Intro

Discover 5 ways to process credit cards securely, including online payment gateways, mobile payments, and POS systems, with tips on merchant accounts, payment processing fees, and credit card transaction security.

The ability to process credit cards is a crucial aspect of any business, particularly those that operate in the retail or service industries. With the rise of digital payments, it's more important than ever for businesses to have a reliable and efficient way to process credit card transactions. In this article, we'll explore the different ways that businesses can process credit cards, including the benefits and drawbacks of each method.

Processing credit cards is an essential part of doing business in today's economy. With so many consumers relying on credit cards as a primary means of payment, businesses that don't accept credit cards can miss out on sales and revenue. Fortunately, there are several ways that businesses can process credit cards, each with its own advantages and disadvantages. By understanding the different options available, businesses can make informed decisions about which method is best for their needs.

The importance of processing credit cards cannot be overstated. Not only does it provide customers with a convenient and secure way to make purchases, but it also helps businesses to increase sales and revenue. In addition, processing credit cards can help businesses to build trust and credibility with their customers, which is essential for building a loyal customer base. With so many benefits to processing credit cards, it's no wonder that more and more businesses are turning to this payment method as a way to stay competitive in the marketplace.

Introduction to Credit Card Processing

There are several different methods that businesses can use to process credit cards, each with its own benefits and drawbacks. Some of the most common methods include using a point-of-sale (POS) system, a virtual terminal, or a payment gateway. Each of these methods has its own advantages and disadvantages, and the best method for a particular business will depend on its specific needs and requirements.

5 Ways to Process Credit Cards

- Point-of-Sale (POS) System: A POS system is a type of computerized system that businesses use to process credit card transactions. POS systems are typically used in retail environments, such as stores and restaurants, and are connected to a credit card reader or terminal.

- Virtual Terminal: A virtual terminal is a type of online platform that businesses can use to process credit card transactions. Virtual terminals are often used by businesses that don't have a physical location, such as online retailers or service-based businesses.

- Payment Gateway: A payment gateway is a type of online platform that connects businesses to the credit card network. Payment gateways are often used by businesses that want to process credit card transactions online, such as e-commerce websites.

- Mobile Credit Card Processing: Mobile credit card processing involves using a mobile device, such as a smartphone or tablet, to process credit card transactions. Mobile credit card processing is often used by businesses that need to process transactions on the go, such as food trucks or delivery services.

- Online Invoicing: Online invoicing involves sending customers an electronic invoice that they can pay online using a credit card. Online invoicing is often used by businesses that provide services or products to customers on a recurring basis, such as subscription-based businesses.

Benefits of Credit Card Processing

- Increased Sales: Processing credit cards can help businesses to increase sales and revenue by providing customers with a convenient and secure way to make purchases.

- Improved Cash Flow: Processing credit cards can help businesses to improve their cash flow by providing a fast and reliable way to receive payments.

- Enhanced Customer Experience: Processing credit cards can help businesses to enhance the customer experience by providing a convenient and secure way to make purchases.

- Reduced Risk: Processing credit cards can help businesses to reduce their risk by providing a secure and reliable way to process transactions.

- Competitive Advantage: Processing credit cards can help businesses to gain a competitive advantage by providing a convenient and secure way to make purchases.

How to Choose a Credit Card Processing Method

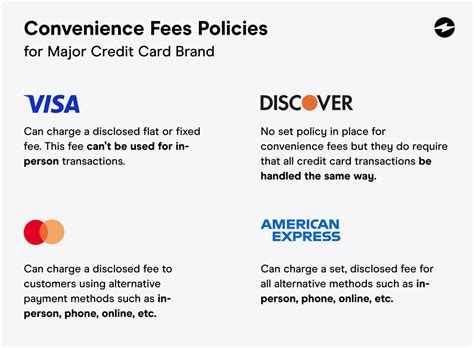

- Fees: Consider the fees associated with each credit card processing method, including transaction fees, monthly fees, and setup fees.

