Intro

Discover what an invoice is, including types, templates, and billing processes, to streamline financial management and payment tracking with effective invoicing systems and online invoicing tools.

The importance of invoices cannot be overstated, as they play a crucial role in the financial management of businesses, freelancers, and individuals. An invoice is a document that outlines the details of a transaction, including the products or services provided, the quantity, rate, and total amount due. It serves as a request for payment from the buyer to the seller, and its accuracy and clarity are essential for maintaining a healthy cash flow. In this article, we will delve into the world of invoices, exploring their benefits, working mechanisms, and best practices for creation and management.

Invoices are an integral part of any business, as they help to establish a clear understanding of the terms and conditions of a sale. They provide a paper trail that can be used to track payments, resolve disputes, and maintain a record of all financial transactions. With the advancement of technology, invoices have evolved to become more efficient, secure, and environmentally friendly. Electronic invoices, in particular, have gained popularity, as they can be easily created, sent, and stored, reducing the need for physical paperwork and minimizing the risk of errors.

The benefits of invoices extend beyond their functional purpose, as they also contribute to the overall professionalism and credibility of a business. A well-designed invoice can help to establish trust with customers, convey a sense of reliability, and reinforce a company's brand identity. Moreover, invoices can be used as a marketing tool, providing an opportunity to promote services, offer discounts, and encourage customer loyalty. By understanding the significance of invoices and leveraging their potential, businesses can streamline their financial operations, improve customer relationships, and drive growth.

