Intro

Discover the 5 key operating expenses, including labor, inventory, and marketing costs, to optimize business finances and reduce overhead expenses, improving operational efficiency and profitability.

Operating expenses are a crucial aspect of any business, as they directly impact the company's profitability and financial health. Understanding and managing operating expenses is essential for entrepreneurs, managers, and financial professionals to make informed decisions and drive business growth. In this article, we will delve into the world of operating expenses, exploring their definition, types, and importance, as well as providing practical tips on how to manage and reduce them.

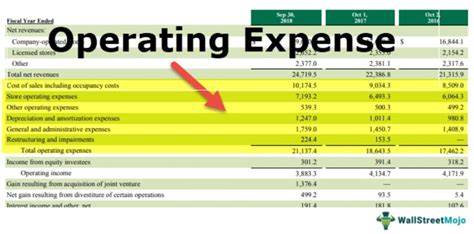

Operating expenses, also known as operating expenditures or opex, refer to the costs incurred by a business to maintain its daily operations and generate revenue. These expenses are typically recurring and can include a wide range of costs, such as salaries, rent, utilities, marketing, and equipment maintenance. Operating expenses are usually contrasted with capital expenditures (capex), which are one-time investments in assets that will benefit the business over an extended period.

Types of Operating Expenses

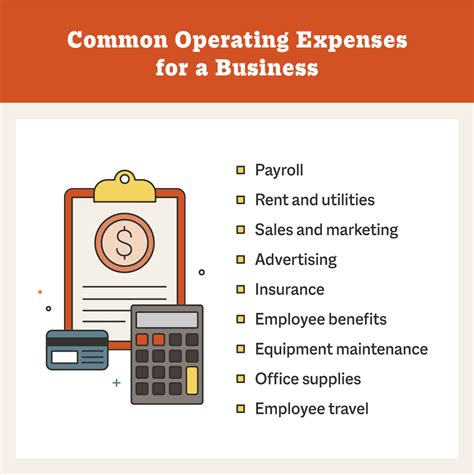

There are several types of operating expenses that businesses may incur, including:

- Salaries and wages: The cost of employing staff, including benefits, bonuses, and payroll taxes.

- Rent and utilities: The cost of occupying a physical space, including rent, electricity, water, and gas.

- Marketing and advertising: The cost of promoting the business and its products or services.

- Equipment and maintenance: The cost of acquiring, maintaining, and repairing equipment and machinery.

- Insurance: The cost of protecting the business against various risks, such as liability, property damage, and employee injuries.

- Travel and entertainment: The cost of business travel, meals, and entertainment.

Importance of Operating Expenses

Operating expenses play a vital role in the financial health and sustainability of a business. They can have a significant impact on the company's profitability, cash flow, and competitiveness. Some of the key reasons why operating expenses are important include:

- Profitability: Operating expenses directly affect the business's bottom line, as they are subtracted from revenue to calculate net income.

- Cash flow: Operating expenses can impact the business's cash flow, as they require regular payments and can lead to cash outflows.

- Competitiveness: Operating expenses can influence the business's competitiveness, as high expenses can make it difficult to compete with other companies on price or quality.

Managing Operating Expenses

Managing operating expenses is crucial to maintaining a healthy and sustainable business. Some strategies for managing operating expenses include:

- Budgeting: Creating a budget that outlines projected operating expenses and revenue.

- Cost control: Implementing measures to reduce or control operating expenses, such as renegotiating contracts or reducing energy consumption.

- Expense tracking: Monitoring and tracking operating expenses to identify areas for improvement.

- Vendor management: Building relationships with vendors and suppliers to negotiate better prices or terms.

