Intro

Discover Advanced Cash Definition, a digital payment system offering secure online transactions, e-wallet services, and instant money transfers, utilizing cutting-edge fintech solutions for efficient cash management and online banking experiences.

The concept of advanced cash has become increasingly important in today's fast-paced financial landscape. Advanced cash refers to a type of financial transaction or payment that is made before the actual delivery of goods or services. This concept is widely used in various industries, including business, finance, and commerce. In this article, we will delve into the world of advanced cash, exploring its definition, benefits, and applications.

Advanced cash is a payment made by a buyer to a seller before the seller delivers the promised goods or services. This payment is typically made in advance of the delivery date and can be in the form of cash, credit, or other payment methods. The concept of advanced cash is often used in business-to-business (B2B) transactions, where buyers and sellers agree on a payment terms that require payment before the delivery of goods or services.

The use of advanced cash has several benefits for both buyers and sellers. For buyers, advanced cash can provide a sense of security and assurance that the goods or services will be delivered as promised. It can also help buyers to budget and plan their finances more effectively. For sellers, advanced cash can provide a steady stream of income and help to reduce the risk of non-payment or delayed payment.

Understanding Advanced Cash

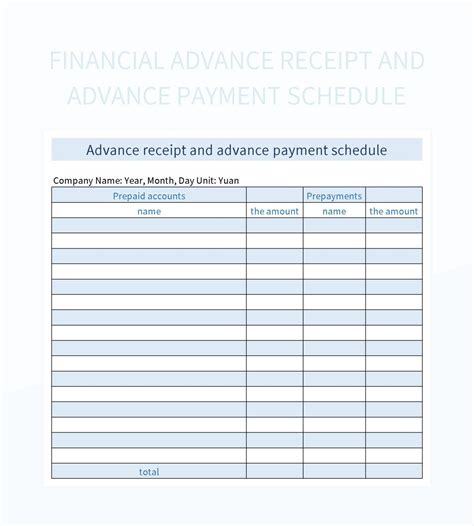

To understand advanced cash, it's essential to consider the different types of advanced cash payments. These include down payments, deposits, and prepayments. Down payments are a type of advanced cash payment that is made as a percentage of the total purchase price. Deposits, on the other hand, are a type of advanced cash payment that is made to secure a purchase or reservation. Prepayments, as the name suggests, are payments made before the delivery of goods or services.

Types of Advanced Cash Payments

The different types of advanced cash payments have distinct characteristics and uses. Down payments, for example, are commonly used in real estate transactions, where a buyer pays a percentage of the purchase price as a down payment. Deposits, on the other hand, are commonly used in the hospitality industry, where a guest pays a deposit to secure a hotel room or reservation. Prepayments, as mentioned earlier, are payments made before the delivery of goods or services and are commonly used in business-to-business transactions.Benefits of Advanced Cash

The benefits of advanced cash are numerous and can be seen from both the buyer's and seller's perspectives. For buyers, advanced cash can provide a sense of security and assurance that the goods or services will be delivered as promised. It can also help buyers to budget and plan their finances more effectively. For sellers, advanced cash can provide a steady stream of income and help to reduce the risk of non-payment or delayed payment.

Some of the key benefits of advanced cash include:

- Reduced risk of non-payment or delayed payment

- Improved cash flow and financial planning

- Increased sense of security and assurance

- Better budgeting and financial management

- Enhanced customer satisfaction and loyalty

Applications of Advanced Cash

The applications of advanced cash are diverse and can be seen in various industries, including business, finance, and commerce. In the business world, advanced cash is commonly used in business-to-business transactions, where buyers and sellers agree on payment terms that require payment before the delivery of goods or services.In the finance industry, advanced cash is used in various financial transactions, including loans and credit agreements. In commerce, advanced cash is used in online transactions, where buyers pay for goods or services before they are delivered.

Some of the key applications of advanced cash include:

- Business-to-business transactions

- Financial transactions, such as loans and credit agreements

- Online transactions, such as e-commerce and digital payments

- Real estate transactions, such as down payments and deposits

- Hospitality industry, such as hotel reservations and deposits

Working Mechanisms of Advanced Cash

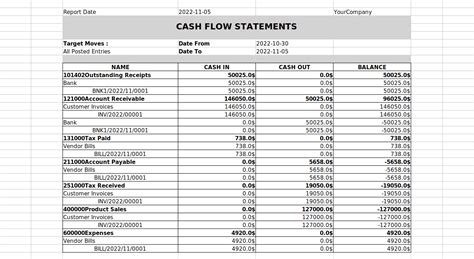

The working mechanisms of advanced cash involve a series of steps and processes that ensure the smooth and efficient transfer of funds. These mechanisms include payment processing, transaction verification, and fund transfer.

