Intro

Discover what is surcharge fee, extra charges, and additional costs, understanding payment processing fees, convenience fees, and service fees to avoid unexpected expenses.

The concept of surcharge fees has become increasingly prevalent in various industries, including finance, retail, and hospitality. A surcharge fee is an additional charge imposed on customers for using a specific payment method, service, or feature. This fee is usually a percentage of the total transaction amount or a fixed amount. The purpose of surcharge fees is to compensate businesses for the costs associated with processing transactions, providing services, or offering convenience to customers.

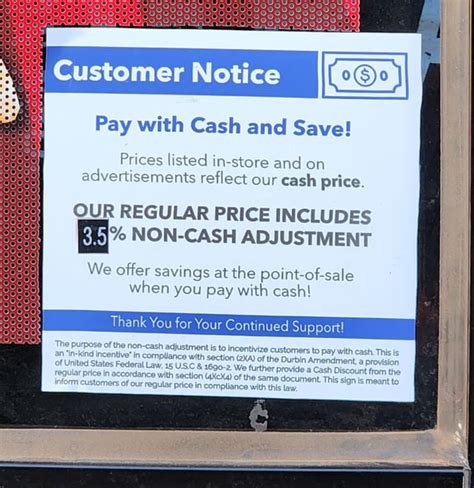

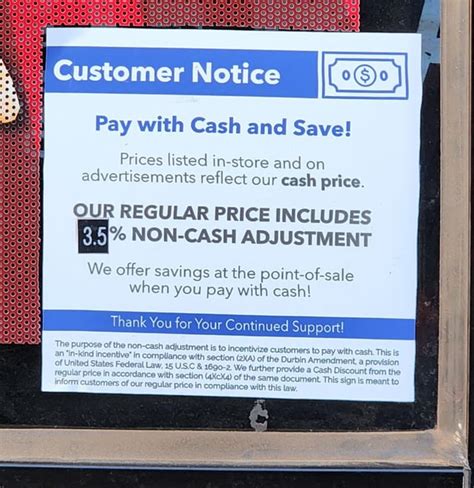

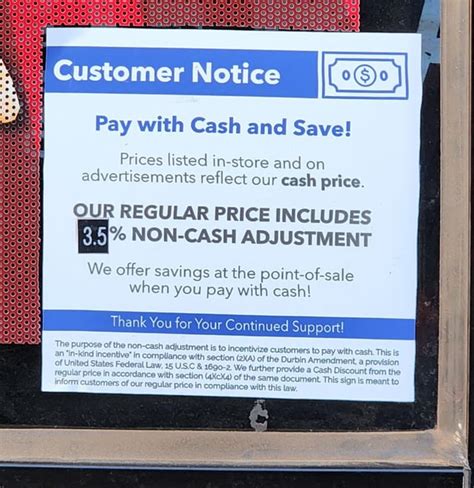

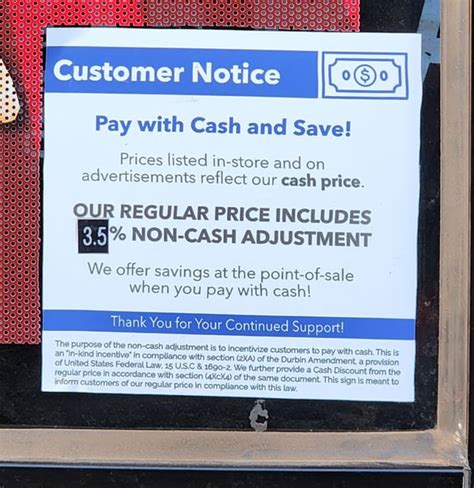

In recent years, surcharge fees have gained significant attention due to their widespread adoption by merchants, banks, and other financial institutions. The rise of digital payments, credit cards, and online transactions has led to an increase in surcharge fees, as businesses seek to offset the costs of processing these transactions. For instance, some merchants may impose a surcharge fee on customers who use credit cards, while others may charge extra for using certain payment methods, such as mobile payments or online banking transfers.

The importance of understanding surcharge fees cannot be overstated. With the increasing use of digital payments and online transactions, consumers need to be aware of the potential fees associated with their transactions. Surcharge fees can add up quickly, and unaware consumers may find themselves paying more than they expected. Furthermore, businesses that impose surcharge fees must comply with relevant regulations and laws, ensuring that they are transparent and fair in their pricing practices.

Types of Surcharge Fees

There are several types of surcharge fees, each with its own characteristics and purposes. Some common types of surcharge fees include:

- Payment processing fees: These fees are charged by merchants for processing credit card transactions, online payments, or other payment methods.

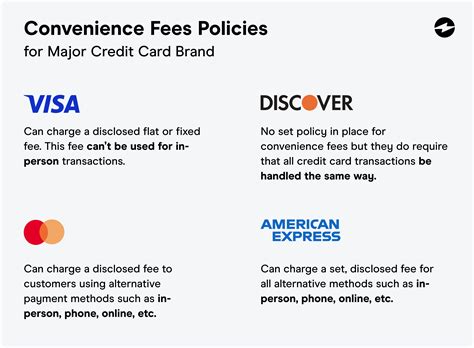

- Convenience fees: These fees are imposed for using certain services or features, such as online bill payments, mobile payments, or ATM withdrawals.

- Service fees: These fees are charged for providing specific services, such as account maintenance, customer support, or transaction processing.

- Regulatory fees: These fees are imposed by governments or regulatory bodies to fund specific programs or initiatives.