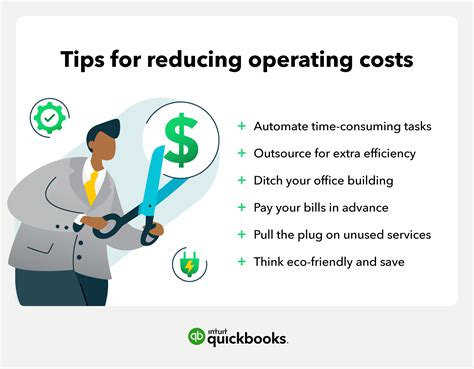

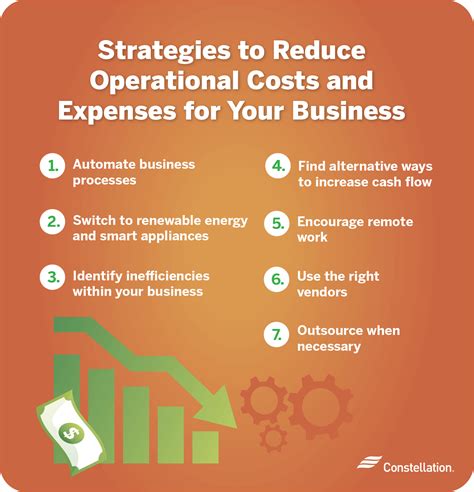

Reducing Operating Expenses

Reducing operating expenses can have a significant impact on a business's profitability and competitiveness. Some strategies for reducing operating expenses include:

- Outsourcing: Outsourcing non-core functions or activities to reduce labor costs and improve efficiency.

- Automation: Implementing automation technologies to reduce labor costs and improve productivity.

- Energy efficiency: Implementing energy-efficient practices and technologies to reduce energy consumption and costs.

- Supply chain optimization: Optimizing the supply chain to reduce costs and improve efficiency.

Best Practices for Operating Expense Management

Some best practices for operating expense management include:

- Regularly reviewing and updating the budget to ensure it is accurate and relevant.

- Implementing a cost control program to identify and reduce unnecessary expenses.

- Monitoring and tracking operating expenses to identify areas for improvement.

- Building relationships with vendors and suppliers to negotiate better prices or terms.

- Continuously evaluating and improving processes and procedures to reduce waste and improve efficiency.

Common Challenges in Operating Expense Management

Some common challenges in operating expense management include:

- Lack of visibility and transparency into operating expenses.

- Inadequate budgeting and forecasting.

- Insufficient cost control measures.

- Inefficient processes and procedures.

- Limited resources and bandwidth to manage operating expenses.

Technologies for Operating Expense Management

Some technologies that can help with operating expense management include:

- Enterprise resource planning (ERP) systems.

- Accounting and financial management software.

- Expense tracking and reporting tools.

- Budgeting and forecasting software.

- Automation and artificial intelligence (AI) technologies.

Benefits of Effective Operating Expense Management

Some benefits of effective operating expense management include:

- Improved profitability and competitiveness.

- Enhanced cash flow and financial stability.

- Increased efficiency and productivity.

- Better decision-making and strategic planning.

- Improved relationships with vendors and suppliers.

Gallery of Operating Expenses

Operating Expenses Image Gallery

What are operating expenses?

+Operating expenses refer to the costs incurred by a business to maintain its daily operations and generate revenue.

Why are operating expenses important?

+Operating expenses are important because they directly impact the business's profitability, cash flow, and competitiveness.

How can operating expenses be managed?

+Operating expenses can be managed through budgeting, cost control, expense tracking, and vendor management.

What are some common challenges in operating expense management?

+Some common challenges in operating expense management include lack of visibility and transparency, inadequate budgeting and forecasting, and insufficient cost control measures.

What are some benefits of effective operating expense management?

+Some benefits of effective operating expense management include improved profitability and competitiveness, enhanced cash flow and financial stability, and increased efficiency and productivity.

In conclusion, operating expenses are a critical component of any business, and effective management of these expenses is essential for maintaining a healthy and sustainable business. By understanding the types of operating expenses, their importance, and how to manage and reduce them, businesses can improve their profitability, cash flow, and competitiveness. We encourage readers to share their thoughts and experiences on operating expense management in the comments section below. Additionally, we invite readers to share this article with others who may benefit from the information and insights provided. By working together, we can help businesses of all sizes and industries achieve their goals and succeed in an ever-changing market.