290 form electronically include:

- Faster processing times: Electronic filing allows the IRS to process returns more quickly, reducing the time it takes to receive a stamped schedule 1.

- Reduced errors: Electronic filing reduces the risk of errors, as the IRS system checks the return for accuracy and completeness before accepting it.

- Immediate receipt of stamped schedule 1: Taxpayers who file electronically receive their stamped schedule 1 immediately, which serves as proof of payment for the heavy highway vehicle use tax.

- Environmentally friendly: Electronic filing reduces the need for paper and ink, making it a more environmentally friendly option.

Steps to Fill Out the 2290 Form

Filling out the 2290 form requires attention to detail and accuracy, as errors can result in delays or penalties. The following steps outline the process for filling out the 2290 form:

- Gather required information: Taxpayers must gather the required information, including the vehicle's identification number, gross weight, and the number of miles it was driven on public highways during the tax period.

- Determine tax liability: Taxpayers must calculate their tax liability based on the number of miles driven and the vehicle's gross weight, using the table provided by the IRS.

- Complete the form: Taxpayers must complete the 2290 form, providing the required information and calculating their tax liability.

- File the form: Taxpayers can file the 2290 form electronically or by mail, depending on their preference.

Common Errors to Avoid When Filing the 2290 Form

When filling out the 2290 form, taxpayers must be careful to avoid common errors that can result in delays or penalties. Some of the most common errors include: * Inaccurate or incomplete information: Taxpayers must ensure that all information is accurate and complete, as errors can result in delays or penalties. * Incorrect calculation of tax liability: Taxpayers must calculate their tax liability accurately, using the table provided by the IRS. * Failure to sign the form: Taxpayers must sign the 2290 form, as unsigned returns are not considered valid.Penalties for Late Filing or Non-Payment of the 2290 Form

The IRS imposes penalties on taxpayers who fail to file the 2290 form on time or pay their tax liability in full. The penalties can be significant, and taxpayers must be aware of the consequences of late filing or non-payment. Some of the penalties include:

- Late filing penalty: Taxpayers who fail to file the 2290 form on time may be subject to a late filing penalty, which can be up to 4.5% of the total tax liability.

- Late payment penalty: Taxpayers who fail to pay their tax liability in full may be subject to a late payment penalty, which can be up to 0.5% of the unpaid tax liability.

- Interest on unpaid tax: Taxpayers who fail to pay their tax liability in full may be subject to interest on the unpaid amount, which can accrue over time.

Consequences of Not Filing the 2290 Form

Failure to file the 2290 form can have serious consequences, including: * Loss of vehicle registration: Taxpayers who fail to file the 2290 form may be unable to register their vehicle, as the IRS will not provide a stamped schedule 1. * Penalties and interest: Taxpayers who fail to file the 2290 form may be subject to penalties and interest on their tax liability, which can accrue over time. * Audit and examination: Taxpayers who fail to file the 2290 form may be subject to audit and examination by the IRS, which can result in additional penalties and interest.Gallery of Printable 2290 Forms

Printable 2290 Form Image Gallery

Frequently Asked Questions

What is the purpose of the 2290 form?

+The 2290 form is used to calculate and pay the heavy highway vehicle use tax, which is a federal tax imposed on vehicles with a gross weight of 55,000 pounds or more.

Who is required to file the 2290 form?

+Owners and operators of heavy vehicles with a gross weight of 55,000 pounds or more are required to file the 2290 form.

What is the deadline for filing the 2290 form?

+The deadline for filing the 2290 form is the last day of the month following the month in which the vehicle was first used on a public highway.

Can I file the 2290 form electronically?

+Yes, the IRS encourages taxpayers to file the 2290 form electronically, as it provides faster processing times and reduced errors.

What are the consequences of not filing the 2290 form?

+Failure to file the 2290 form can result in penalties, interest, and the loss of vehicle registration.

In conclusion, the printable 2290 form is an essential document for owners and operators of heavy vehicles, serving as proof of payment for the heavy highway vehicle use tax. Taxpayers must be aware of the importance of filing the 2290 form on time and accurately, as errors can result in delays or penalties. By understanding the benefits and steps involved in filling out the 2290 form, taxpayers can ensure compliance with the IRS and avoid potential consequences. We encourage readers to share their experiences and tips for filling out the 2290 form, and to ask any questions they may have about the process. Additionally, we invite readers to explore our website for more information on tax-related topics and to take advantage of our resources and tools to help with tax preparation and planning.