Intro

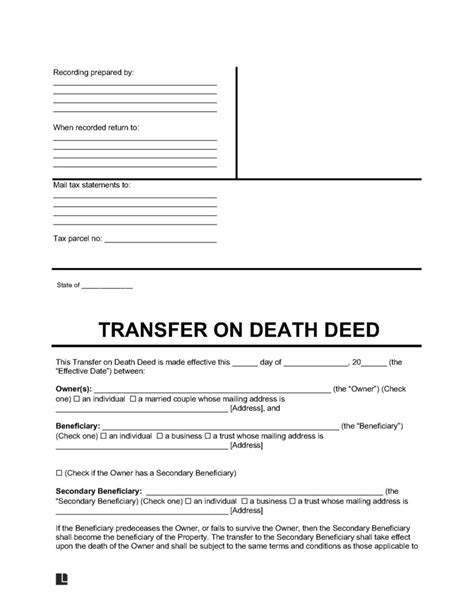

Download a printable Transfer on Death form to simplify estate planning, bypass probate, and ensure seamless property transfer, using beneficiary deeds and lady bird deeds for secure inheritance.

The importance of having a well-planned estate cannot be overstated. One crucial aspect of estate planning is ensuring that your assets are transferred to your loved ones according to your wishes after you pass away. A Transfer on Death (TOD) form is a valuable tool that allows you to achieve this goal. In this article, we will delve into the world of TOD forms, exploring their benefits, working mechanisms, and the steps involved in creating a printable Transfer on Death form.

