Intro

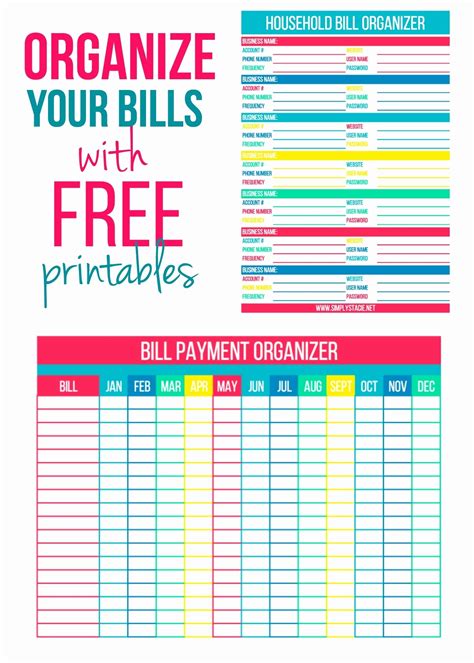

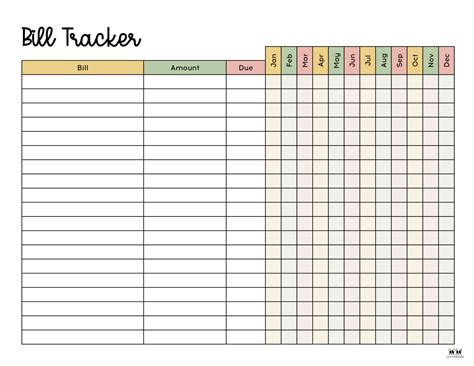

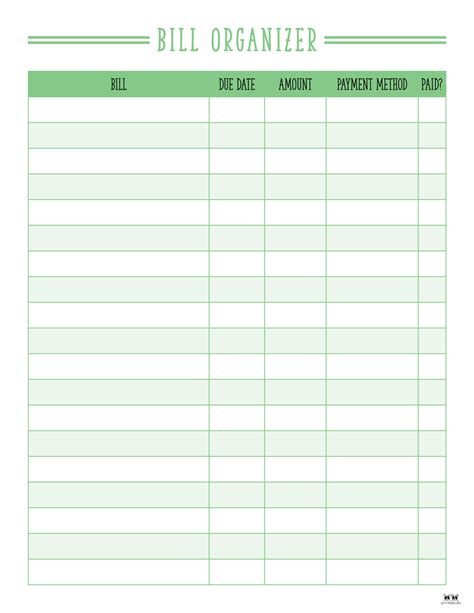

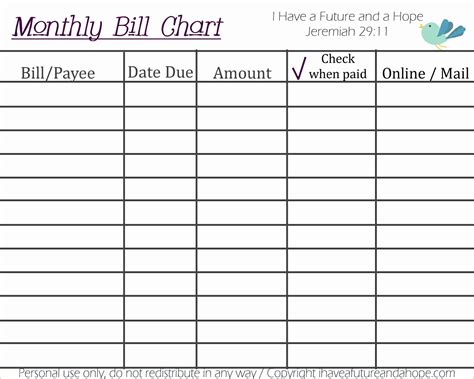

Get organized with a free bill organizer printable template, featuring budget trackers, payment schedules, and expense managers to streamline finances and reduce debt.

Staying on top of bills and payments can be a daunting task, especially with the numerous financial responsibilities that come with modern life. From rent and utilities to credit cards and loan payments, it's easy to lose track of what's due and when. This is where a bill organizer comes in – a simple yet effective tool to help you manage your finances and avoid missed payments. In this article, we'll explore the importance of using a bill organizer, how it works, and provide you with a free bill organizer printable template to get started.

Managing your bills effectively is crucial for maintaining a good credit score, avoiding late fees, and reducing financial stress. A bill organizer is a powerful tool that helps you keep track of all your bills, payments, and due dates in one place. By using a bill organizer, you can ensure that you never miss a payment, and you can also identify areas where you can cut back on unnecessary expenses. Whether you're a student, a working professional, or a homeowner, a bill organizer is an essential tool for anyone looking to take control of their finances.

