Intro

Boost retail business with 5 tips on retail insurance, covering risk management, liability coverage, and commercial protection, to ensure a secure and thriving store operation.

The world of retail insurance can be complex and overwhelming, especially for small business owners or individuals who are new to the industry. With so many options and considerations to keep in mind, it can be difficult to know where to start. However, having the right insurance coverage is crucial for protecting your business and assets from unforeseen risks and losses. In this article, we will explore five tips for retail insurance that can help you make informed decisions and ensure you have the coverage you need.

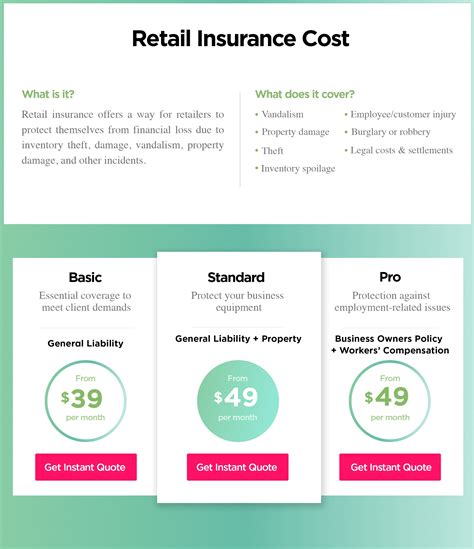

Retail insurance is a type of insurance that is specifically designed for businesses that sell products or services directly to customers. This type of insurance can provide coverage for a range of risks, including property damage, liability, and business interruption. Whether you own a small boutique or a large retail chain, having the right insurance coverage is essential for protecting your business and assets.

One of the most important things to consider when it comes to retail insurance is the type of coverage you need. There are many different types of insurance policies available, and each one provides coverage for specific risks and losses. For example, property insurance can provide coverage for damage to your store or inventory, while liability insurance can provide coverage for accidents or injuries that occur on your premises.

Understanding Retail Insurance

Types of Retail Insurance

There are many different types of retail insurance policies available, and each one provides coverage for specific risks and losses. Some of the most common types of retail insurance include: * Property insurance: This type of insurance provides coverage for damage to your store or inventory. * Liability insurance: This type of insurance provides coverage for accidents or injuries that occur on your premises. * Business interruption insurance: This type of insurance provides coverage for losses that occur when your business is unable to operate due to unforeseen circumstances. * Workers' compensation insurance: This type of insurance provides coverage for employees who are injured on the job.Tip 1: Assess Your Risks

To assess your risks, you should consider the following factors:

- The type of products or services you sell

- The location of your store

- The number of employees you have

- The amount of inventory you carry

- The potential for accidents or injuries on your premises

Conducting a Risk Assessment

Conducting a risk assessment is an important step in determining the type and amount of insurance coverage you need. This involves identifying the potential risks and losses that your business may face, and determining the likelihood and potential impact of each one. You can conduct a risk assessment by: * Reviewing your business operations and identifying potential risks * Consulting with insurance professionals or other experts * Reviewing industry data and statistics * Conducting regular audits and inspections to identify potential risks and lossesTip 2: Choose the Right Insurance Provider

Researching Insurance Providers

Researching insurance providers is an important step in choosing the right one for your business. You can research insurance providers by: * Reviewing industry ratings and reviews * Consulting with other business owners or insurance professionals * Reviewing the company's website and marketing materials * Contacting the company directly to ask questions and request quotesTip 3: Read the Fine Print

Understanding Policy Terms and Conditions

Understanding the terms and conditions of your insurance policy is crucial for ensuring you have the coverage you need. You can understand policy terms and conditions by: * Carefully reviewing the policy documents and materials * Asking questions and seeking clarification from your insurance provider * Consulting with insurance professionals or other experts * Reviewing industry data and statistics to understand common policy terms and conditionsTip 4: Consider Additional Coverage Options

Exploring Additional Coverage Options

Exploring additional coverage options is an important step in ensuring you have the protection you need. You can explore additional coverage options by: * Reviewing industry data and statistics to understand common risks and losses * Consulting with insurance professionals or other experts * Reviewing the types and amounts of coverage offered by different insurance providers * Considering the cost and potential benefits of each optionTip 5: Review and Update Your Policy Regularly

Regular Policy Reviews

Regular policy reviews are an important step in ensuring you have the coverage you need. You can conduct regular policy reviews by: * Scheduling regular meetings with your insurance provider * Reviewing industry data and statistics to understand common risks and losses * Consulting with insurance professionals or other experts * Reviewing the types and amounts of coverage offered by different insurance providersRetail Insurance Image Gallery

What is retail insurance?

+Retail insurance is a type of insurance that is specifically designed for businesses that sell products or services directly to customers. This type of insurance can provide coverage for a range of risks, including property damage, liability, and business interruption.

What types of retail insurance are available?

+There are many different types of retail insurance policies available, including property insurance, liability insurance, business interruption insurance, and workers' compensation insurance.

How do I choose the right insurance provider?

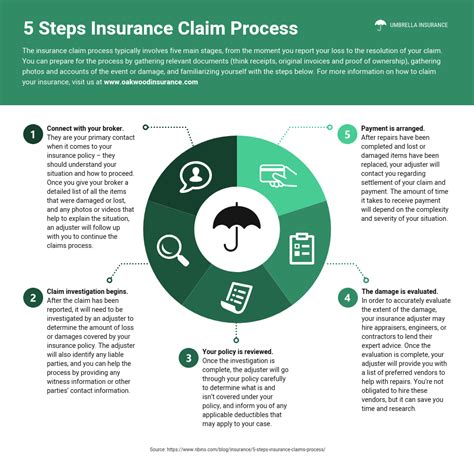

+When choosing an insurance provider, you should consider the company's reputation and financial stability, the types and amounts of coverage offered, the cost of premiums and deductibles, the level of customer service and support provided, and the company's claims process and reputation for paying claims promptly and fairly.

How often should I review my insurance policy?

+You should review your insurance policy regularly to ensure it is adequate and up-to-date. This may involve scheduling regular meetings with your insurance provider, reviewing industry data and statistics, and consulting with insurance professionals or other experts.

What are some common risks and losses that retail businesses face?

+Retail businesses may face a range of risks and losses, including property damage, liability, business interruption, and workers' compensation claims. Other common risks and losses include cyber attacks, data breaches, and natural disasters.

In final thoughts, retail insurance is a crucial aspect of protecting your business and assets from unforeseen risks and losses. By following these five tips, you can ensure you have the coverage you need to operate your business with confidence. Remember to assess your risks, choose the right insurance provider, read the fine print, consider additional coverage options, and review and update your policy regularly. With the right insurance coverage, you can focus on growing and succeeding in your business, without worrying about the unexpected. We encourage you to share your thoughts and experiences with retail insurance in the comments below, and to share this article with others who may benefit from this information.