Intro

Boost retail business with 5 tips on retail insurance, covering risk management, liability coverage, and commercial protection, to ensure a secure and thriving store operation.

As a retail business owner, it's essential to protect your investment from unforeseen events that could impact your operations. Retail insurance is a crucial aspect of managing risk, and having the right coverage can make all the difference in ensuring the long-term success of your business. In this article, we'll explore five tips for retail insurance that can help you navigate the complex world of risk management.

The retail industry is highly competitive, and businesses face a wide range of risks, from property damage and theft to liability claims and employee injuries. Without adequate insurance coverage, a single incident could lead to financial devastation, forcing you to close your doors permanently. By understanding the importance of retail insurance and taking proactive steps to manage risk, you can minimize potential losses and maintain a stable, profitable business.

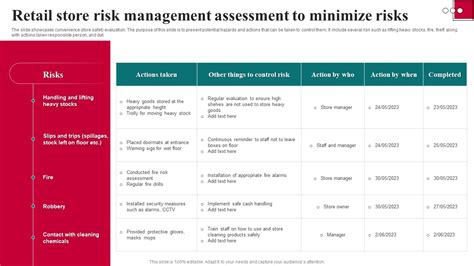

Effective risk management is critical for retail businesses, as it enables owners to identify potential hazards, assess their likelihood and impact, and implement strategies to mitigate or transfer risk. Retail insurance is a key component of this process, providing financial protection against a range of risks, including property damage, business interruption, and liability claims. By investing in the right insurance coverage, retail business owners can reduce their exposure to risk, ensure compliance with regulatory requirements, and maintain a positive reputation with customers and stakeholders.

Understanding Retail Insurance Options

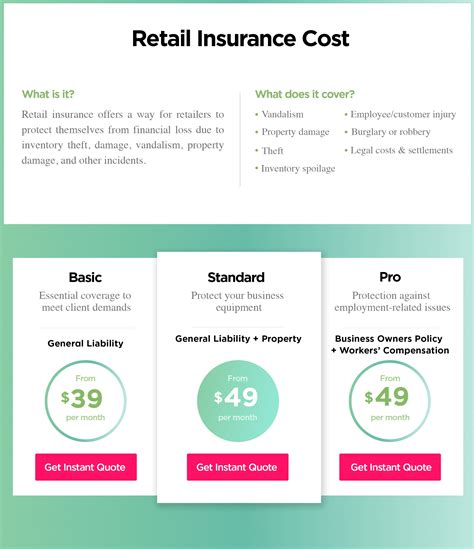

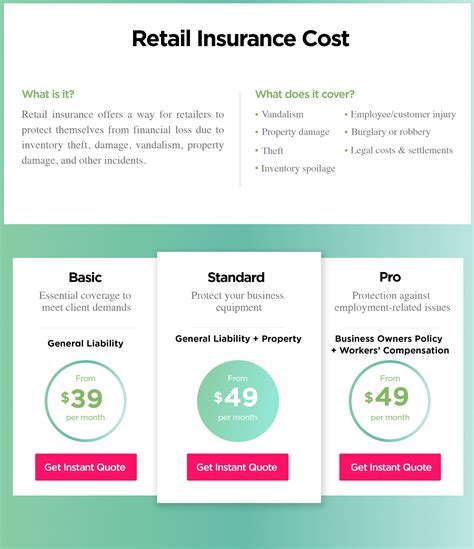

When it comes to retail insurance, there are several options to consider, each designed to address specific risks and provide financial protection. Property insurance, for example, covers damage to buildings, equipment, and inventory, while liability insurance protects against claims arising from accidents, injuries, or property damage. Business interruption insurance, on the other hand, provides financial support in the event of a disruption to operations, helping to minimize losses and maintain cash flow. By understanding the different types of retail insurance available, business owners can make informed decisions about their coverage needs and ensure they have the right protection in place.

Types of Retail Insurance

Some of the most common types of retail insurance include: * Property insurance: Covers damage to buildings, equipment, and inventory * Liability insurance: Protects against claims arising from accidents, injuries, or property damage * Business interruption insurance: Provides financial support in the event of a disruption to operations * Workers' compensation insurance: Covers employee injuries and illnesses * Cyber insurance: Protects against data breaches and cyber attacksAssessing Risk and Determining Coverage Needs

To determine their coverage needs, retail business owners should conduct a thorough risk assessment, identifying potential hazards and evaluating their likelihood and impact. This involves analyzing various factors, including the type of business, location, and operations, as well as the value of assets and potential liabilities. By understanding their risk profile, business owners can make informed decisions about their insurance coverage, ensuring they have adequate protection in place to mitigate potential losses.

