Intro

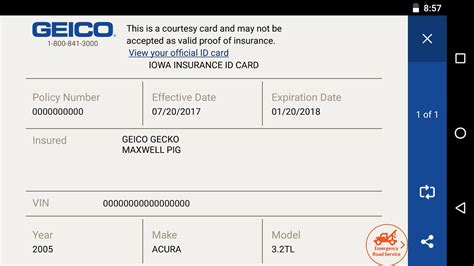

Get instant access to your Printable Geico Insurance Card, featuring policy details, coverage info, and claim instructions, with downloadable ID cards and proof of insurance documents.

In today's digital age, having access to important documents at our fingertips is more crucial than ever. For car owners, one such essential document is the insurance card. Geico, a well-known insurance provider, offers a convenient way to access and print insurance cards online. This feature is particularly useful for those who need to provide proof of insurance for various purposes, such as vehicle registration or when stopped by law enforcement.

The ability to print a Geico insurance card is a significant advantage for policyholders. It eliminates the need to wait for a physical copy to arrive by mail or to visit a local agent's office. Instead, policyholders can simply log in to their Geico account, navigate to the necessary section, and print out their insurance card. This process is not only time-efficient but also environmentally friendly, as it reduces the need for paper waste.

Moreover, having a printable Geico insurance card can provide peace of mind for drivers. In the event of an accident or when dealing with law enforcement, being able to produce proof of insurance promptly can help avoid unnecessary complications. It's also a good practice to keep a physical copy of the insurance card in the vehicle, as this can be easily referenced if needed.

Benefits of Printable Geico Insurance Cards

The benefits of having a printable Geico insurance card are numerous. For one, it offers convenience and flexibility. Policyholders can access and print their insurance cards at any time, from any location with an internet connection. This is particularly useful for those who travel frequently or have multiple vehicles insured under the same policy.

Another significant advantage is the ability to keep track of insurance information easily. By having a physical copy of the insurance card, policyholders can quickly verify their coverage details, including policy numbers, expiration dates, and vehicle information. This can be especially helpful when reviewing or updating insurance policies.

Furthermore, printable insurance cards can help reduce administrative burdens. In the past, policyholders might have had to contact their insurance provider or visit an agent's office to obtain a replacement card. With the option to print insurance cards online, this process is streamlined, saving time and effort for both policyholders and insurance providers.

How to Print a Geico Insurance Card

Printing a Geico insurance card is a straightforward process. Here are the steps to follow:

- Log in to your Geico account online or through the mobile app.

- Navigate to the "Policy" or "Documents" section, depending on the platform's layout.

- Look for the option to view or print your insurance card.

- Select the vehicle for which you want to print the insurance card, if you have multiple vehicles on your policy.

- Review the insurance card details to ensure everything is accurate and up-to-date.

- Print the insurance card on a standard 8.5 x 11-inch paper.

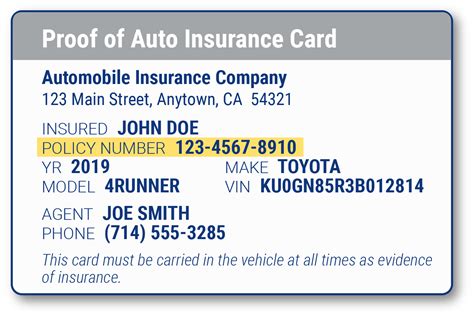

It's essential to verify that the printed insurance card includes all necessary information, such as the policy number, vehicle identification number (VIN), and effective dates of coverage. If any details are incorrect, contact Geico customer service to rectify the issue before printing the card.

Importance of Keeping Insurance Information Up-to-Date

Keeping insurance information current is vital for several reasons. Firstly, it ensures that policyholders have the most recent and accurate details on their insurance cards. This is crucial in the event of an accident or when dealing with law enforcement, as outdated information can lead to complications.

Secondly, updated insurance information helps policyholders stay compliant with state regulations regarding vehicle insurance. Each state has its own requirements for minimum coverage levels and proof of insurance, so it's essential to ensure that your insurance policy meets these standards.

Lastly, maintaining current insurance information can help prevent gaps in coverage. If policy details are not updated promptly, policyholders might inadvertently allow their coverage to lapse, leaving them unprotected in case of an accident or other insured events.

Tips for Managing Insurance Documents

Effective management of insurance documents is key to avoiding potential issues. Here are some tips:

- Keep digital and physical copies of your insurance documents in secure, easily accessible locations.

- Regularly review your insurance policy to ensure it still meets your needs and that all information is up-to-date.

- Understand what is covered under your policy and what is not to avoid surprises in case of a claim.

- Consider setting reminders for policy renewal dates to prevent lapses in coverage.

