Intro

Discover the 5 SBA loan criteria, including credit score, business plan, and cash flow requirements, to increase approval chances for small business administration loans and financing options.

The Small Business Administration (SBA) loan program is a popular financing option for small businesses in the United States. The program offers favorable terms, such as lower down payments and longer repayment periods, making it an attractive choice for entrepreneurs. However, to qualify for an SBA loan, businesses must meet specific criteria. In this article, we will explore the 5 SBA loan criteria that businesses must meet to be eligible for this type of financing.

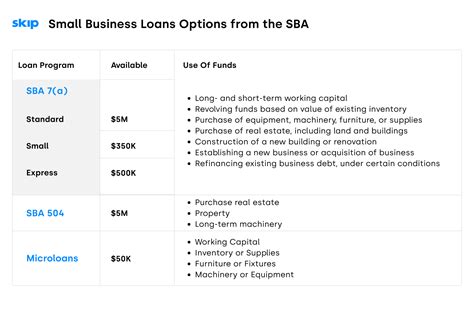

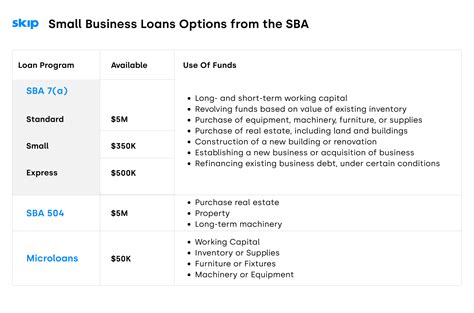

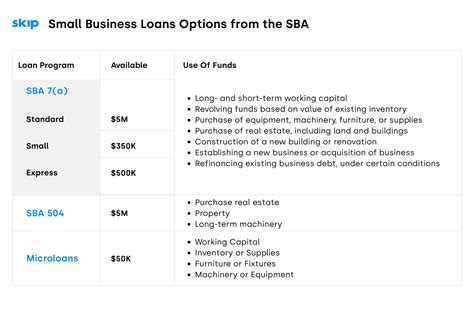

The SBA loan program is designed to support small businesses that may not qualify for traditional bank loans. The program provides a guarantee to lenders, which reduces the risk of lending to small businesses. This guarantee allows lenders to offer more favorable terms to borrowers, making it easier for small businesses to access the capital they need to grow and succeed. With the SBA loan program, businesses can borrow up to $5 million, with repayment terms of up to 25 years.

To be eligible for an SBA loan, businesses must meet specific criteria. These criteria are designed to ensure that only qualified businesses receive financing through the program. The 5 SBA loan criteria are: credit score, business size, industry, cash flow, and collateral. Each of these criteria plays a critical role in determining whether a business is eligible for an SBA loan.

Understanding the 5 SBA Loan Criteria

The first criterion is credit score. The SBA requires borrowers to have a good credit score, typically above 650. This ensures that borrowers have a history of repaying debts on time and are likely to repay the SBA loan. The credit score is just one factor that lenders consider when evaluating loan applications. Lenders also review business financials, such as income statements and balance sheets, to determine whether the business can afford to repay the loan.

Business Size and Industry

The second and third criteria are business size and industry. The SBA has specific size standards for businesses, which vary by industry. For example, a business in the manufacturing industry may be considered small if it has fewer than 500 employees, while a business in the retail industry may be considered small if it has fewer than $7 million in annual sales. The SBA also has a list of ineligible industries, such as casinos and racetracks, which are not eligible for SBA loans.

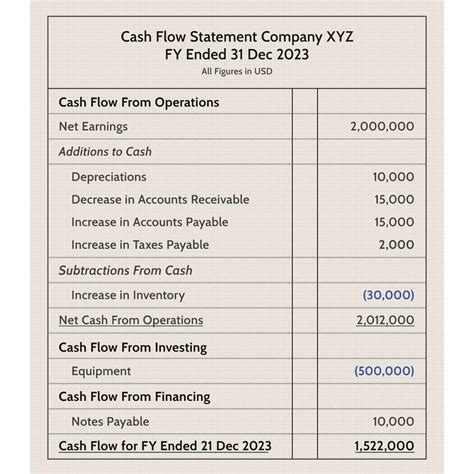

The fourth criterion is cash flow. The SBA requires businesses to demonstrate a positive cash flow, which ensures that the business can afford to repay the loan. Lenders review business financials, such as income statements and cash flow statements, to determine whether the business has sufficient cash flow to repay the loan. A positive cash flow is critical for businesses, as it ensures that they can meet their financial obligations and invest in growth opportunities.

Cash Flow and Collateral

The fifth criterion is collateral. The SBA requires borrowers to provide collateral for the loan, which can include business assets, such as equipment or real estate. The collateral ensures that the lender can recover some or all of the loan amount if the borrower defaults. The type and amount of collateral required vary by lender and loan program.

In addition to these criteria, the SBA also requires borrowers to meet other eligibility requirements, such as being a for-profit business and operating in the United States. The SBA also has specific requirements for loan use, such as using the loan proceeds for business purposes only.

Benefits of SBA Loans

SBA loans offer several benefits to small businesses, including lower down payments, longer repayment terms, and lower interest rates. The SBA guarantee also reduces the risk of lending to small businesses, making it easier for lenders to offer financing to businesses that may not qualify for traditional bank loans.

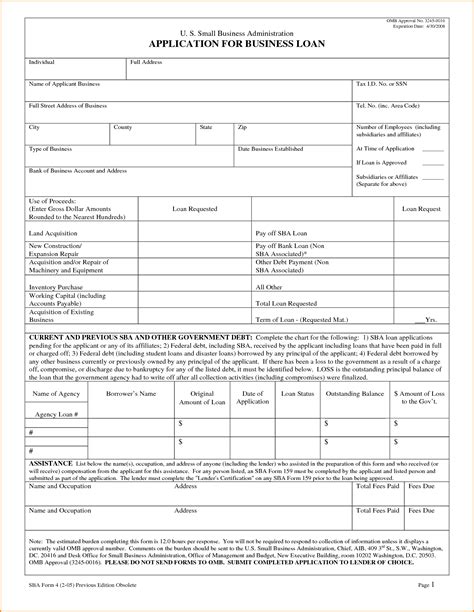

To apply for an SBA loan, businesses must prepare a loan application package, which includes business financials, tax returns, and other documentation. The application package is submitted to an SBA-approved lender, which reviews the application and makes a lending decision.

Applying for an SBA Loan

The SBA loan application process can be complex and time-consuming, but it is worth the effort for businesses that need financing to grow and succeed. With the right preparation and documentation, businesses can increase their chances of being approved for an SBA loan.

In conclusion, the 5 SBA loan criteria are critical for businesses to understand when applying for an SBA loan. By meeting these criteria, businesses can increase their chances of being approved for financing and accessing the capital they need to grow and succeed.

Gallery of SBA Loan Images

SBA Loan Image Gallery

What is the maximum amount that can be borrowed through an SBA loan?

+The maximum amount that can be borrowed through an SBA loan is $5 million.

What is the repayment term for an SBA loan?

+The repayment term for an SBA loan can be up to 25 years.

What are the benefits of an SBA loan?

+The benefits of an SBA loan include lower down payments, longer repayment terms, and lower interest rates.

We hope this article has provided you with a comprehensive understanding of the 5 SBA loan criteria and the benefits of SBA loans. If you have any further questions or would like to learn more about SBA loans, please do not hesitate to contact us. We are always happy to help businesses navigate the complex world of financing and find the best options for their needs. Share this article with your friends and colleagues to help them understand the benefits of SBA loans and how to qualify for this type of financing.