Risk Assessment Factors

Some key factors to consider when assessing risk and determining coverage needs include: * Business type and operations * Location and environment * Asset values and potential liabilities * Regulatory requirements and compliance * Industry trends and best practicesChoosing the Right Insurance Provider

When selecting an insurance provider, retail business owners should consider several factors, including the provider's reputation, experience, and financial stability. It's essential to work with a provider that understands the unique risks and challenges faced by retail businesses, offering tailored coverage solutions and expert guidance. By choosing the right insurance provider, business owners can ensure they have the support and protection they need to manage risk and maintain a successful, profitable business.

Insurance Provider Selection Criteria

Some key criteria to consider when selecting an insurance provider include: * Reputation and experience * Financial stability and ratings * Coverage options and flexibility * Claims handling and customer service * Industry expertise and knowledgeManaging Premiums and Costs

To manage premiums and costs, retail business owners should regularly review their insurance coverage, ensuring they have the right protection in place without overpaying for unnecessary coverage. This involves monitoring changes in their risk profile, adjusting coverage limits and deductibles as needed, and exploring cost-saving opportunities, such as bundling policies or implementing risk-reducing measures. By actively managing their insurance premiums and costs, business owners can minimize their expenses and maintain a healthy bottom line.

Premium Management Strategies

Some effective strategies for managing premiums and costs include: * Regularly reviewing coverage and adjusting limits and deductibles as needed * Bundling policies or exploring package deals * Implementing risk-reducing measures, such as security systems or employee training programs * Shopping around and comparing quotes from different providers * Working with an insurance broker or agent to negotiate rates and termsReviewing and Updating Coverage

Finally, retail business owners should regularly review and update their insurance coverage, ensuring they have the right protection in place to address changing risks and challenges. This involves staying informed about industry trends and developments, monitoring changes in their risk profile, and adjusting their coverage accordingly. By reviewing and updating their insurance coverage on a regular basis, business owners can maintain adequate protection, minimize potential losses, and ensure the long-term success of their business.

Review and Update Strategies

Some effective strategies for reviewing and updating coverage include: * Scheduling regular reviews with an insurance provider or broker * Staying informed about industry trends and developments * Monitoring changes in the business and adjusting coverage accordingly * Exploring new coverage options and products * Seeking expert advice and guidance from an insurance professionalRetail Insurance Image Gallery

What types of insurance do retail businesses need?

+Retail businesses typically need a range of insurance coverage, including property insurance, liability insurance, business interruption insurance, workers' compensation insurance, and cyber insurance.

How do I determine my retail business's insurance coverage needs?

+To determine your retail business's insurance coverage needs, you should conduct a thorough risk assessment, identifying potential hazards and evaluating their likelihood and impact. This will help you understand your risk profile and make informed decisions about your insurance coverage.

What factors should I consider when choosing a retail insurance provider?

+When choosing a retail insurance provider, you should consider several factors, including the provider's reputation, experience, and financial stability, as well as their coverage options, claims handling, and customer service.

How can I manage my retail insurance premiums and costs?

+To manage your retail insurance premiums and costs, you should regularly review your coverage, adjusting limits and deductibles as needed, and explore cost-saving opportunities, such as bundling policies or implementing risk-reducing measures.

Why is it important to review and update my retail insurance coverage regularly?

+Regularly reviewing and updating your retail insurance coverage is essential to ensure you have the right protection in place to address changing risks and challenges. This will help you maintain adequate protection, minimize potential losses, and ensure the long-term success of your business.

In conclusion, retail insurance is a critical aspect of managing risk and maintaining a successful, profitable business. By understanding the importance of retail insurance, assessing risk, choosing the right insurance provider, managing premiums and costs, and reviewing and updating coverage, retail business owners can minimize potential losses and ensure the long-term success of their business. We hope this article has provided you with valuable insights and practical tips to help you navigate the complex world of retail insurance. If you have any questions or comments, please don't hesitate to share them with us.