Intro

Discover the 5 Apple Pay fees, including transaction, processing, and payment fees, to understand costs and benefits of using Apples mobile payment service, with insights on wallet, credit card, and debit card fees.

The world of digital payments has revolutionized the way we make transactions, and Apple Pay is one of the leading players in this field. With its ease of use, security, and convenience, Apple Pay has become a popular choice among consumers. However, like any other payment method, Apple Pay also comes with some fees that users should be aware of. In this article, we will delve into the world of Apple Pay fees, exploring what they are, how they work, and what users can expect.

For businesses and individuals who use Apple Pay, understanding the associated fees is crucial for managing finances effectively. Apple Pay fees can vary depending on the type of transaction, the country, and the financial institution involved. Whether you are a merchant looking to integrate Apple Pay into your payment system or a consumer wanting to use it for your daily purchases, knowing the fees can help you make informed decisions.

The importance of understanding Apple Pay fees cannot be overstated. It not only helps in budgeting and financial planning but also in choosing the right payment methods for your needs. With the rise of contactless payments, the landscape of financial transactions is becoming increasingly digital, and being aware of the costs associated with these transactions is vital for navigating this landscape efficiently.

Introduction to Apple Pay Fees

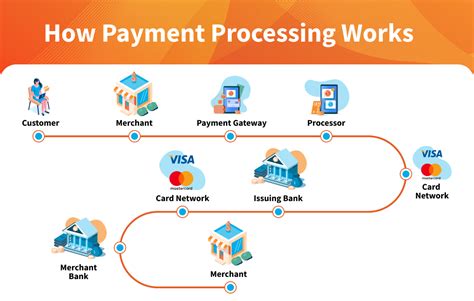

The mechanism behind Apple Pay fees involves the interaction between the consumer's device, the merchant's payment terminal, and the financial institutions involved. When a transaction is made using Apple Pay, the payment is processed through the consumer's device, using a unique device account number instead of the actual card number. This enhances security and reduces the risk of fraud.

Types of Apple Pay Fees

For consumers, using Apple Pay for transactions does not usually incur direct fees, except in specific cases such as international transactions or certain types of purchases where a small fee might be applied. Merchants, on the other hand, need to consider the fees associated with accepting Apple Pay as part of their overall payment processing costs.

Transaction Fees

Transaction fees for Apple Pay are generally similar to those for traditional credit or debit card transactions. Merchants pay a small percentage of the transaction amount, which can range from about 1.5% to 3.5% depending on the card type and the merchant's agreement with the payment processor. These fees are standard in the payment processing industry and are not unique to Apple Pay.Processing Fees

Processing fees are another cost that merchants incur when accepting Apple Pay. These fees are paid to the payment processor for handling the transaction and can vary widely depending on the processor and the specific services provided. Some payment processors may offer flat-rate pricing, while others may charge a percentage of the transaction amount plus a fixed fee per transaction.How Apple Pay Fees Work

For merchants, managing Apple Pay fees involves understanding the terms of their payment processing agreement, including the rates and fees charged for different types of transactions. This can help merchants predict their costs and make informed decisions about their pricing and payment options.

Steps Involved in Apple Pay Transactions

The steps involved in an Apple Pay transaction include: 1. **Initiation**: The consumer initiates the transaction by holding their device near the merchant's contactless payment terminal. 2. **Authentication**: The consumer authenticates the transaction using Face ID, Touch ID, or their device's passcode. 3. **Processing**: The transaction is processed through the payment network, with the merchant's bank and the consumer's bank communicating to complete the transaction. 4. **Settlement**: The transaction is settled, with the funds being transferred from the consumer's account to the merchant's account, minus any applicable fees.Benefits of Using Apple Pay

For merchants, accepting Apple Pay can increase customer satisfaction and loyalty, as it provides another convenient payment option. Additionally, the security features of Apple Pay can help reduce the risk of fraudulent transactions, which can save merchants money in the long run.

Security Benefits

One of the significant benefits of Apple Pay is its security. By using a unique device account number and requiring authentication for each transaction, Apple Pay reduces the risk of fraud and protects both consumers and merchants.Convenience

Apple Pay is also highly convenient, allowing consumers to make payments with just their device. This eliminates the need to carry cash or physical cards, making it easier to shop both online and in-store.Comparison with Other Payment Methods

When comparing Apple Pay to other payment methods, it's essential to consider not just the fees but also the convenience, security, and acceptance. Apple Pay is widely accepted at merchants who support contactless payments, making it a versatile option for consumers.

Google Pay Fees

Google Pay, another popular digital wallet, charges fees similar to Apple Pay. Merchants pay a small percentage of the transaction amount, and there may be additional fees for certain types of transactions.Samsung Pay Fees

Samsung Pay also charges fees to merchants for processing transactions. The fees can vary based on the merchant's agreement with the payment processor and the type of card used for the transaction.Future of Apple Pay Fees

Moreover, advancements in technology, such as the integration of artificial intelligence and blockchain, could further enhance the security and efficiency of digital payments, potentially reducing costs and fees associated with transactions.

Trends in Digital Payments

The trend towards digital payments is expected to continue, with more consumers turning to contactless and mobile payments for their convenience and security. This trend is likely to influence the development of Apple Pay and other digital payment services, including their fee structures.Impact of Technology

Technological advancements will play a crucial role in shaping the future of digital payments. Innovations in security, user experience, and transaction processing will be key factors in determining the fees associated with Apple Pay and other services.Apple Pay Fees Image Gallery

What are Apple Pay fees?

+Apple Pay fees are charges associated with using the Apple Pay service for transactions. These fees can be incurred by both consumers and merchants.

How do Apple Pay fees work?

+Apple Pay fees work by deducting a small percentage of the transaction amount from the merchant's account for each transaction processed through Apple Pay.

Are Apple Pay fees competitive with other payment methods?

+Yes, Apple Pay fees are competitive with those of other digital payment methods, such as Google Pay and Samsung Pay.

How can merchants manage Apple Pay fees?

+Merchants can manage Apple Pay fees by understanding the terms of their payment processing agreement and considering the fees as part of their overall payment processing costs.

What is the future of Apple Pay fees?

+The future of Apple Pay fees is likely to evolve as the payment landscape continues to shift towards more digital and contactless transactions, potentially making fees more competitive and cost-effective.

In conclusion, Apple Pay fees are an essential aspect of using the Apple Pay service for transactions. Understanding these fees, how they work, and their benefits can help both consumers and merchants make informed decisions about their payment options. As the world of digital payments continues to evolve, the importance of convenience, security, and cost-effectiveness will only grow, making services like Apple Pay increasingly popular. Whether you are a consumer looking for a convenient way to make payments or a merchant seeking to expand your payment options, Apple Pay is definitely worth considering. We invite you to share your thoughts on Apple Pay fees and how they impact your payment choices.