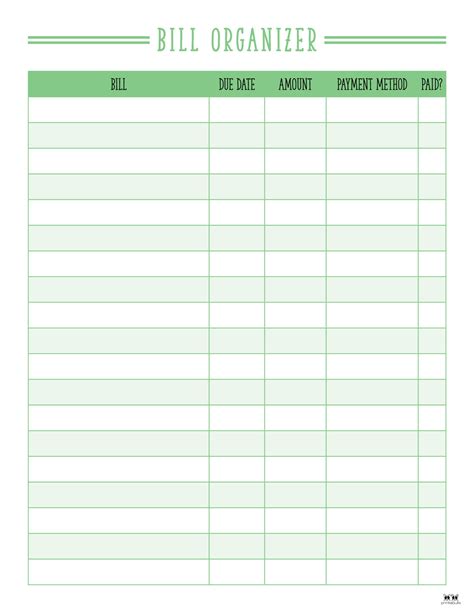

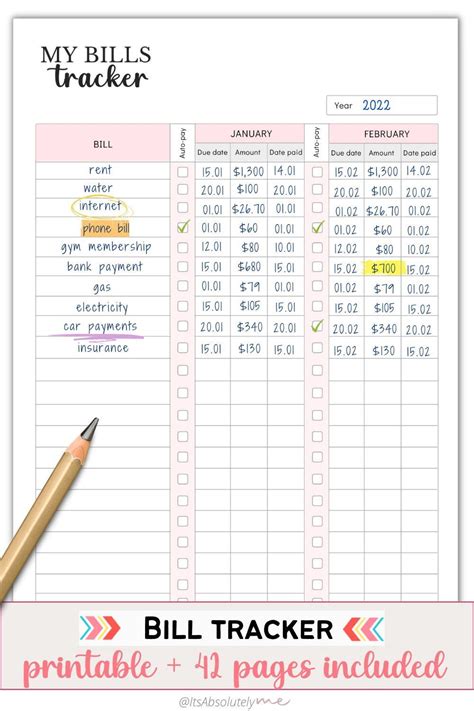

Using a bill organizer is straightforward. You simply write down all your bills, including the payment amount, due date, and payment method. You can also include additional information such as the account number, payment address, and any relevant notes. By having all this information in one place, you can easily see what bills are due and when, and you can plan your payments accordingly. You can also use a bill organizer to track your payments, so you can see which bills have been paid and which ones are still outstanding.

Benefits of Using a Bill Organizer

There are many benefits to using a bill organizer. One of the main advantages is that it helps you avoid missed payments. By keeping track of all your bills and due dates, you can ensure that you never miss a payment, which can help you avoid late fees and negative marks on your credit report. A bill organizer can also help you identify areas where you can cut back on unnecessary expenses. By seeing all your bills in one place, you can identify areas where you can reduce your spending and allocate that money towards more important things.

Another benefit of using a bill organizer is that it helps you stay organized. By having all your bills and payment information in one place, you can easily see what's due and when, and you can plan your payments accordingly. This can help reduce financial stress and make it easier to manage your finances. A bill organizer can also help you improve your credit score. By making timely payments and avoiding missed payments, you can demonstrate to lenders that you're responsible with credit, which can help improve your credit score over time.

