Intro

Discover what Ach stands for, exploring Automated Clearing House, its role in electronic payments, and related terms like direct deposit, bank transfers, and payment processing.

The term "ACH" stands for Automated Clearing House, which is a network used for electronic payments and money transfers in the United States. It is a system that enables individuals and businesses to make payments and transfer funds between bank accounts. The ACH network is managed by the National Automated Clearing House Association (NACHA) and is used for a wide range of transactions, including direct deposit, bill payments, and electronic checks.

The ACH system has been in place since the 1970s and has become a widely accepted method for making electronic payments. It is a cost-effective and efficient way to transfer funds between bank accounts, and it is often used for transactions such as payroll direct deposit, tax refunds, and utility bill payments. The ACH network is also used for business-to-business transactions, such as payments to vendors and suppliers.

One of the key benefits of the ACH system is its ability to process transactions quickly and efficiently. Transactions are typically processed in batches, and funds are transferred between bank accounts on the next business day. This makes it a convenient option for individuals and businesses who need to make payments or transfer funds on a regular basis.

In addition to its speed and efficiency, the ACH system is also highly secure. Transactions are encrypted and authenticated to prevent unauthorized access, and the system is monitored closely to prevent fraud and other types of malicious activity. This makes it a safe and reliable option for individuals and businesses who need to make electronic payments.

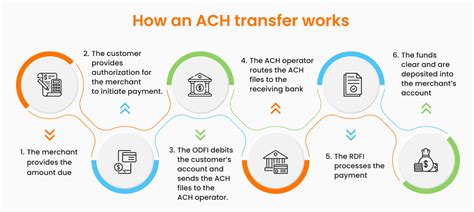

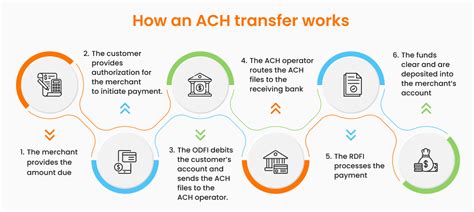

How ACH Works

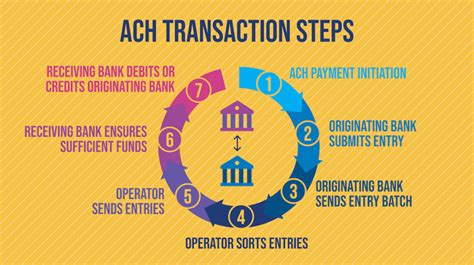

The ACH system works by using a network of financial institutions to process transactions. When an individual or business initiates an ACH transaction, the transaction is sent to the originating bank, which then forwards it to the ACH operator. The ACH operator then sorts and batches the transactions, and sends them to the receiving bank, which deposits the funds into the recipient's account.

The ACH system uses a variety of codes and identifiers to ensure that transactions are processed correctly. For example, each bank has a unique routing number that is used to identify it in the ACH system. Additionally, each transaction is assigned a unique trace number that can be used to track the transaction and resolve any issues that may arise.

Benefits of ACH

The ACH system offers a number of benefits to individuals and businesses. Some of the key benefits include: * Convenience: ACH transactions can be initiated online or through mobile banking, making it easy to make payments and transfer funds from anywhere. * Speed: ACH transactions are typically processed quickly, with funds being transferred between bank accounts on the next business day. * Security: The ACH system is highly secure, with transactions being encrypted and authenticated to prevent unauthorized access. * Cost-effectiveness: ACH transactions are often less expensive than other payment methods, such as wire transfers or paper checks.Types of ACH Transactions

There are several types of ACH transactions, including:

- Direct deposit: This type of transaction is used to deposit funds directly into an individual's bank account. It is often used for payroll and tax refunds.

- Direct payment: This type of transaction is used to make payments to businesses or individuals. It is often used for bill payments and online purchases.

- Electronic checks: This type of transaction is used to make payments by check, but instead of using a physical check, the payment is made electronically through the ACH system.

ACH Transaction Codes

The ACH system uses a variety of codes and identifiers to ensure that transactions are processed correctly. Some of the key codes include: * Routing number: This is a unique number that is assigned to each bank and is used to identify it in the ACH system. * Account number: This is the account number of the individual or business that is initiating the transaction. * Trace number: This is a unique number that is assigned to each transaction and can be used to track the transaction and resolve any issues that may arise.ACH Security Measures

The ACH system has a number of security measures in place to prevent unauthorized access and protect sensitive information. Some of the key security measures include:

- Encryption: Transactions are encrypted to prevent unauthorized access.

