Intro

Discover what profit margins are, including gross, operating, and net margins, to understand revenue, expenses, and financial performance in business and commerce.

The concept of profit margins is crucial for businesses, as it directly affects their financial health and sustainability. Understanding profit margins is essential for entrepreneurs, managers, and investors to make informed decisions about their investments and strategies. In this article, we will delve into the world of profit margins, exploring their definition, types, importance, and factors that influence them.

Profit margins are a measure of a company's profitability, calculated by dividing its net income by its total revenue. This ratio indicates the percentage of revenue that is converted into profit. A higher profit margin indicates that a company is more efficient in converting its revenue into profit, while a lower profit margin suggests that a company is struggling to maintain its profitability. Profit margins can be calculated for different periods, such as quarterly or annually, and can be used to compare the performance of different companies or industries.

The importance of profit margins cannot be overstated. A company with a high profit margin has more flexibility to invest in growth initiatives, pay dividends to shareholders, and weather economic downturns. On the other hand, a company with a low profit margin may struggle to survive, as it may not have enough resources to invest in its operations or pay its debts. Furthermore, profit margins can be used to evaluate the effectiveness of a company's pricing strategy, cost management, and operational efficiency.

Types of Profit Margins

There are several types of profit margins, each with its own unique characteristics and uses. The most common types of profit margins include:

- Gross profit margin: This is the most basic type of profit margin, calculated by dividing the gross profit by the total revenue. Gross profit is the difference between revenue and the cost of goods sold.

- Operating profit margin: This type of profit margin is calculated by dividing the operating profit by the total revenue. Operating profit is the profit earned from a company's core operations, excluding non-operating items such as interest and taxes.

- Net profit margin: This is the most comprehensive type of profit margin, calculated by dividing the net income by the total revenue. Net income is the profit earned by a company after deducting all expenses, including non-operating items.

Each type of profit margin has its own strengths and weaknesses, and can be used to evaluate different aspects of a company's performance. For example, the gross profit margin can be used to evaluate a company's pricing strategy, while the operating profit margin can be used to evaluate its operational efficiency.

Factors That Influence Profit Margins

Several factors can influence a company's profit margins, including:

- Pricing strategy: A company's pricing strategy can have a significant impact on its profit margins. If a company sets its prices too low, it may not be able to generate enough revenue to cover its costs, resulting in low profit margins.

- Cost management: A company's ability to manage its costs can also impact its profit margins. If a company is able to reduce its costs, it can increase its profit margins, even if its revenue remains the same.

- Operational efficiency: A company's operational efficiency can also impact its profit margins. If a company is able to streamline its operations and reduce waste, it can increase its profit margins.

- Market conditions: Market conditions, such as competition and demand, can also impact a company's profit margins. If a company operates in a highly competitive market, it may need to reduce its prices to remain competitive, resulting in lower profit margins.

Understanding these factors is essential for companies to develop effective strategies to improve their profit margins. By analyzing these factors, companies can identify areas for improvement and make informed decisions about their investments and operations.

Importance of Profit Margins

The importance of profit margins cannot be overstated. A company with high profit margins has more flexibility to invest in growth initiatives, pay dividends to shareholders, and weather economic downturns. On the other hand, a company with low profit margins may struggle to survive, as it may not have enough resources to invest in its operations or pay its debts.

High profit margins can also indicate a company's competitive advantage, such as a unique product or service, a strong brand, or a patented technology. Companies with high profit margins are often able to maintain their market share and expand their customer base, resulting in increased revenue and profitability.

In addition, profit margins can be used to evaluate the effectiveness of a company's management team. A company with high profit margins may indicate that its management team is effective in managing costs, pricing products, and allocating resources.

Calculating Profit Margins

Calculating profit margins is a straightforward process that involves dividing a company's net income by its total revenue. The formula for calculating profit margins is:

Profit Margin = (Net Income / Total Revenue) x 100

For example, if a company has a net income of $100,000 and total revenue of $1,000,000, its profit margin would be:

Profit Margin = ($100,000 / $1,000,000) x 100 = 10%

This means that the company has a profit margin of 10%, indicating that it is able to convert 10% of its revenue into profit.

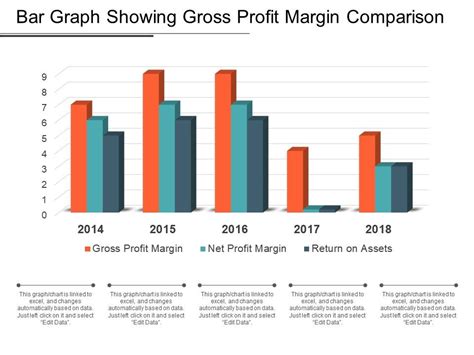

Industry Comparison

Comparing a company's profit margins to those of its industry peers can provide valuable insights into its performance. A company with higher profit margins than its industry peers may indicate that it has a competitive advantage, such as a unique product or service, a strong brand, or a patented technology.

On the other hand, a company with lower profit margins than its industry peers may indicate that it is struggling to maintain its market share or expand its customer base. This can be due to a variety of factors, such as increased competition, changing market conditions, or ineffective management.

By comparing a company's profit margins to those of its industry peers, investors and analysts can gain a better understanding of its performance and make informed decisions about their investments.

Gallery of Profit Margins

Profit Margins Image Gallery

Frequently Asked Questions

What is the importance of profit margins?

+Profit margins are important because they indicate a company's ability to convert revenue into profit. A high profit margin indicates that a company is efficient in its operations and has a strong competitive advantage.

How are profit margins calculated?

+Profit margins are calculated by dividing a company's net income by its total revenue and multiplying by 100.

What are the different types of profit margins?

+The different types of profit margins include gross profit margin, operating profit margin, and net profit margin. Each type of profit margin has its own unique characteristics and uses.

Why is it important to compare profit margins to industry peers?

+Comparing profit margins to industry peers provides valuable insights into a company's performance and can help investors and analysts make informed decisions about their investments.

How can companies improve their profit margins?

+Companies can improve their profit margins by reducing costs, increasing revenue, and optimizing their operations. This can be achieved through a variety of strategies, such as streamlining processes, reducing waste, and investing in new technologies.

In conclusion, profit margins are a crucial aspect of a company's financial performance, indicating its ability to convert revenue into profit. Understanding the different types of profit margins, calculating them, and comparing them to industry peers can provide valuable insights into a company's performance and help investors and analysts make informed decisions about their investments. By improving their profit margins, companies can increase their competitiveness, expand their customer base, and achieve long-term sustainability. We hope this article has provided you with a comprehensive understanding of profit margins and their importance in the business world. If you have any further questions or would like to share your thoughts, please feel free to comment below.