How to Use a Bill Organizer

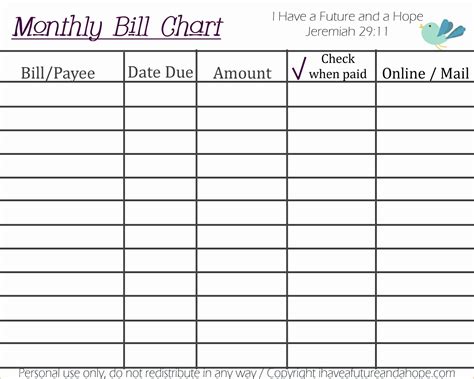

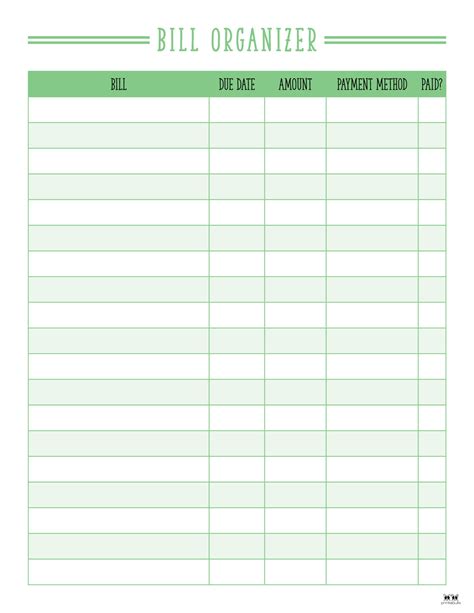

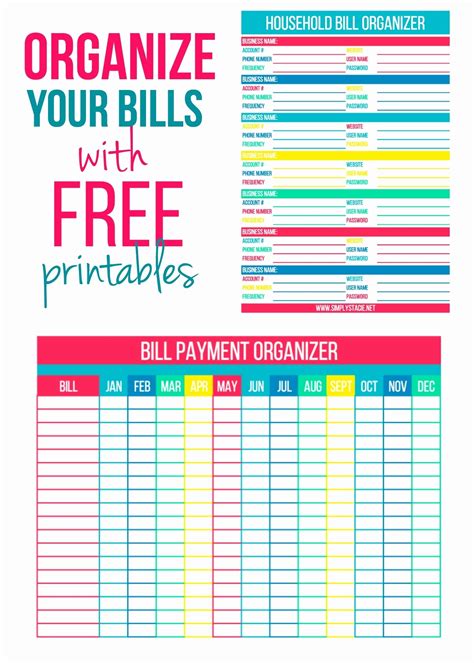

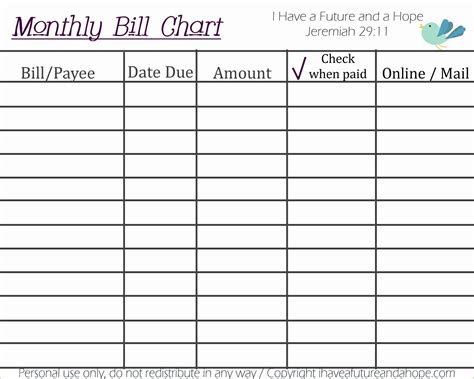

Using a bill organizer is straightforward. Here are the steps to follow: * Write down all your bills, including the payment amount, due date, and payment method. * Include additional information such as the account number, payment address, and any relevant notes. * Review your bill organizer regularly to ensure that you're on top of all your payments. * Use a bill organizer to track your payments, so you can see which bills have been paid and which ones are still outstanding.Free Bill Organizer Printable Template

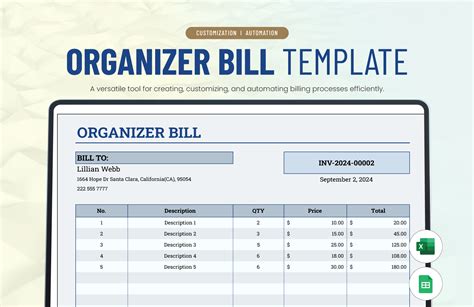

We've created a free bill organizer printable template that you can use to get started. This template includes space for you to write down all your bills, including the payment amount, due date, and payment method. It also includes additional space for notes and reminders. You can print out this template and use it to keep track of all your bills and payments.

To use this template, simply print it out and fill in the relevant information. You can use a pen or pencil to write down your bills and payment information. Be sure to review your bill organizer regularly to ensure that you're on top of all your payments. You can also use this template to track your payments, so you can see which bills have been paid and which ones are still outstanding.

Tips for Using a Bill Organizer

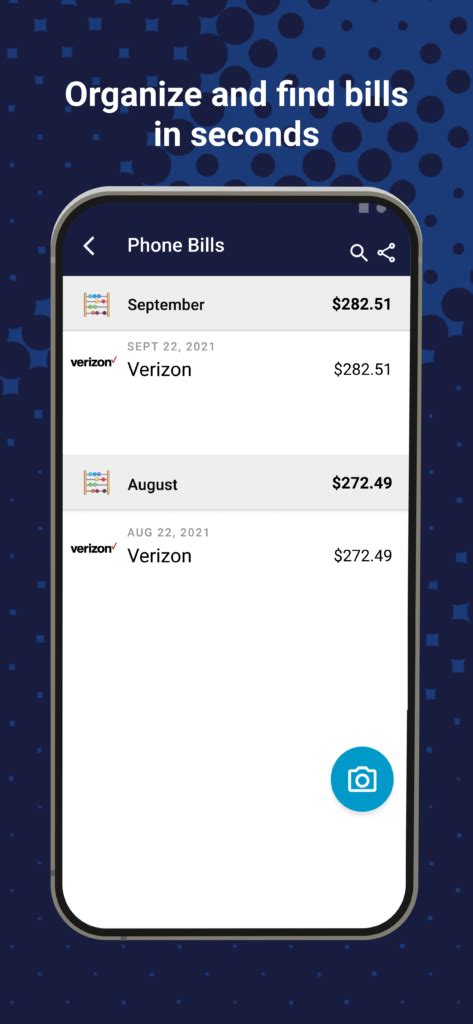

Here are some tips for using a bill organizer: * Review your bill organizer regularly to ensure that you're on top of all your payments. * Use a bill organizer to track your payments, so you can see which bills have been paid and which ones are still outstanding. * Consider setting up automatic payments for your bills, so you can ensure that you never miss a payment. * Use a bill organizer to identify areas where you can cut back on unnecessary expenses. * Consider using a digital bill organizer, such as a spreadsheet or app, to make it easier to track your bills and payments.Types of Bill Organizers

There are many different types of bill organizers available, including printable templates, digital spreadsheets, and mobile apps. Each type of bill organizer has its own advantages and disadvantages. For example, printable templates are easy to use and don't require any special software or equipment. However, they can be easy to lose or misplace, and they may not be as convenient to use as digital bill organizers.

