Intro

Discover 5 cost-effective ways to save money, featuring budget-friendly tips and affordable strategies for frugal living, cost reduction, and expense management.

The cost of living can be overwhelming, and it's essential to find ways to save money without sacrificing our quality of life. Reducing expenses is a crucial step towards achieving financial stability, and it's easier than you think. In this article, we'll explore 5 cost-effective ways to save money and live a more frugal lifestyle.

Living on a budget requires discipline, patience, and creativity. By making a few simple changes to our daily habits, we can significantly reduce our expenses and allocate that money towards more important things. Whether you're trying to pay off debt, build an emergency fund, or simply save for a big purchase, these cost-effective ways will help you get started.

The key to saving money is to identify areas where we can cut back without feeling deprived. It's about making conscious choices and finding alternative solutions that are just as effective, if not more so. From cooking at home to canceling subscription services, there are many ways to reduce our expenses and live a more frugal lifestyle.

Cost-Effective Ways to Save Money

One of the most effective ways to save money is to cook at home. Eating out can be expensive, and it's often unhealthy. By cooking at home, we can save money on food and also eat healthier. Here are some tips for cooking at home on a budget:

- Plan your meals in advance to avoid food waste and save money on groceries.

- Buy ingredients in bulk and use them to make multiple meals.

- Use coupons and discount codes to save money on groceries.

- Cook simple meals that use fewer ingredients and are less expensive.

Another way to save money is to cancel subscription services that we don't use. Many of us have subscription services like gym memberships, streaming services, and magazine subscriptions that we don't use regularly. By canceling these services, we can save money and allocate it towards more important things.

Benefits of Saving Money

Saving money has many benefits, including reducing stress and anxiety, improving our financial stability, and increasing our sense of security. When we have money saved, we feel more confident and prepared for the future. We can use our savings to pay off debt, build an emergency fund, or invest in our future.

Here are some benefits of saving money:

- Reduces stress and anxiety

- Improves financial stability

- Increases sense of security

- Allows us to pay off debt

- Helps us build an emergency fund

- Enables us to invest in our future

Ways to Reduce Expenses

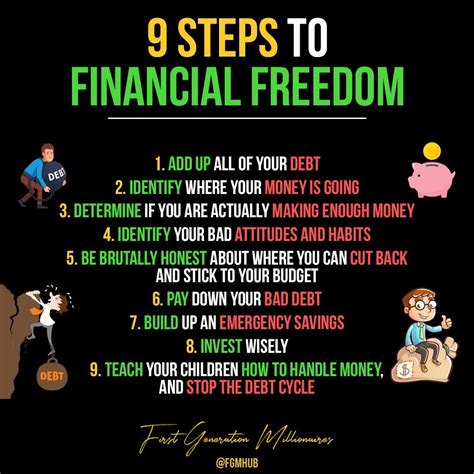

Reducing expenses is a crucial step towards saving money. By identifying areas where we can cut back, we can allocate that money towards more important things. Here are some ways to reduce expenses:

- Cancel subscription services that we don't use

- Cook at home instead of eating out

- Use public transportation or walk/bike instead of driving

- Use energy-efficient appliances and turn off lights to reduce utility bills

- Avoid impulse purchases and shop during sales

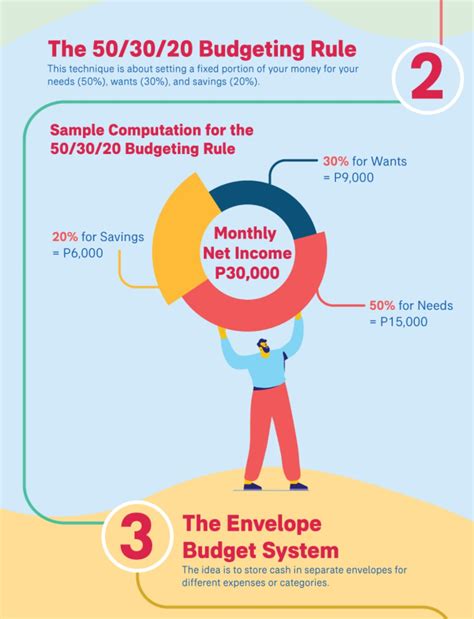

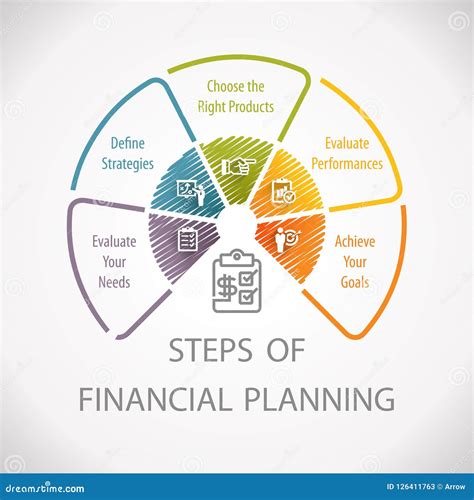

Importance of Budgeting

Budgeting is essential for saving money and achieving financial stability. By creating a budget, we can identify areas where we can cut back and allocate that money towards more important things. Here are some tips for creating a budget:

- Track our expenses to see where our money is going

- Set financial goals and prioritize them

- Create a budget that accounts for all our expenses

- Review and adjust our budget regularly

Long-Term Benefits of Saving

Saving money has long-term benefits that can improve our quality of life. By saving money, we can achieve financial stability, reduce stress and anxiety, and increase our sense of security. Here are some long-term benefits of saving:

- Achieves financial stability

- Reduces stress and anxiety

- Increases sense of security

- Enables us to invest in our future

- Helps us build wealth over time

Conclusion and Next Steps

In conclusion, saving money is essential for achieving financial stability and improving our quality of life. By following these 5 cost-effective ways to save money, we can reduce our expenses, allocate that money towards more important things, and achieve our financial goals. Remember to always track our expenses, create a budget, and review and adjust it regularly.

To take the next step, start by implementing one or two of these cost-effective ways to save money. See how it goes and then add more ways to save as you become more comfortable with the new habits. Don't forget to reward yourself for your progress and stay motivated to continue saving.

Cost-Effective Ways Image Gallery

What are some ways to save money on groceries?

+Some ways to save money on groceries include planning your meals in advance, buying ingredients in bulk, using coupons and discount codes, and shopping during sales.

How can I reduce my expenses and save money?

+You can reduce your expenses and save money by canceling subscription services that you don't use, cooking at home instead of eating out, using public transportation or walking/biking instead of driving, and using energy-efficient appliances and turning off lights to reduce utility bills.

What are the benefits of saving money?

+The benefits of saving money include reducing stress and anxiety, improving financial stability, increasing sense of security, allowing you to pay off debt, helping you build an emergency fund, and enabling you to invest in your future.

How can I create a budget and stick to it?

+You can create a budget and stick to it by tracking your expenses to see where your money is going, setting financial goals and prioritizing them, creating a budget that accounts for all your expenses, and reviewing and adjusting your budget regularly.

What are some long-term benefits of saving money?

+Some long-term benefits of saving money include achieving financial stability, reducing stress and anxiety, increasing sense of security, enabling you to invest in your future, and helping you build wealth over time.

We hope this article has provided you with valuable insights and practical tips on how to save money and live a more frugal lifestyle. Remember, saving money is a journey, and it's essential to be patient, disciplined, and consistent. By following these 5 cost-effective ways to save money, you can achieve financial stability, reduce stress and anxiety, and improve your overall quality of life. Share your thoughts and experiences in the comments below, and don't forget to share this article with your friends and family who may benefit from these cost-effective ways to save money.