Intro

Discover 5 ways Square Up credit card simplifies payments, with contactless transactions, mobile payments, and digital wallets, offering seamless checkout experiences and secure payment processing solutions.

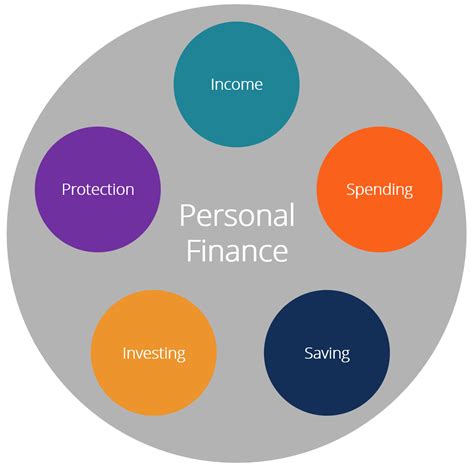

The importance of managing finances effectively cannot be overstated, especially in today's fast-paced world where financial decisions can significantly impact one's quality of life. One aspect of financial management that often receives attention is credit card debt. Credit cards, when used wisely, can be powerful tools for building credit, earning rewards, and making purchases. However, they can also lead to debt if not managed properly. Square Up Credit Card is a financial tool designed to help individuals manage their credit card debt and improve their financial health.

Understanding the concept of credit and how it affects one's financial standing is crucial. Credit scores are essentially a measure of how well an individual manages their debt. A good credit score can open doors to better loan rates, higher credit limits, and even affect the ability to rent an apartment or buy a house. On the other hand, a poor credit score can limit financial options and increase the cost of borrowing. The Square Up Credit Card is positioned as a solution to help navigate these challenges by offering a straightforward and manageable way to pay off debt.

The financial landscape is filled with products and services aimed at helping individuals manage their debt. From balance transfer credit cards to debt consolidation loans, the options can be overwhelming. What sets the Square Up Credit Card apart is its focus on simplicity and transparency. By providing a clear and manageable repayment plan, individuals can focus on paying off their debt without the confusion that often comes with complex financial products. This approach has resonated with many who are seeking a straightforward solution to their debt issues.

Introduction to Square Up Credit Card

The Square Up Credit Card is designed with the user in mind, offering features that cater to those looking to pay off their debt efficiently. One of the key benefits is the ability to consolidate debt from higher-interest credit cards into a single, lower-interest payment. This not only simplifies the payment process but can also save individuals money on interest over time. Additionally, the Square Up Credit Card often comes with no late fees, which can be a significant advantage for those who occasionally miss payments.

Benefits of Using Square Up Credit Card

The benefits of using a Square Up Credit Card are multifaceted. Firstly, it provides a structured approach to debt repayment, which can be incredibly motivating for individuals who feel overwhelmed by their debt. Knowing exactly how much to pay each month and having a clear end date for becoming debt-free can be a powerful tool for staying on track. Furthermore, the Square Up Credit Card can help improve credit scores over time by demonstrating responsible payment behavior. This, in turn, can lead to better financial opportunities in the future.

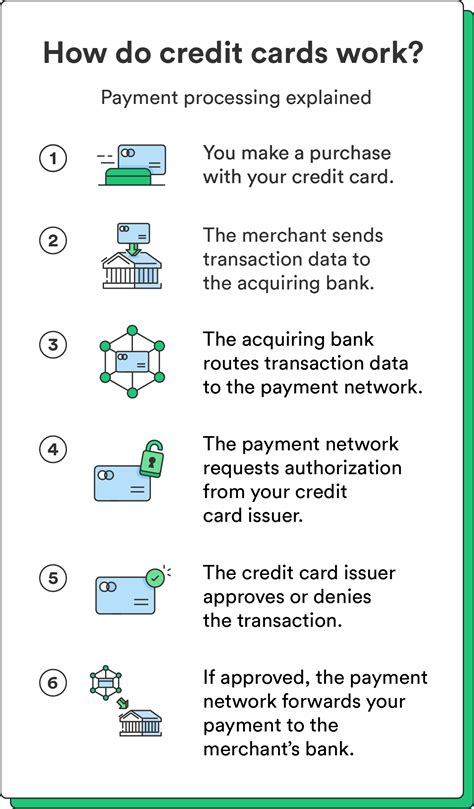

How Square Up Credit Card Works

Understanding how the Square Up Credit Card works is essential for those considering it as a debt management tool. The process typically begins with an application, where the individual's creditworthiness is assessed. If approved, the card can be used to consolidate debt from other credit cards. The repayment plan is then structured over a set period, with fixed monthly payments. This predictability can be a welcome change for those dealing with variable interest rates and minimum payments that seem to stretch on indefinitely.

Steps to Apply for Square Up Credit Card

Applying for a Square Up Credit Card involves several steps. The first step is to check eligibility, which can usually be done online with a soft credit check that does not affect one's credit score. If eligible, the next step is to apply formally, which may require providing financial information and consenting to a hard credit inquiry. After approval, the card is issued, and the debt consolidation process can begin. It's essential to carefully review the terms and conditions before applying to ensure it's the right fit for one's financial situation.

Managing Debt with Square Up Credit Card

Managing debt effectively with a Square Up Credit Card requires discipline and a clear understanding of the repayment plan. It's crucial to make payments on time and in full each month to avoid any potential penalties and to ensure the debt is paid off as efficiently as possible. Additionally, avoiding new credit card purchases during the repayment period can help prevent accumulating more debt. By sticking to the plan and maintaining good payment habits, individuals can successfully pay off their debt and improve their financial health.

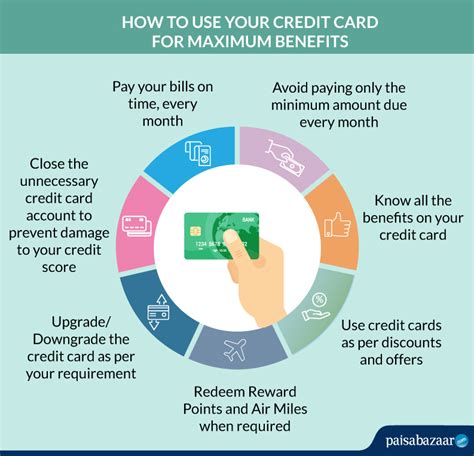

Practical Tips for Debt Management

Some practical tips for managing debt with a Square Up Credit Card include: - Creating a budget to understand where money is going and how it can be allocated towards debt repayment. - Avoiding unnecessary expenses to free up more money for debt payments. - Considering ways to increase income, such as taking on a side job, to put more towards the debt. - Regularly reviewing credit reports to ensure there are no errors that could affect credit scores.Square Up Credit Card Image Gallery

What is the Square Up Credit Card?

+The Square Up Credit Card is a financial tool designed to help individuals manage their credit card debt and improve their financial health.

How does the Square Up Credit Card work?

+The Square Up Credit Card works by allowing individuals to consolidate their debt into a single, lower-interest payment, with a structured repayment plan.

What are the benefits of using the Square Up Credit Card?

+The benefits include a simplified payment process, potential savings on interest, and the opportunity to improve credit scores over time.

In conclusion, the Square Up Credit Card offers a valuable solution for individuals looking to manage their debt and improve their financial health. By providing a clear and manageable repayment plan, it helps individuals stay on track and avoid the pitfalls of high-interest debt. Whether you're struggling with credit card debt or simply looking for a more efficient way to manage your finances, the Square Up Credit Card is certainly worth considering. We invite you to share your thoughts on debt management and financial health in the comments below, and to explore more resources on managing debt and improving credit scores.