By following these tips and taking advantage of the option to print a Geico insurance card, policyholders can enjoy a more streamlined and stress-free experience when it comes to their vehicle insurance.

Common Misconceptions About Insurance Cards

There are several misconceptions about insurance cards that it's essential to clarify. One common myth is that digital insurance cards are not accepted by law enforcement or other authorities. However, many states now accept digital proof of insurance, making it just as valid as a physical card.

Another misconception is that insurance cards are only necessary for vehicle registration or when involved in an accident. While these are indeed critical situations where insurance cards are required, having ready access to this information can be beneficial in various other scenarios, such as when renting a vehicle or dealing with insurance claims.

Future of Insurance Documentation

The future of insurance documentation is likely to be increasingly digital. With advancements in technology and the growing acceptance of digital documents, it's probable that physical insurance cards will become less common. Insurance providers like Geico are already embracing this shift by offering digital insurance cards and online account management tools.

This digital transformation can lead to greater convenience, reduced administrative costs, and enhanced security for policyholders. Digital documents can be easily updated, reducing the risk of outdated information. Additionally, digital storage solutions can provide a secure and organized way to manage insurance documents, reducing the likelihood of loss or damage.

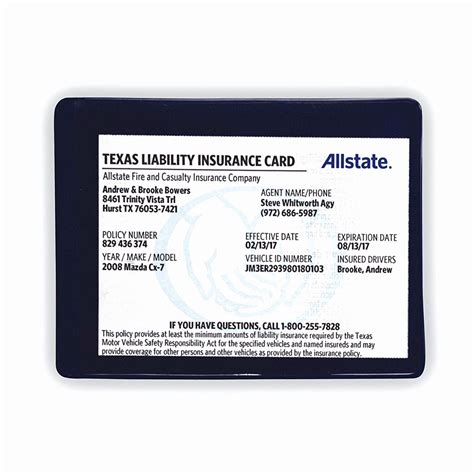

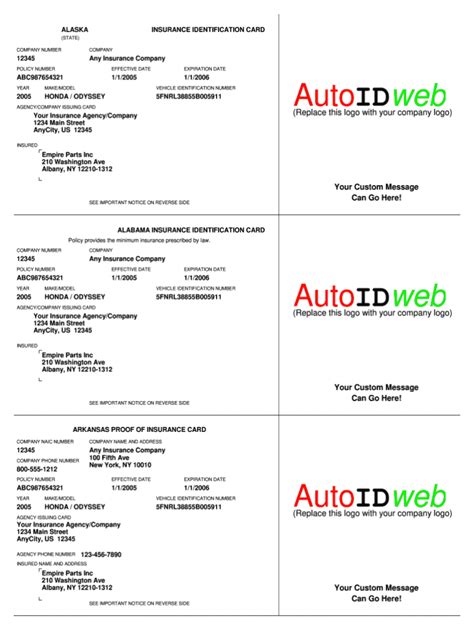

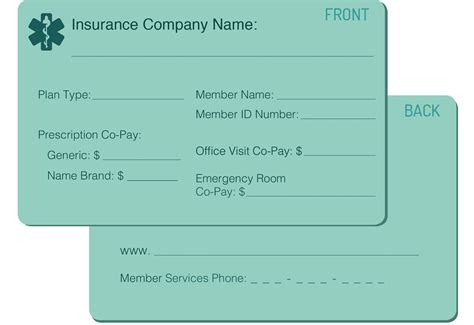

Gallery of Printable Insurance Cards

Printable Insurance Cards Gallery

Frequently Asked Questions

How do I print my Geico insurance card?

+To print your Geico insurance card, log in to your Geico account, navigate to the "Policy" or "Documents" section, select the vehicle for which you want to print the card, review the details for accuracy, and then print the card on standard 8.5 x 11-inch paper.

Are digital insurance cards accepted by law enforcement?

+Yes, many states now accept digital proof of insurance. However, it's always a good idea to check with your local authorities to confirm their policies on digital insurance cards.

How often should I update my insurance information?

+You should update your insurance information whenever there are changes to your policy, such as adding or removing vehicles, changing your address, or modifying your coverage levels. Regularly reviewing your policy can help ensure that your information remains current and accurate.

In conclusion, having access to a printable Geico insurance card offers numerous benefits, from convenience and flexibility to reduced administrative burdens. By understanding the importance of keeping insurance information up-to-date and how to effectively manage insurance documents, policyholders can enjoy a more streamlined and stress-free experience with their vehicle insurance. As the insurance industry continues to evolve, embracing digital solutions will likely play a significant role in shaping the future of insurance documentation. We invite you to share your thoughts on the benefits and challenges of printable insurance cards and how you manage your insurance documents. Your insights can help others navigate the world of vehicle insurance more effectively.