Intro

Master loan management with 5 loan schedule tips, including repayment planning, interest rate optimization, and debt consolidation strategies to achieve financial stability and credit score improvement.

Creating a loan schedule is an essential step in managing debt effectively. It helps borrowers understand their financial obligations, make timely payments, and avoid defaulting on loans. A well-planned loan schedule can also assist in reducing debt stress and improving overall financial health. In this article, we will delve into the importance of loan schedules, their benefits, and provide valuable tips on how to create and manage them effectively.

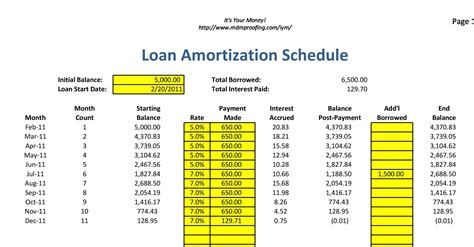

A loan schedule is a detailed plan that outlines the loan amount, interest rate, repayment terms, and payment due dates. It serves as a roadmap for borrowers to navigate their debt repayment journey. By having a clear understanding of their loan obligations, individuals can better manage their finances, prioritize their expenses, and make informed decisions about their financial future. Whether you're dealing with a personal loan, mortgage, or student loan, a loan schedule is a vital tool that can help you stay on track and achieve financial stability.

Effective loan scheduling can have a significant impact on one's financial well-being. It can help reduce debt anxiety, improve credit scores, and increase financial flexibility. By making timely payments and sticking to the loan schedule, borrowers can demonstrate their creditworthiness and potentially qualify for better loan terms in the future. Moreover, a loan schedule can help individuals avoid late payment fees, penalties, and negative marks on their credit reports. With a well-structured loan schedule, borrowers can take control of their debt, make progress towards financial freedom, and achieve their long-term financial goals.

Understanding Loan Schedules

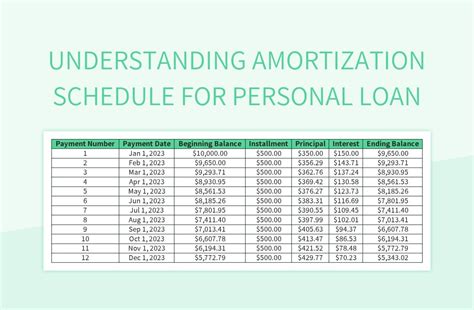

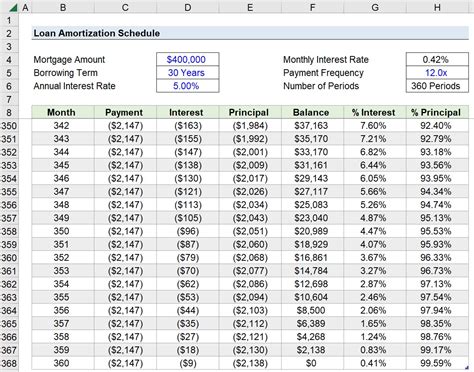

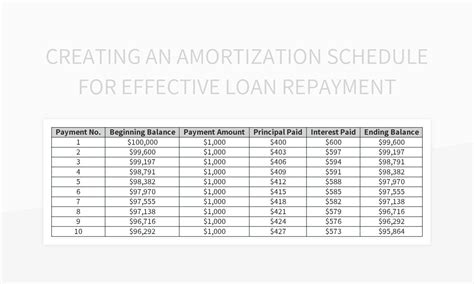

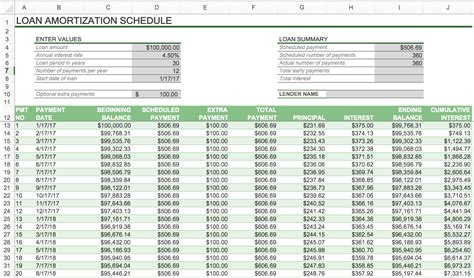

Before we dive into the tips for creating an effective loan schedule, it's essential to understand the components of a loan schedule. A typical loan schedule includes the loan amount, interest rate, repayment term, payment frequency, and payment amount. It may also include additional details such as late payment fees, prepayment penalties, and credit reporting information. By reviewing and understanding these components, borrowers can create a personalized loan schedule that meets their unique financial needs and goals.

Benefits of Loan Schedules

Loan schedules offer numerous benefits to borrowers. Some of the most significant advantages include reduced debt stress, improved credit scores, and increased financial flexibility. By having a clear understanding of their loan obligations, individuals can better manage their finances, prioritize their expenses, and make informed decisions about their financial future. Additionally, loan schedules can help borrowers avoid late payment fees, penalties, and negative marks on their credit reports. With a well-structured loan schedule, individuals can take control of their debt, make progress towards financial freedom, and achieve their long-term financial goals.

