Intro

Calculate costs accurately with our Total Cost Calculation Formula Guide, covering capital costs, operational expenses, and hidden fees, to optimize budgeting and financial planning.

The total cost calculation is a crucial aspect of any business or project, as it helps determine the overall expense of producing a product, providing a service, or completing a project. Understanding the total cost calculation formula is essential for businesses, entrepreneurs, and individuals to make informed decisions and ensure profitability. In this article, we will delve into the world of total cost calculation, exploring its importance, the formula, and providing practical examples to help you master this essential concept.

The total cost calculation is a comprehensive approach that considers all the expenses incurred during a project or production process. It includes direct costs, indirect costs, fixed costs, and variable costs. By calculating the total cost, businesses can determine the minimum price they need to charge to break even, set realistic budgets, and make informed decisions about investments and resource allocation. The total cost calculation formula is a powerful tool that helps organizations optimize their operations, reduce waste, and increase profitability.

As we explore the total cost calculation formula, it's essential to understand the different types of costs involved. Direct costs are expenses directly related to the production process, such as labor, materials, and equipment. Indirect costs, on the other hand, are expenses that are not directly related to production, such as rent, utilities, and marketing. Fixed costs remain the same regardless of production levels, while variable costs change depending on the quantity produced. By understanding these different cost categories, businesses can better manage their expenses and make more accurate total cost calculations.

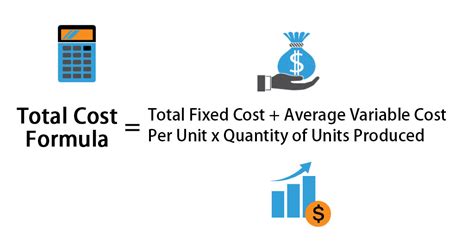

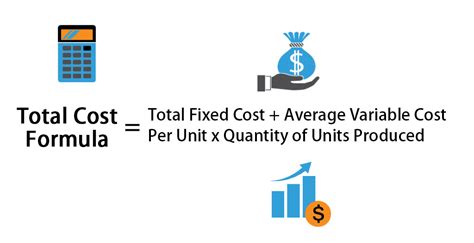

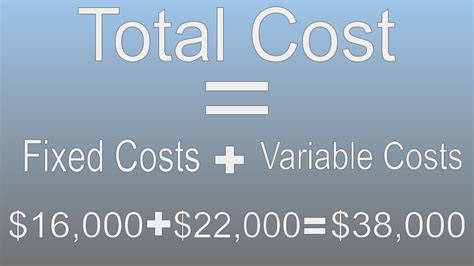

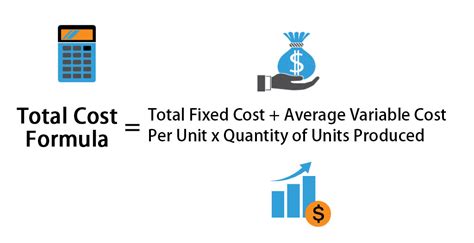

Total Cost Calculation Formula

The total cost calculation formula is a straightforward yet powerful tool that helps businesses determine their overall expenses. The formula is:

Total Cost = Fixed Costs + Variable Costs

Where:

- Fixed Costs = Rent + Utilities + Salaries + Insurance + Depreciation

- Variable Costs = Direct Materials + Direct Labor + Overhead

By adding fixed and variable costs, businesses can determine their total cost and make informed decisions about pricing, budgeting, and resource allocation.

