Intro

Discover how merchant services work with 5 key methods, including payment processing, credit card transactions, and online payment gateways, to facilitate secure and efficient transactions for businesses and customers alike.

The world of merchant services is a complex and fascinating one, playing a crucial role in facilitating transactions between businesses and their customers. As the payments landscape continues to evolve, it's essential for merchants to understand the intricacies of merchant services and how they can benefit from them. In this article, we'll delve into the inner workings of merchant services, exploring the various ways they operate and the advantages they offer to businesses.

Merchant services encompass a broad range of financial services and tools designed to help businesses process transactions efficiently and securely. From credit card processing to online payment gateways, these services enable merchants to accept various payment methods, manage transactions, and mitigate risks associated with payments. With the rise of digital payments, merchant services have become an indispensable component of modern commerce, allowing businesses to stay competitive and adapt to changing consumer preferences.

The importance of merchant services cannot be overstated, as they provide businesses with the necessary infrastructure to process transactions, manage cash flow, and expand their customer base. By understanding how merchant services work, merchants can optimize their payment processes, reduce costs, and improve the overall customer experience. In the following sections, we'll examine the five primary ways merchant services operate, highlighting their benefits, features, and applications.

Payment Processing

Authorization and Settlement

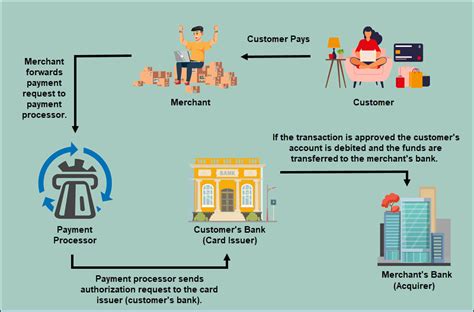

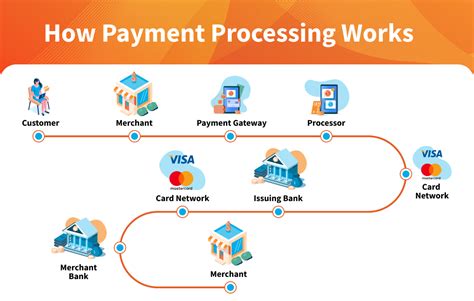

The payment processing cycle begins with authorization, where the merchant requests permission from the cardholder's bank to charge the card. Once authorized, the transaction is settled, and the funds are transferred from the cardholder's account to the merchant's account. This process involves multiple stakeholders, including the merchant, the payment processor, and the financial institutions involved.Merchant Accounts

Types of Merchant Accounts

There are several types of merchant accounts available, each designed to meet the specific needs of different businesses. These include retail merchant accounts, e-commerce merchant accounts, and mobile merchant accounts, among others. By choosing the right type of merchant account, businesses can optimize their payment processes, reduce costs, and improve their overall competitiveness.Online Payment Gateways

Features and Benefits

Online payment gateways offer a range of features and benefits, including tokenization, encryption, and recurring billing. These features help to reduce the risk of fraud, improve the customer experience, and increase sales. By choosing the right online payment gateway, businesses can optimize their e-commerce operations, reduce costs, and improve their overall competitiveness.Point of Sale (POS) Systems

Types of POS Systems

There are several types of POS systems available, each designed to meet the specific needs of different businesses. These include traditional POS systems, mobile POS systems, and cloud-based POS systems, among others. By choosing the right type of POS system, businesses can optimize their operations, reduce costs, and improve their overall competitiveness.Security and Compliance

Best Practices

To ensure security and compliance, businesses should follow best practices, such as implementing robust security protocols, conducting regular audits, and training staff on security procedures. By taking a proactive approach to security and compliance, businesses can protect their customers, their reputation, and their bottom line.Merchant Services Image Gallery

What is a merchant account?

+A merchant account is a type of bank account that enables businesses to accept and process credit card transactions.

How do online payment gateways work?

+Online payment gateways are secure platforms that enable businesses to accept and process online transactions, integrating with e-commerce platforms to accept various payment methods.

What is PCI-DSS compliance?

+PCI-DSS compliance refers to the Payment Card Industry Data Security Standard, a set of security protocols designed to protect sensitive payment information and prevent data breaches.

How do I choose the right merchant services provider?

+When choosing a merchant services provider, consider factors such as fees, security, customer support, and compatibility with your business needs.

What are the benefits of using a point of sale system?

+Point of sale systems offer a range of benefits, including improved efficiency, increased accuracy, and enhanced customer satisfaction, helping businesses to manage transactions, inventory, and customer data effectively.

In conclusion, merchant services play a vital role in facilitating transactions between businesses and their customers. By understanding the various ways merchant services work, businesses can optimize their payment processes, reduce costs, and improve the overall customer experience. Whether it's payment processing, merchant accounts, online payment gateways, point of sale systems, or security and compliance, each component of merchant services offers a range of benefits and advantages. As the payments landscape continues to evolve, it's essential for businesses to stay informed and adapt to changing consumer preferences, ensuring they remain competitive and successful in an increasingly digital world. We invite you to share your thoughts and experiences with merchant services, and to explore the various resources and solutions available to help your business thrive.