Creating an Effective Loan Schedule

Creating an effective loan schedule requires careful planning and consideration. Here are five loan schedule tips to help you get started:

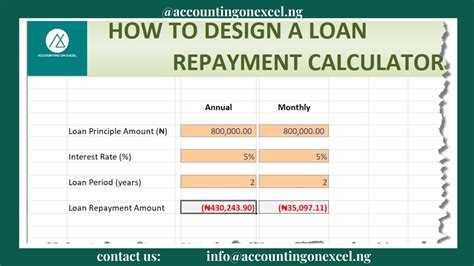

- Determine your loan amount and interest rate: The first step in creating a loan schedule is to determine your loan amount and interest rate. This information can be found in your loan agreement or by contacting your lender.

- Choose a repayment term: The repayment term refers to the length of time you have to repay your loan. Common repayment terms include 3, 5, 7, or 10 years. When choosing a repayment term, consider your financial goals and how much you can afford to pay each month.

- Select a payment frequency: The payment frequency refers to how often you make payments on your loan. Common payment frequencies include monthly, bi-weekly, or weekly. When selecting a payment frequency, consider your income schedule and how often you receive paychecks.

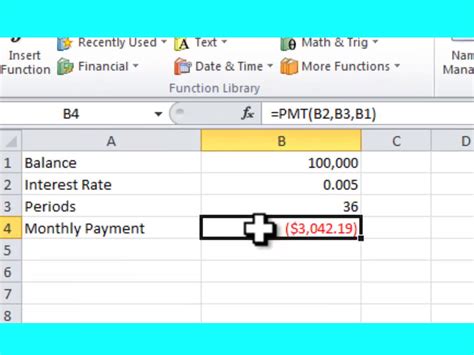

- Calculate your payment amount: The payment amount refers to the amount you need to pay each month to repay your loan. This amount can be calculated using a loan calculator or by contacting your lender.

- Review and adjust your loan schedule: Finally, review your loan schedule regularly and adjust as needed. This may involve increasing your payment amount, changing your payment frequency, or refinancing your loan to a lower interest rate.

Additional Tips for Managing Your Loan Schedule

In addition to the tips mentioned above, here are some additional strategies for managing your loan schedule:

- Make timely payments: Making timely payments is essential for avoiding late payment fees and negative marks on your credit report. Consider setting up automatic payments or reminders to ensure you never miss a payment.

- Pay more than the minimum: Paying more than the minimum payment can help you pay off your loan faster and reduce the amount of interest you pay over time. Consider increasing your payment amount or making extra payments whenever possible.

- Avoid late payment fees: Late payment fees can add up quickly and increase the cost of your loan. Avoid late payment fees by making timely payments and communicating with your lender if you're experiencing financial difficulties.

- Consider refinancing: Refinancing your loan to a lower interest rate can help you save money on interest and reduce your monthly payment amount. Consider refinancing if interest rates have fallen or if you've improved your credit score.

Common Mistakes to Avoid

When creating and managing a loan schedule, there are several common mistakes to avoid. These include:

- Missing payments: Missing payments can result in late payment fees, negative marks on your credit report, and increased interest rates.

- Underestimating your loan amount: Underestimating your loan amount can result in a longer repayment term and increased interest payments.

- Overestimating your income: Overestimating your income can result in a higher payment amount than you can afford, leading to missed payments and financial difficulties.

- Failing to review and adjust your loan schedule: Failing to review and adjust your loan schedule regularly can result in missed opportunities to save money on interest and reduce your loan term.

Conclusion and Next Steps

In conclusion, creating and managing a loan schedule is an essential step in managing debt effectively. By understanding the components of a loan schedule, determining your loan amount and interest rate, choosing a repayment term, selecting a payment frequency, and calculating your payment amount, you can create a personalized loan schedule that meets your unique financial needs and goals. Remember to review and adjust your loan schedule regularly, avoid common mistakes, and consider refinancing or seeking professional advice if needed.

Loan Schedule Image Gallery

What is a loan schedule?

+A loan schedule is a detailed plan that outlines the loan amount, interest rate, repayment terms, and payment due dates.

Why is a loan schedule important?

+A loan schedule is important because it helps borrowers understand their financial obligations, make timely payments, and avoid defaulting on loans.

How do I create a loan schedule?

+To create a loan schedule, determine your loan amount and interest rate, choose a repayment term, select a payment frequency, and calculate your payment amount.

What are the benefits of a loan schedule?

+The benefits of a loan schedule include reduced debt stress, improved credit scores, and increased financial flexibility.

How often should I review and adjust my loan schedule?

+You should review and adjust your loan schedule regularly, ideally every 6-12 months, to ensure you're on track to meet your financial goals.

We hope this article has provided you with valuable insights and tips on creating and managing an effective loan schedule. By following these tips and avoiding common mistakes, you can take control of your debt, make progress towards financial freedom, and achieve your long-term financial goals. If you have any questions or comments, please don't hesitate to share them below. Remember to share this article with friends and family who may benefit from learning about loan schedules and debt management. Together, we can work towards a brighter financial future.