Introduction to Invoices

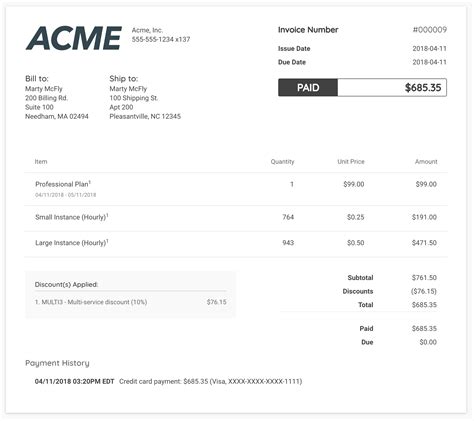

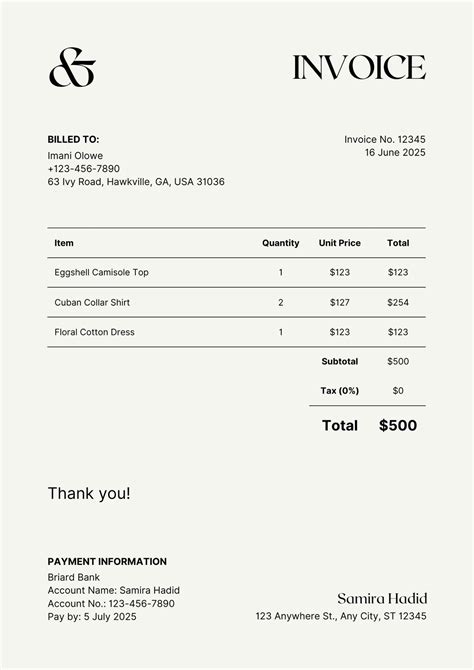

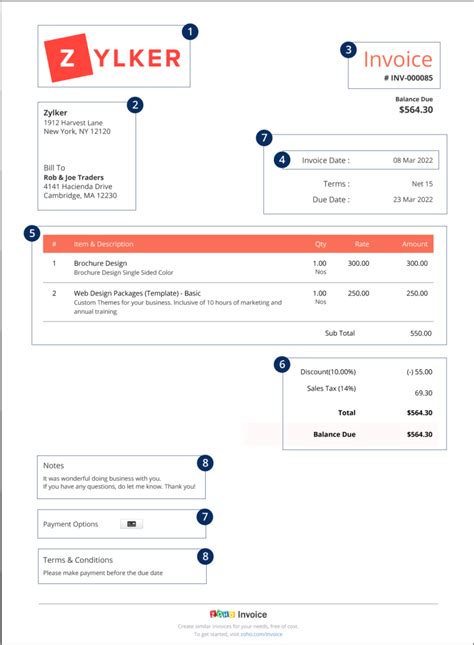

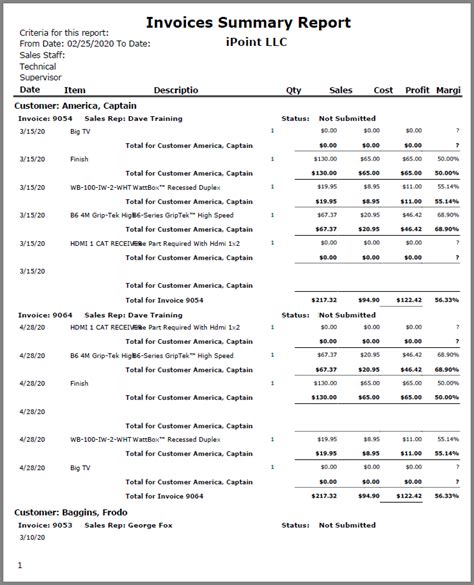

Invoices are a fundamental component of business transactions, and their structure typically includes essential information, such as the seller's and buyer's details, invoice number, date, and payment terms. The invoice should also itemize the products or services provided, including their quantities, rates, and subtotal amounts. Additionally, it may include tax calculations, discounts, and any other relevant charges. By providing a clear and concise summary of the transaction, invoices facilitate communication between parties, reduce misunderstandings, and ensure timely payments.

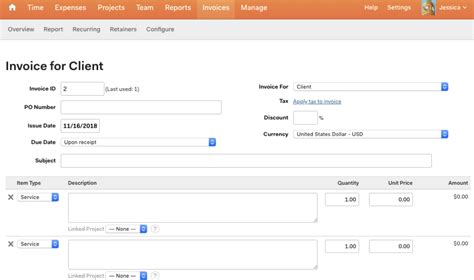

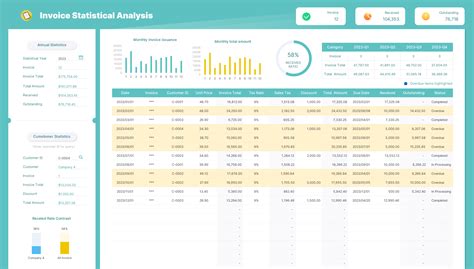

The creation of invoices can be a straightforward process, especially with the help of accounting software and templates. These tools enable businesses to generate professional-looking invoices quickly and efficiently, saving time and reducing errors. Moreover, electronic invoicing systems can automate tasks, such as sending reminders, tracking payments, and updating records, freeing up resources for more strategic activities. By adopting a systematic approach to invoicing, businesses can improve their financial management, enhance customer satisfaction, and increase their competitiveness.

Benefits of Invoices

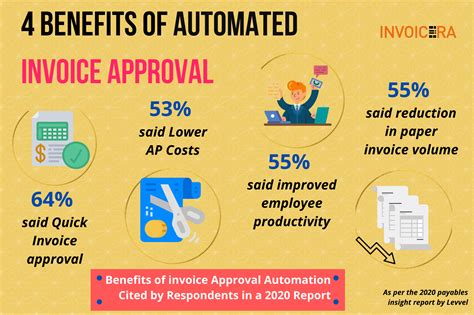

The benefits of invoices are numerous, and they can have a significant impact on a business's financial health and reputation. Some of the key advantages of invoices include:

- Improved cash flow: Invoices help to establish a clear payment schedule, reducing the risk of late payments and minimizing the need for costly reminders.

- Enhanced professionalism: A well-designed invoice can convey a sense of reliability, trustworthiness, and attention to detail, reinforcing a company's brand identity.

- Increased efficiency: Electronic invoicing systems can automate tasks, reduce paperwork, and minimize errors, freeing up resources for more strategic activities.

- Better record-keeping: Invoices provide a paper trail that can be used to track payments, resolve disputes, and maintain a record of all financial transactions.

- Tax compliance: Invoices can help businesses to comply with tax regulations, providing a clear summary of taxable amounts and payment dates.

By leveraging these benefits, businesses can streamline their financial operations, improve customer relationships, and drive growth. Moreover, invoices can be used as a marketing tool, providing an opportunity to promote services, offer discounts, and encourage customer loyalty.

Types of Invoices

There are several types of invoices, each with its own unique characteristics and purposes. Some of the most common types of invoices include:

- Pro forma invoice: A provisional invoice that outlines the terms and conditions of a sale, including the products or services provided, quantities, rates, and total amount due.

- Commercial invoice: A standard invoice that is used for international trade, providing detailed information about the products or services provided, including their weights, measures, and values.

- Recurring invoice: A regular invoice that is sent to customers at fixed intervals, typically used for subscription-based services or ongoing projects.

- Credit invoice: A type of invoice that is used to correct errors or discrepancies in previous invoices, providing a credit note to the customer.

- Debit invoice: A type of invoice that is used to charge customers for additional services or products, providing a debit note to the customer.