Payment Processing Fees

Payment processing fees are a type of surcharge fee that merchants impose on customers for processing credit card transactions or other payment methods. These fees are usually a percentage of the total transaction amount, ranging from 1% to 3%. Payment processing fees are designed to compensate merchants for the costs associated with processing transactions, including the costs of equipment, software, and personnel.Convenience Fees

Convenience fees are another type of surcharge fee that businesses impose on customers for using certain services or features. These fees are usually fixed amounts, ranging from $1 to $5, and are designed to compensate businesses for the costs associated with providing convenience to customers. Convenience fees are commonly found in industries such as retail, hospitality, and finance.How Surcharge Fees Work

Surcharge fees work by adding an extra charge to the total transaction amount or service cost. The amount of the surcharge fee is usually determined by the business or merchant, and it can vary depending on the type of transaction, payment method, or service used. When a customer makes a transaction or uses a service, the surcharge fee is added to the total amount, and the customer is required to pay the additional fee.

For example, if a merchant imposes a 2% surcharge fee on credit card transactions, and a customer makes a purchase of $100, the total amount the customer will pay is $102. The $2 surcharge fee is added to the original purchase price, and the customer is required to pay the additional amount.

Benefits of Surcharge Fees

Surcharge fees can provide several benefits to businesses and merchants, including:- Compensating for transaction processing costs

- Generating additional revenue streams

- Encouraging customers to use preferred payment methods or services

- Helping to offset the costs of providing convenience to customers

However, surcharge fees can also have negative consequences, such as:

- Increasing the cost of transactions for customers

- Reducing customer satisfaction and loyalty

- Creating complexity and confusion for customers

- Violating regulations and laws if not implemented transparently and fairly

Regulations and Laws

Surcharge fees are subject to various regulations and laws, which vary by country, state, or region. In the United States, for example, the Dodd-Frank Wall Street Reform and Consumer Protection Act prohibits merchants from imposing surcharge fees on customers for using credit cards, unless the merchant is exempt under certain circumstances.

In other countries, such as Australia and the United Kingdom, surcharge fees are regulated by specific laws and guidelines, which require businesses to be transparent and fair in their pricing practices. The regulations and laws governing surcharge fees are designed to protect consumers from unfair and deceptive practices, while also ensuring that businesses can operate efficiently and effectively.

Best Practices for Implementing Surcharge Fees

To implement surcharge fees effectively and fairly, businesses should follow best practices, such as:- Clearly disclosing surcharge fees to customers

- Providing transparent and easy-to-understand information about surcharge fees

- Ensuring that surcharge fees are reasonable and proportionate to the costs associated with processing transactions or providing services

- Offering alternative payment methods or services that do not incur surcharge fees

- Complying with relevant regulations and laws governing surcharge fees

By following these best practices, businesses can minimize the risks associated with surcharge fees and ensure that they are using these fees in a way that is fair, transparent, and beneficial to both the business and the customer.

Conclusion and Future Outlook

In conclusion, surcharge fees are an increasingly common practice in various industries, and they can have significant implications for businesses and consumers. While surcharge fees can provide benefits to businesses, such as compensating for transaction processing costs and generating additional revenue streams, they can also have negative consequences, such as increasing the cost of transactions for customers and reducing customer satisfaction and loyalty.

As the use of digital payments and online transactions continues to grow, it is likely that surcharge fees will become even more prevalent. However, it is essential for businesses to implement surcharge fees in a way that is fair, transparent, and compliant with relevant regulations and laws. By doing so, businesses can minimize the risks associated with surcharge fees and ensure that they are using these fees in a way that is beneficial to both the business and the customer.

The future outlook for surcharge fees is uncertain, but it is likely that they will continue to evolve and adapt to changing market conditions and regulatory requirements. As consumers become more aware of surcharge fees and their implications, they will likely demand greater transparency and fairness in pricing practices. Businesses that are able to adapt to these changing demands and implement surcharge fees in a way that is fair and transparent will be better positioned to succeed in a rapidly changing market.

Surcharge Fees Image Gallery

What is a surcharge fee?

+A surcharge fee is an additional charge imposed on customers for using a specific payment method, service, or feature.

Why do businesses impose surcharge fees?

+Businesses impose surcharge fees to compensate for transaction processing costs, generate additional revenue streams, and encourage customers to use preferred payment methods or services.

Are surcharge fees regulated?

+Yes, surcharge fees are regulated by various laws and guidelines, which vary by country, state, or region. Businesses must comply with these regulations to ensure that they are implementing surcharge fees in a fair and transparent manner.

How can customers avoid surcharge fees?

+Customers can avoid surcharge fees by using alternative payment methods or services that do not incur surcharge fees, such as cash or debit cards. They can also shop around for businesses that do not impose surcharge fees or offer discounts for using specific payment methods.

What is the future outlook for surcharge fees?

+The future outlook for surcharge fees is uncertain, but it is likely that they will continue to evolve and adapt to changing market conditions and regulatory requirements. As consumers become more aware of surcharge fees and their implications, they will likely demand greater transparency and fairness in pricing practices.

We hope this article has provided you with a comprehensive understanding of surcharge fees and their implications for businesses and consumers. If you have any further questions or would like to share your thoughts on surcharge fees, please feel free to comment below. You can also share this article with others who may be interested in learning more about surcharge fees and their impact on the market. By working together, we can create a more transparent and fair marketplace for everyone.