Intro

Create a secure future with a Retirement Planning Worksheet Printable, featuring pension, savings, and investment trackers, to help you strategize and achieve financial freedom through effective retirement planning and wealth management.

As people approach retirement age, they often find themselves wondering if they have saved enough money to maintain their standard of living. Retirement planning is a crucial step in ensuring that individuals have a secure financial future. One of the most effective ways to start planning for retirement is by using a retirement planning worksheet. In this article, we will explore the importance of retirement planning, the benefits of using a retirement planning worksheet, and provide a comprehensive guide on how to create a printable retirement planning worksheet.

Retirement planning is not just about saving money; it's about creating a sustainable income stream that will last throughout an individual's retirement years. With the rising cost of living and increasing life expectancy, it's essential to start planning for retirement early. A retirement planning worksheet can help individuals assess their current financial situation, set realistic goals, and create a tailored plan to achieve those goals. By using a worksheet, individuals can identify areas where they need to make adjustments, such as increasing their savings rate or investing in a retirement account.

A retirement planning worksheet can be a valuable tool for individuals who are just starting to plan for retirement, as well as those who are already retired. It can help individuals determine how much they need to save, what investments to make, and how to create a sustainable income stream. With a worksheet, individuals can also track their progress over time, making adjustments as needed to ensure they stay on track. Whether you're just starting to plan for retirement or are already enjoying your golden years, a retirement planning worksheet can be a valuable resource in achieving your financial goals.

Benefits of Using a Retirement Planning Worksheet

Using a retirement planning worksheet can have numerous benefits, including:

- Helping individuals assess their current financial situation and set realistic retirement goals

- Providing a clear picture of how much they need to save and what investments to make

- Allowing individuals to track their progress over time and make adjustments as needed