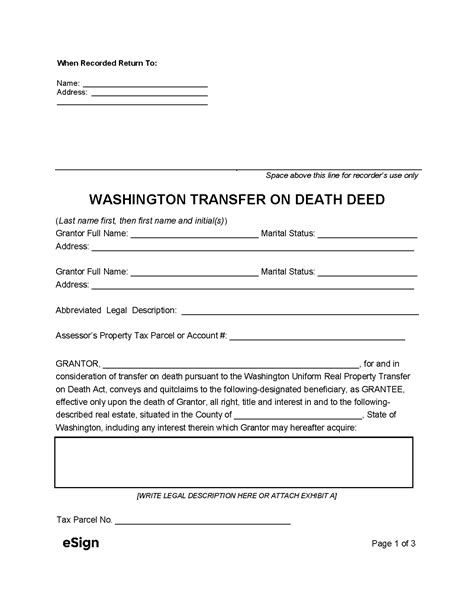

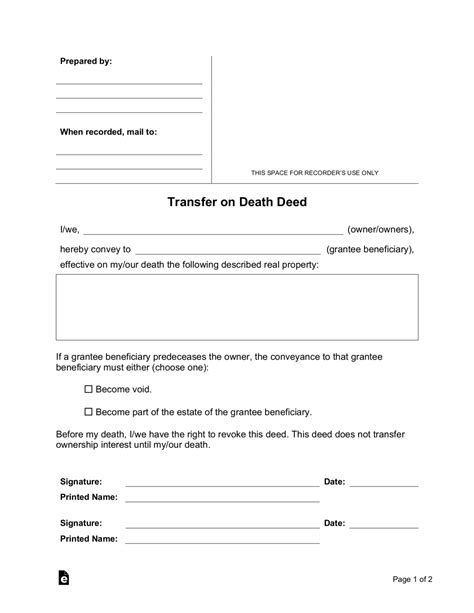

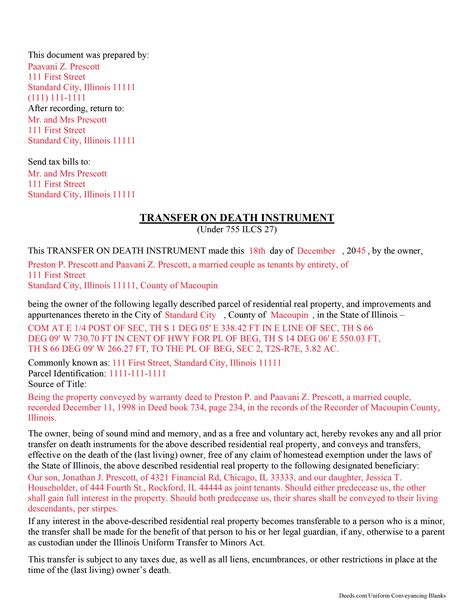

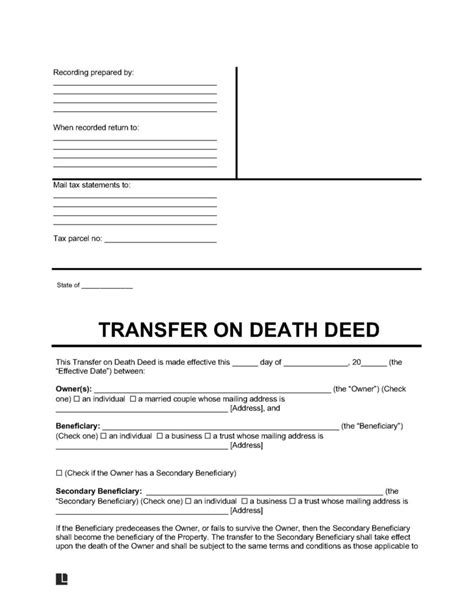

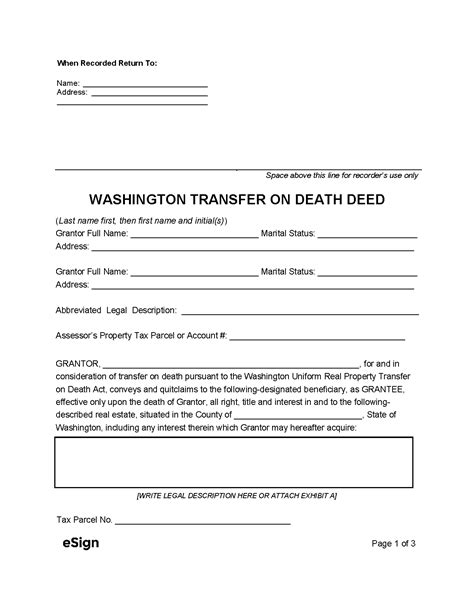

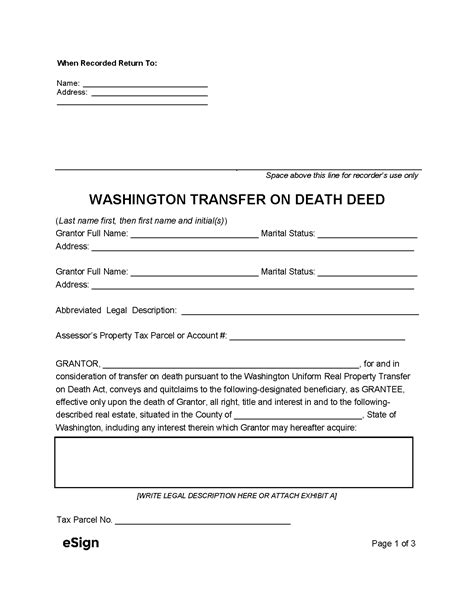

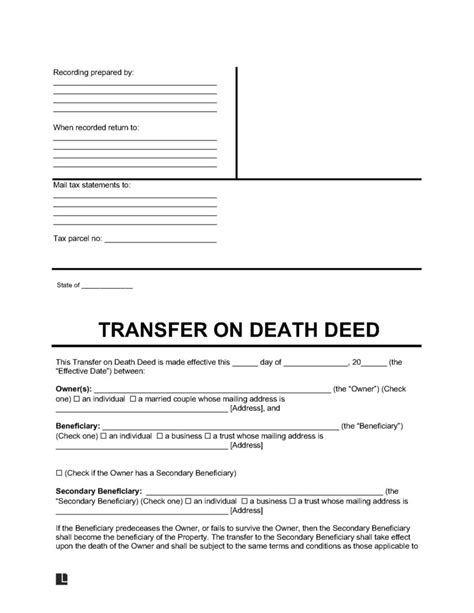

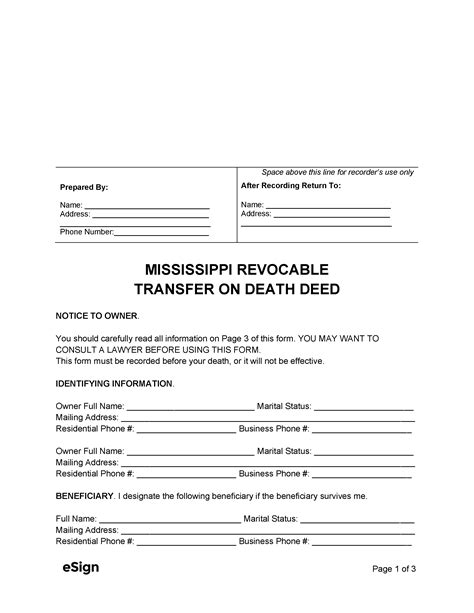

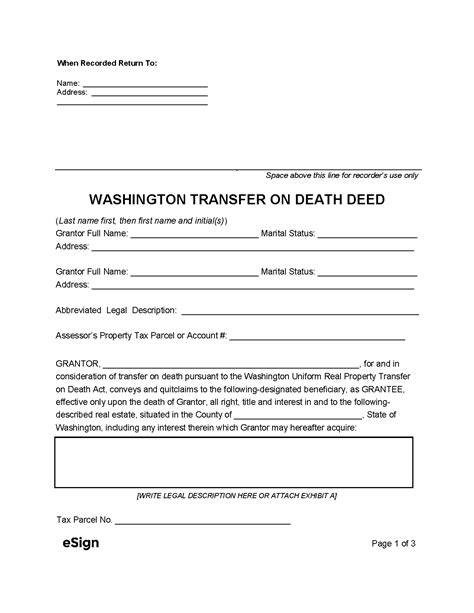

A Transfer on Death form is a legal document that enables you to transfer ownership of your assets, such as real estate, vehicles, and securities, to a designated beneficiary upon your death. This document is also known as a beneficiary deed or a TOD deed. The primary advantage of using a TOD form is that it allows you to avoid probate, which can be a lengthy and costly process. By using a TOD form, you can ensure that your assets are transferred quickly and efficiently to your beneficiaries.

The process of creating a TOD form is relatively straightforward. You can start by obtaining a printable Transfer on Death form template, which is available online or through an attorney. The template will guide you through the necessary steps, including designating the beneficiary, describing the asset, and signing the document. It is essential to note that the specific requirements for creating a TOD form may vary depending on your state or locality, so it is crucial to consult with an attorney or a qualified professional to ensure that your document is valid and enforceable.

Benefits of Using a Transfer on Death Form

How to Create a Printable Transfer on Death Form

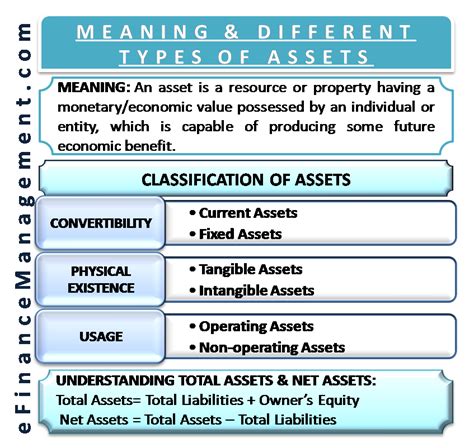

Types of Assets That Can Be Transferred Using a TOD Form

Steps to Fill Out a Transfer on Death Form

Common Mistakes to Avoid When Creating a Transfer on Death Form