- Security: Consider the security features of each credit card processing method, including encryption, tokenization, and PCI compliance.

- Convenience: Consider the convenience of each credit card processing method, including the ease of use, mobility, and integration with existing systems.

- Customer Support: Consider the level of customer support provided by each credit card processing method, including phone, email, and online support.

- Reputation: Consider the reputation of each credit card processing method, including reviews, ratings, and testimonials from other businesses.

Common Credit Card Processing Mistakes

- Not Verifying Customer Information: Failing to verify customer information, such as the customer's name, address, and credit card number, can increase the risk of fraud and chargebacks.

- Not Providing Clear Disclosures: Failing to provide clear disclosures, such as the terms and conditions of the sale, can increase the risk of disputes and chargebacks.

- Not Maintaining PCI Compliance: Failing to maintain PCI compliance, including encrypting sensitive data and using secure protocols, can increase the risk of data breaches and fines.

- Not Monitoring Transactions: Failing to monitor transactions, including tracking sales and refunds, can increase the risk of errors and disputes.

- Not Providing Good Customer Service: Failing to provide good customer service, including responding to customer inquiries and resolving disputes, can increase the risk of negative reviews and lost sales.

Gallery of Credit Card Processing

Credit Card Processing Image Gallery

What is credit card processing?

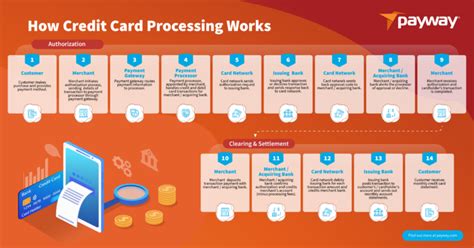

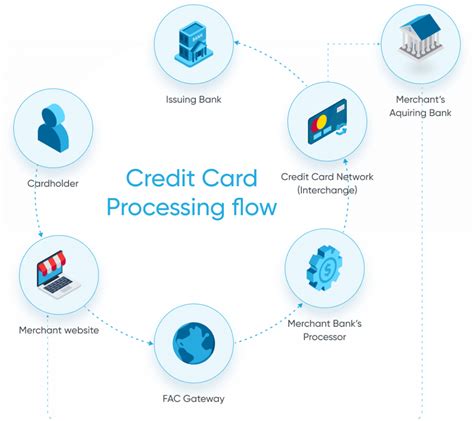

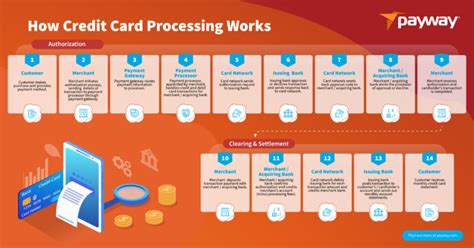

+Credit card processing involves several steps, including authorization, settlement, and funding.

What are the benefits of credit card processing?

+The benefits of credit card processing include increased sales, improved cash flow, enhanced customer experience, reduced risk, and competitive advantage.

How do I choose a credit card processing method?

+Choosing a credit card processing method involves considering factors such as fees, security, convenience, customer support, and reputation.

What are some common credit card processing mistakes?

+Common credit card processing mistakes include not verifying customer information, not providing clear disclosures, not maintaining PCI compliance, not monitoring transactions, and not providing good customer service.

How can I avoid credit card processing mistakes?

+Avoiding credit card processing mistakes involves following best practices, such as verifying customer information, providing clear disclosures, maintaining PCI compliance, monitoring transactions, and providing good customer service.

In conclusion, processing credit cards is an essential part of doing business in today's economy. By understanding the different methods available, businesses can make informed decisions about which method is best for their needs. Whether you're a small business or a large corporation, credit card processing can help you to increase sales, improve cash flow, and enhance the customer experience. We hope this article has provided you with a comprehensive understanding of credit card processing and how it can benefit your business. If you have any questions or comments, please don't hesitate to reach out. Share this article with your friends and colleagues to help them understand the importance of credit card processing.