- Authentication: Transactions are authenticated to ensure that they are legitimate and authorized.

- Monitoring: The ACH system is monitored closely to prevent fraud and other types of malicious activity.

ACH Fraud Prevention

The ACH system has a number of measures in place to prevent fraud and other types of malicious activity. Some of the key measures include: * Verification: Transactions are verified to ensure that they are legitimate and authorized. * Validation: Transactions are validated to ensure that they are correct and complete. * Reconciliation: Transactions are reconciled to ensure that they are accurate and complete.ACH Transaction Limits

The ACH system has a number of transaction limits in place to prevent excessive activity and protect sensitive information. Some of the key limits include:

- Per-transaction limit: This is the maximum amount that can be transferred in a single transaction.

- Daily limit: This is the maximum amount that can be transferred in a single day.

- Monthly limit: This is the maximum amount that can be transferred in a single month.

ACH Transaction Fees

The ACH system has a number of fees associated with it, including: * Per-transaction fee: This is a fee that is charged for each transaction. * Monthly fee: This is a fee that is charged for using the ACH system. * Setup fee: This is a fee that is charged for setting up an ACH account.ACH vs. Wire Transfer

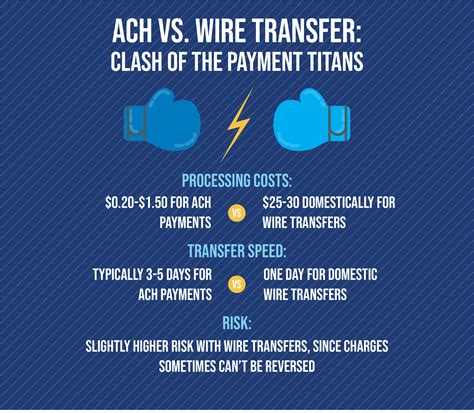

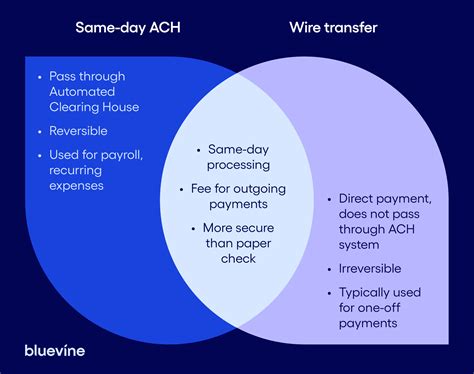

The ACH system is often compared to wire transfer, which is another method of transferring funds electronically. Some of the key differences between ACH and wire transfer include:

- Speed: Wire transfers are typically faster than ACH transactions, with funds being transferred in real-time.

- Cost: Wire transfers are often more expensive than ACH transactions, with higher fees and charges.

- Security: Both ACH and wire transfer are secure, but wire transfer is often considered more secure due to its real-time processing and verification.

ACH vs. Credit Card

The ACH system is also often compared to credit card, which is another method of making payments electronically. Some of the key differences between ACH and credit card include: * Fees: Credit card transactions often have higher fees and charges than ACH transactions. * Interest rates: Credit card transactions often have higher interest rates than ACH transactions. * Security: Both ACH and credit card are secure, but credit card is often considered more secure due to its real-time processing and verification.ACH Image Gallery

What is ACH?

+ACH stands for Automated Clearing House, which is a network used for electronic payments and money transfers in the United States.

How does ACH work?

+The ACH system works by using a network of financial institutions to process transactions. When an individual or business initiates an ACH transaction, the transaction is sent to the originating bank, which then forwards it to the ACH operator.

What are the benefits of ACH?

+The ACH system offers a number of benefits, including convenience, speed, security, and cost-effectiveness. ACH transactions can be initiated online or through mobile banking, making it easy to make payments and transfer funds from anywhere.

What are the different types of ACH transactions?

+There are several types of ACH transactions, including direct deposit, direct payment, and electronic checks. Direct deposit is used to deposit funds directly into an individual's bank account, while direct payment is used to make payments to businesses or individuals.

How secure is the ACH system?

+The ACH system is highly secure, with transactions being encrypted and authenticated to prevent unauthorized access. The system is also monitored closely to prevent fraud and other types of malicious activity.

In conclusion, the ACH system is a widely used and highly secure method of making electronic payments and transferring funds. It offers a number of benefits, including convenience, speed, security, and cost-effectiveness. By understanding how the ACH system works and the different types of transactions that can be made, individuals and businesses can take advantage of this convenient and efficient payment method. We invite you to share your thoughts and experiences with the ACH system in the comments below, and to share this article with others who may be interested in learning more about this topic.