Gallery of Transfer on Death Forms

Transfer on Death Form Gallery

Frequently Asked Questions

What is a Transfer on Death form?

+A Transfer on Death form is a legal document that enables you to transfer ownership of your assets to a designated beneficiary upon your death.

How do I create a Transfer on Death form?

+You can create a Transfer on Death form by obtaining a template, designating the beneficiary, describing the asset, signing the document, and recording it with the relevant authorities.

What are the benefits of using a Transfer on Death form?

+The benefits of using a Transfer on Death form include avoiding probate, ensuring quick transfer of assets, maintaining control, and reducing taxes.

Can I use a Transfer on Death form to transfer any type of asset?

+No, a Transfer on Death form can only be used to transfer certain types of assets, such as real estate, vehicles, and securities.

Do I need to consult with an attorney to create a Transfer on Death form?

+It is recommended that you consult with an attorney to ensure that your Transfer on Death form is valid and enforceable.

In conclusion, a printable Transfer on Death form is a valuable tool that can help you ensure that your assets are transferred to your loved ones according to your wishes after you pass away. By understanding the benefits, working mechanisms, and steps involved in creating a TOD form, you can take control of your estate planning and provide for your beneficiaries. We encourage you to share this article with your friends and family, and to take the necessary steps to create a Transfer on Death form that reflects your wishes. If you have any questions or comments, please do not hesitate to reach out to us.