Digital spreadsheets, such as Google Sheets or Microsoft Excel, are another popular type of bill organizer. These spreadsheets allow you to easily track your bills and payments, and you can access them from any device with an internet connection. However, they may require some technical expertise to set up and use, and they may not be as user-friendly as other types of bill organizers.

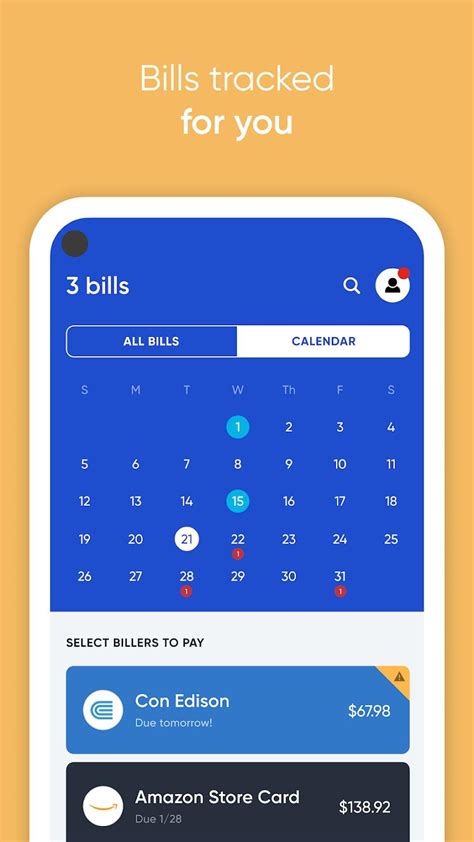

Mobile apps, such as Mint or Personal Capital, are another type of bill organizer. These apps allow you to track your bills and payments on your smartphone or tablet, and they often include additional features such as budgeting and investment tracking. However, they may require you to link your financial accounts, which can be a security risk, and they may not be as comprehensive as other types of bill organizers.

Choosing the Right Bill Organizer

Choosing the right bill organizer depends on your individual needs and preferences. Here are some factors to consider: * Ease of use: Look for a bill organizer that is easy to use and understand. * Features: Consider the features that you need, such as budgeting and investment tracking. * Security: Consider the security risks associated with linking your financial accounts to a digital bill organizer. * Cost: Consider the cost of the bill organizer, including any subscription fees or charges.Common Mistakes to Avoid

There are several common mistakes to avoid when using a bill organizer. Here are some of the most common mistakes:

- Not reviewing your bill organizer regularly: This can lead to missed payments and late fees.

- Not tracking your payments: This can make it difficult to see which bills have been paid and which ones are still outstanding.

- Not identifying areas where you can cut back on unnecessary expenses: This can lead to wasted money and a lack of financial progress.

- Not considering the security risks associated with digital bill organizers: This can lead to identity theft and financial loss.

Best Practices for Using a Bill Organizer

Here are some best practices for using a bill organizer: * Review your bill organizer regularly to ensure that you're on top of all your payments. * Use a bill organizer to track your payments, so you can see which bills have been paid and which ones are still outstanding. * Consider setting up automatic payments for your bills, so you can ensure that you never miss a payment. * Use a bill organizer to identify areas where you can cut back on unnecessary expenses. * Consider using a digital bill organizer, such as a spreadsheet or app, to make it easier to track your bills and payments.Bill Organizer Image Gallery

What is a bill organizer?

+A bill organizer is a tool that helps you keep track of all your bills, payments, and due dates in one place.

How do I use a bill organizer?

+To use a bill organizer, simply write down all your bills, including the payment amount, due date, and payment method. Review your bill organizer regularly to ensure that you're on top of all your payments.

What are the benefits of using a bill organizer?

+The benefits of using a bill organizer include avoiding missed payments, reducing financial stress, and improving your credit score.

Can I use a digital bill organizer?

+Yes, you can use a digital bill organizer, such as a spreadsheet or app, to make it easier to track your bills and payments.

Is a bill organizer secure?

+A bill organizer can be secure if you use a reputable digital bill organizer and keep your financial information private.

We hope this article has provided you with a comprehensive guide to using a bill organizer. By following the tips and best practices outlined in this article, you can take control of your finances and avoid missed payments. Remember to review your bill organizer regularly and use it to track your payments, so you can see which bills have been paid and which ones are still outstanding. With a bill organizer, you can reduce financial stress and improve your credit score. So why not get started today and download our free bill organizer printable template? Share your thoughts and experiences with bill organizers in the comments below, and don't forget to share this article with your friends and family who may benefit from using a bill organizer.