Payment processing involves the use of payment systems, such as credit cards, debit cards, and online payment platforms, to facilitate the transfer of funds. Transaction verification involves the verification of the transaction details, including the payment amount, payment method, and payment terms.

Fund transfer involves the transfer of funds from the buyer's account to the seller's account, using a payment system or financial institution.

Some of the key working mechanisms of advanced cash include:

- Payment processing, using payment systems and platforms

- Transaction verification, to ensure the accuracy and validity of the transaction

- Fund transfer, using payment systems and financial institutions

- Payment confirmation, to confirm the receipt of payment

- Dispute resolution, to resolve any disputes or issues that may arise

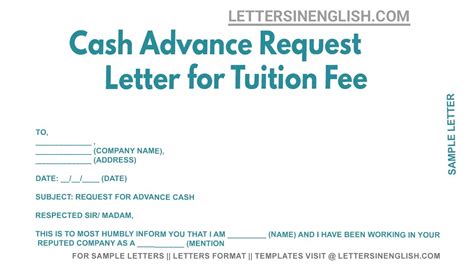

Steps Involved in Advanced Cash Transactions

The steps involved in advanced cash transactions include: 1. Payment initiation, where the buyer initiates the payment process 2. Payment processing, where the payment is processed using a payment system or platform 3. Transaction verification, where the transaction details are verified 4. Fund transfer, where the funds are transferred from the buyer's account to the seller's account 5. Payment confirmation, where the receipt of payment is confirmed 6. Dispute resolution, where any disputes or issues are resolvedPractical Examples of Advanced Cash

There are many practical examples of advanced cash in use today. One example is the use of down payments in real estate transactions. Another example is the use of deposits in the hospitality industry, where a guest pays a deposit to secure a hotel room or reservation.

In business-to-business transactions, advanced cash is commonly used to secure payment before the delivery of goods or services. For example, a buyer may pay a seller a deposit or down payment to secure a purchase or reservation.

Some other examples of advanced cash include:

- Prepayments, where a buyer pays for goods or services before they are delivered

- Retainers, where a buyer pays a seller a fee to secure their services

- Escrow payments, where a buyer pays a seller through a third-party escrow service

Statistical Data on Advanced Cash

According to recent statistics, the use of advanced cash is on the rise. In 2020, the global advanced cash market was valued at $1.2 trillion, with an expected growth rate of 10% per annum.In the United States, the use of advanced cash is widespread, with over 70% of businesses using advanced cash payments in their transactions. In Europe, the use of advanced cash is also common, with over 60% of businesses using advanced cash payments.

Some of the key statistics on advanced cash include:

- Global advanced cash market valued at $1.2 trillion in 2020

- Expected growth rate of 10% per annum

- Over 70% of businesses in the United States use advanced cash payments

- Over 60% of businesses in Europe use advanced cash payments

Gallery of Advanced Cash Images

Advanced Cash Image Gallery

Frequently Asked Questions

What is advanced cash?

+Advanced cash refers to a payment made by a buyer to a seller before the seller delivers the promised goods or services.

What are the benefits of advanced cash?

+The benefits of advanced cash include reduced risk of non-payment or delayed payment, improved cash flow and financial planning, and increased sense of security and assurance.

What are the different types of advanced cash payments?

+The different types of advanced cash payments include down payments, deposits, and prepayments.

How does advanced cash work?

+Advanced cash works by facilitating the transfer of funds from the buyer's account to the seller's account, using a payment system or financial institution.

What are some examples of advanced cash in use today?

+Some examples of advanced cash in use today include down payments in real estate transactions, deposits in the hospitality industry, and prepayments in business-to-business transactions.

In final thoughts, advanced cash is a vital concept in today's financial landscape, providing a sense of security and assurance for both buyers and sellers. By understanding the definition, benefits, and applications of advanced cash, individuals and businesses can make informed decisions about their financial transactions. Whether you're a buyer or a seller, advanced cash can help you to navigate the complex world of finance with confidence and ease. We invite you to share your thoughts and experiences with advanced cash in the comments below, and to share this article with others who may benefit from its insights.