Intro

Discover 5 Boston sales tax tips to navigate Massachusetts tax laws, exemptions, and deductions, optimizing sales tax compliance and management for businesses and individuals.

As a consumer or business owner in Boston, understanding the sales tax system is crucial to avoid any potential issues or penalties. Boston, being the capital city of Massachusetts, follows the state's sales tax rules with some specific exemptions and regulations. In this article, we will delve into five essential Boston sales tax tips that you should know to navigate the system effectively.

The importance of understanding sales tax cannot be overstated, especially for businesses. It not only helps in maintaining compliance with the law but also in managing finances efficiently. For consumers, knowledge of sales tax can help in making informed purchasing decisions and potentially saving money. Whether you are a small business owner, a large corporation, or simply a resident of Boston, grasping the basics of sales tax is vital.

Sales tax in Boston is part of a broader system that includes state and local taxes. Massachusetts imposes a state sales tax rate, and while there are no additional local sales taxes in Boston, there are specific rules and exemptions that apply. For instance, certain types of goods and services are exempt from sales tax, which can be beneficial for both consumers and businesses. Understanding these exemptions and how they apply can help in reducing tax liabilities and making the most out of purchases.

Understanding Boston Sales Tax Basics

To navigate the Boston sales tax system, it's essential to start with the basics. This includes knowing the current sales tax rate in Massachusetts, which is 6.25% as of the last update. This rate applies to most goods and services sold in Boston. However, there are exceptions, such as groceries, clothing items under $175, and certain medical devices, which are exempt from sales tax. Understanding what is taxable and what is not can significantly impact your tax obligations and savings.

Key Exemptions and Their Applications

- Groceries: Food items for human consumption are generally exempt from sales tax. This includes most grocery items but excludes prepared foods like restaurant meals or hot foods from grocery stores.

- Clothing: Clothing and footwear items priced under $175 are exempt. This exemption applies per item, meaning if you purchase multiple items, each one under $175, they are all exempt from sales tax.

- Medical Devices: Certain medical and dental devices, as well as prescription medications, are exempt from sales tax.

Managing Sales Tax for Businesses

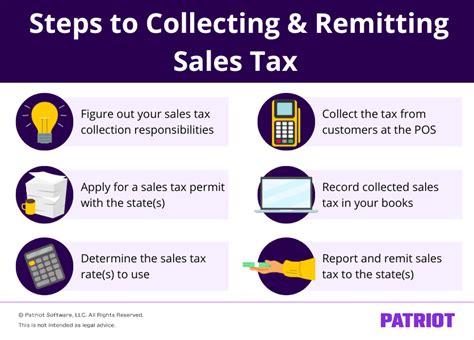

For businesses operating in Boston, managing sales tax is a critical aspect of financial management. This involves understanding what products or services are subject to sales tax, collecting the tax from customers, and remitting it to the state. Businesses must register for a sales tax permit with the Massachusetts Department of Revenue to legally collect and remit sales tax. This process can be done online and is a necessary step for any business selling taxable goods or services.

Steps for Sales Tax Compliance

- Registration: Apply for a sales tax permit if your business sells taxable goods or services.

- Collection: Collect sales tax from customers on taxable sales.

- Reporting: File sales tax returns with the Massachusetts Department of Revenue, usually on a quarterly basis, but possibly monthly if your business has a high volume of sales.

- Remittance: Pay the collected sales tax to the state by the due date to avoid penalties and interest.

Navigating Sales Tax Audits

Sales tax audits are a reality for many businesses and can be a source of significant stress and financial burden if not handled properly. An audit is an examination of a business's financial records to ensure compliance with sales tax laws. This can include verifying the accuracy of sales tax returns, ensuring proper collection and remittance of sales tax, and reviewing exemptions claimed.

Preparing for an Audit

- Maintain Accurate Records: Keep detailed and accurate financial records, including sales receipts, invoices, and sales tax returns.

- Understand Audit Process: Familiarize yourself with the audit process, including your rights and the potential outcomes.

- Seek Professional Help: Consider hiring a tax professional or accountant experienced in sales tax audits to guide you through the process.

Utilizing Sales Tax Savings Opportunities

There are several ways both consumers and businesses can save on sales tax in Boston. For consumers, buying exempt items, taking advantage of sales tax holidays, and shopping during periods when certain items are discounted can lead to significant savings. Businesses can also benefit from understanding and claiming available exemptions, especially on purchases of equipment, supplies, and other business necessities.

Sales Tax Holidays and Savings

- Annual Sales Tax Holiday: Massachusetts typically offers an annual sales tax holiday, where certain items are exempt from sales tax for a weekend. This can be a great opportunity for consumers to make significant purchases while saving on sales tax.

- Exempt Purchases: For businesses, understanding what purchases are exempt from sales tax can lead to substantial savings. This includes items like manufacturing equipment, research and development materials, and certain types of software.

Staying Informed About Sales Tax Changes

Sales tax laws and regulations can change, and it's crucial for both consumers and businesses to stay informed. These changes can include rate adjustments, new exemptions, or alterations in reporting and remittance requirements. Staying up-to-date can help in planning finances, avoiding non-compliance issues, and taking advantage of new savings opportunities.

Resources for Staying Informed

- Massachusetts Department of Revenue: The official website provides the latest information on sales tax rates, exemptions, and compliance requirements.

- Tax Professionals: Consulting with tax professionals or accountants who specialize in sales tax can provide personalized advice and ensure you are always compliant with the latest regulations.

Boston Sales Tax Gallery

What is the current sales tax rate in Boston?

+The current sales tax rate in Boston, as in the rest of Massachusetts, is 6.25% as of the last update.

Are there any sales tax exemptions in Boston?

+Yes, there are several exemptions, including groceries, clothing items under $175, and certain medical devices.

How often do businesses need to file sales tax returns in Boston?

+Businesses typically need to file sales tax returns on a quarterly basis, but those with high sales volumes may need to file monthly.

In conclusion, navigating the Boston sales tax system requires a thorough understanding of the current rates, exemptions, and compliance requirements. By staying informed and taking advantage of available savings opportunities, both consumers and businesses can minimize their tax liabilities and ensure compliance with state regulations. Whether you're a long-time resident or a new business owner in Boston, grasping these five essential sales tax tips can make a significant difference in your financial planning and management. We invite you to share your thoughts on sales tax in Boston and how you've navigated its complexities. Your experiences and insights can be invaluable to others facing similar challenges.