- Reducing stress and anxiety related to retirement planning

- Increasing confidence in one's ability to achieve their retirement goals

Key Components of a Retirement Planning Worksheet

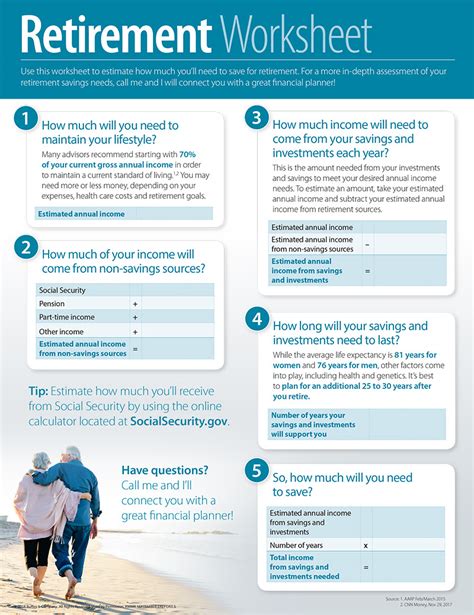

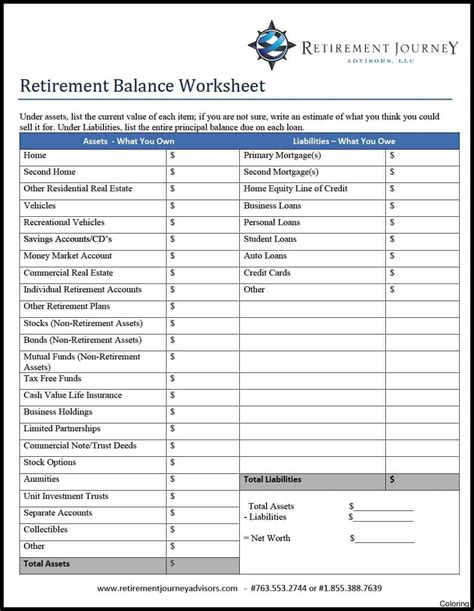

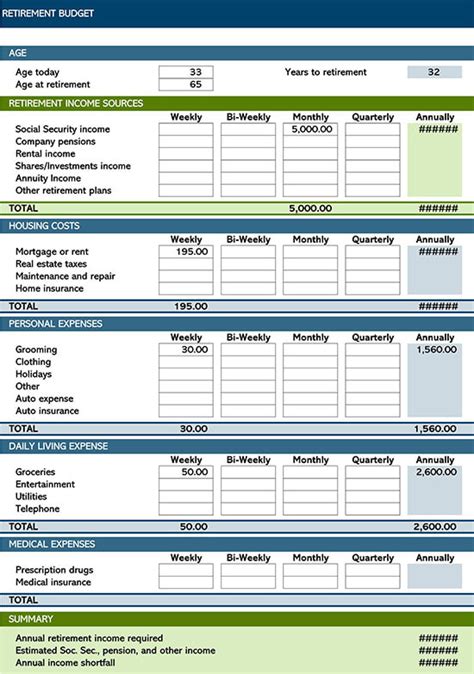

A comprehensive retirement planning worksheet should include the following key components: * Income: Calculate your expected income sources in retirement, including pensions, Social Security, and investments * Expenses: Estimate your monthly expenses in retirement, including housing, food, healthcare, and entertainment * Savings: Calculate your current savings and determine how much you need to save to achieve your retirement goals * Investments: Consider your investment options, including 401(k), IRA, and other retirement accounts * Debt: Assess your current debt and create a plan to pay off high-interest debt before retirementCreating a Printable Retirement Planning Worksheet

To create a printable retirement planning worksheet, follow these steps:

- Determine your retirement goals: What do you want to achieve in retirement? Do you want to travel, pursue hobbies, or simply enjoy time with family and friends?

- Assess your current financial situation: Calculate your income, expenses, savings, and debt

- Estimate your retirement expenses: Consider how your expenses will change in retirement, including housing, food, healthcare, and entertainment

- Calculate your retirement savings needs: Determine how much you need to save to achieve your retirement goals

- Consider your investment options: Look into 401(k), IRA, and other retirement accounts

- Create a plan to pay off high-interest debt: Develop a strategy to pay off debt before retirement

Retirement Planning Worksheet Example

Here's an example of what a retirement planning worksheet might look like: * Income: + Pension: $2,000 per month + Social Security: $1,500 per month + Investments: $1,000 per month * Expenses: + Housing: $1,500 per month + Food: $500 per month + Healthcare: $200 per month + Entertainment: $500 per month * Savings: + Current savings: $100,000 + Retirement savings goal: $500,000 * Investments: + 401(k): $50,000 + IRA: $20,000 * Debt: + Credit card debt: $5,000 + Mortgage: $100,000Retirement Planning Strategies

There are several retirement planning strategies that individuals can use to achieve their goals, including:

- Maximizing retirement account contributions: Contribute as much as possible to 401(k), IRA, and other retirement accounts

- Investing in a diversified portfolio: Spread investments across different asset classes, such as stocks, bonds, and real estate

- Creating a sustainable income stream: Develop a plan to generate income in retirement, such as through dividends, interest, or rental properties

- Reducing expenses: Cut back on unnecessary expenses and create a budget that works for you in retirement

Common Retirement Planning Mistakes

There are several common mistakes that individuals make when planning for retirement, including: * Not starting early enough: The sooner you start planning for retirement, the more time your money has to grow * Not saving enough: Calculate your retirement savings needs and make sure you're saving enough to achieve your goals * Not diversifying investments: Spread investments across different asset classes to reduce risk * Not considering inflation: Inflation can erode the purchasing power of your retirement savings over timeRetirement Planning Resources

There are several retirement planning resources available to individuals, including:

- Financial advisors: Work with a financial advisor to create a personalized retirement plan

- Online retirement planning tools: Utilize online tools and calculators to estimate retirement savings needs and create a plan

- Retirement planning books: Read books on retirement planning to learn more about strategies and techniques

- Retirement planning workshops: Attend workshops and seminars to learn more about retirement planning and network with others

Retirement Planning Tips

Here are some retirement planning tips to keep in mind: * Start early: The sooner you start planning for retirement, the more time your money has to grow * Be consistent: Make saving for retirement a priority and stick to your plan * Diversify investments: Spread investments across different asset classes to reduce risk * Consider inflation: Inflation can erode the purchasing power of your retirement savings over timeRetirement Planning Image Gallery

What is retirement planning?

+Retirement planning is the process of creating a plan to achieve your retirement goals, including saving enough money and creating a sustainable income stream.

Why is retirement planning important?

+Retirement planning is important because it helps individuals create a secure financial future and achieve their retirement goals.

How do I create a retirement planning worksheet?

+To create a retirement planning worksheet, determine your retirement goals, assess your current financial situation, estimate your retirement expenses, calculate your retirement savings needs, and consider your investment options.

As you can see, retirement planning is a complex process that requires careful consideration and planning. By using a retirement planning worksheet and following the tips and strategies outlined in this article, individuals can create a secure financial future and achieve their retirement goals. Remember to start early, be consistent, and diversify your investments to reduce risk. With the right plan in place, you can enjoy a comfortable and secure retirement. We invite you to share your thoughts and experiences with retirement planning in the comments below.