By understanding the different types of invoices and their purposes, businesses can choose the most suitable option for their needs, ensuring that their financial operations are efficient, accurate, and compliant with regulations.

Best Practices for Creating Invoices

Creating an effective invoice requires attention to detail, clarity, and professionalism. Some of the best practices for creating invoices include:

- Using a clear and concise format: The invoice should be easy to read and understand, with a clear summary of the products or services provided, quantities, rates, and total amount due.

- Including essential information: The invoice should include the seller's and buyer's details, invoice number, date, and payment terms, as well as any relevant tax calculations or discounts.

- Using a professional tone: The invoice should convey a sense of reliability, trustworthiness, and attention to detail, reinforcing a company's brand identity.

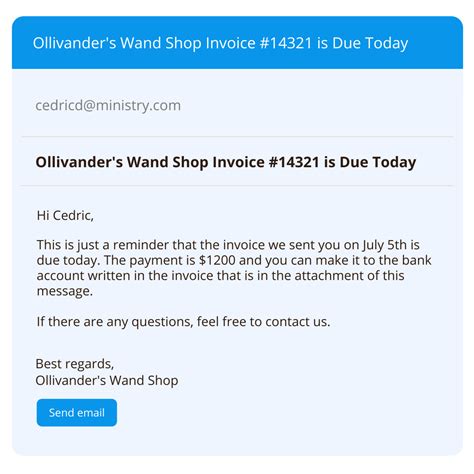

- Providing payment options: The invoice should include clear instructions on how to pay, including payment methods, deadlines, and any relevant penalties for late payments.

- Sending reminders: The invoice should be sent promptly, with reminders and follow-ups as necessary, to ensure timely payments and minimize the risk of late payments.

By following these best practices, businesses can create effective invoices that facilitate communication, reduce misunderstandings, and ensure timely payments.

Managing Invoices

Managing invoices requires a systematic approach, with clear procedures for creation, sending, tracking, and follow-up. Some of the key strategies for managing invoices include:

- Using accounting software: Accounting software can help businesses to generate professional-looking invoices quickly and efficiently, saving time and reducing errors.

- Automating tasks: Electronic invoicing systems can automate tasks, such as sending reminders, tracking payments, and updating records, freeing up resources for more strategic activities.

- Tracking payments: The invoice should be tracked carefully, with reminders and follow-ups as necessary, to ensure timely payments and minimize the risk of late payments.

- Resolving disputes: The invoice should be used to resolve disputes, providing a clear summary of the products or services provided, quantities, rates, and total amount due.

- Maintaining records: The invoice should be stored securely, providing a paper trail that can be used to track payments, resolve disputes, and maintain a record of all financial transactions.

By adopting a systematic approach to invoicing, businesses can improve their financial management, enhance customer satisfaction, and increase their competitiveness.

Conclusion and Future Directions

In conclusion, invoices play a vital role in the financial management of businesses, freelancers, and individuals. By understanding the benefits, working mechanisms, and best practices for creating and managing invoices, businesses can streamline their financial operations, improve customer relationships, and drive growth. As technology continues to evolve, electronic invoicing systems will become increasingly important, providing a secure, efficient, and environmentally friendly way to manage financial transactions.

The future of invoicing is likely to be shaped by emerging trends, such as blockchain technology, artificial intelligence, and the Internet of Things. These technologies will enable businesses to create more secure, transparent, and automated invoicing systems, reducing the risk of errors, fraud, and late payments. Moreover, they will provide new opportunities for businesses to promote their services, offer discounts, and encourage customer loyalty, driving growth and innovation in the years to come.

Invoice Image Gallery

What is an invoice?

+An invoice is a document that outlines the details of a transaction, including the products or services provided, quantities, rates, and total amount due.

What are the benefits of invoices?

+The benefits of invoices include improved cash flow, enhanced professionalism, increased efficiency, better record-keeping, and tax compliance.

How do I create an effective invoice?

+To create an effective invoice, use a clear and concise format, include essential information, use a professional tone, provide payment options, and send reminders as necessary.

What are the different types of invoices?

+The different types of invoices include pro forma invoices, commercial invoices, recurring invoices, credit invoices, and debit invoices.

How do I manage invoices effectively?

+To manage invoices effectively, use accounting software, automate tasks, track payments, resolve disputes, and maintain records securely.

We hope that this article has provided you with a comprehensive understanding of invoices and their importance in business transactions. If you have any further questions or would like to share your experiences with invoicing, please feel free to comment below. Additionally, if you found this article helpful, please share it with your network to help others benefit from this valuable information.