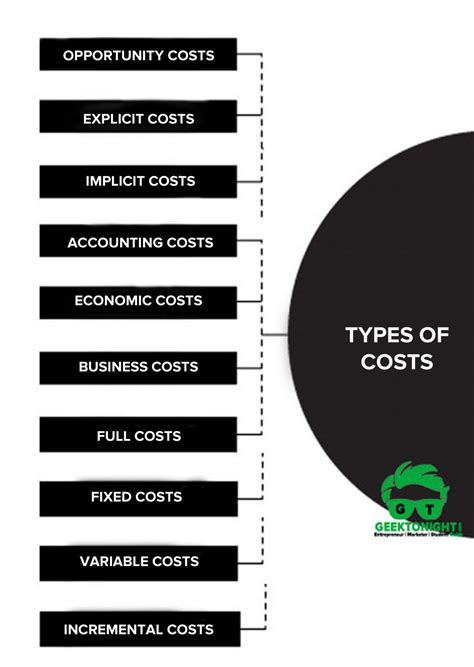

Types of Costs

As mentioned earlier, there are different types of costs involved in the total cost calculation. Understanding these cost categories is essential for accurate calculations and informed decision-making. The main types of costs are:

- Direct Costs: Labor, materials, equipment, and other expenses directly related to production.

- Indirect Costs: Rent, utilities, marketing, and other expenses not directly related to production.

- Fixed Costs: Expenses that remain the same regardless of production levels, such as rent and salaries.

- Variable Costs: Expenses that change depending on the quantity produced, such as direct materials and labor.

By categorizing costs into these categories, businesses can better manage their expenses and make more accurate total cost calculations.

Practical Examples

To illustrate the total cost calculation formula, let's consider a few practical examples. Suppose we have a manufacturing company that produces widgets. The company's fixed costs include rent ($10,000 per month), utilities ($5,000 per month), and salaries ($20,000 per month). The variable costs include direct materials ($5 per unit), direct labor ($10 per unit), and overhead ($2 per unit).

Using the total cost calculation formula, we can determine the total cost of producing 1,000 widgets:

Total Cost = Fixed Costs + Variable Costs = ($10,000 + $5,000 + $20,000) + ($5 + $10 + $2) x 1,000 = $35,000 + $17,000 = $52,000

By calculating the total cost, the company can determine the minimum price they need to charge to break even and make informed decisions about investments and resource allocation.

Benefits of Total Cost Calculation

The total cost calculation formula offers several benefits to businesses and individuals. Some of the key advantages include:

- Accurate pricing: By calculating the total cost, businesses can determine the minimum price they need to charge to break even and make a profit.

- Informed decision-making: The total cost calculation formula helps businesses make informed decisions about investments, resource allocation, and budgeting.

- Cost reduction: By identifying areas of waste and inefficiency, businesses can reduce their costs and increase profitability.

- Improved budgeting: The total cost calculation formula helps businesses create realistic budgets and manage their expenses more effectively.

By understanding the total cost calculation formula and its benefits, businesses can optimize their operations, reduce waste, and increase profitability.

Common Mistakes to Avoid

When using the total cost calculation formula, there are several common mistakes to avoid. Some of the key errors include:

- Failing to account for indirect costs: Indirect costs, such as rent and utilities, can have a significant impact on the total cost.

- Ignoring variable costs: Variable costs, such as direct materials and labor, can change depending on the quantity produced.

- Not considering fixed costs: Fixed costs, such as salaries and depreciation, remain the same regardless of production levels.

- Failing to update costs: Costs can change over time, so it's essential to regularly update the total cost calculation.

By avoiding these common mistakes, businesses can ensure accurate total cost calculations and make informed decisions about their operations.

Best Practices for Total Cost Calculation

To ensure accurate and effective total cost calculations, businesses should follow best practices. Some of the key guidelines include:

- Regularly update costs: Costs can change over time, so it's essential to regularly update the total cost calculation.

- Consider all costs: Include all direct and indirect costs, fixed and variable costs, in the total cost calculation.

- Use accurate data: Ensure that the data used in the total cost calculation is accurate and up-to-date.

- Review and revise: Regularly review and revise the total cost calculation to ensure it remains accurate and effective.

By following these best practices, businesses can ensure accurate total cost calculations and make informed decisions about their operations.

Gallery of Total Cost Calculation

Total Cost Calculation Image Gallery

What is the total cost calculation formula?

+The total cost calculation formula is: Total Cost = Fixed Costs + Variable Costs.

What are the different types of costs?

+The different types of costs include direct costs, indirect costs, fixed costs, and variable costs.

Why is the total cost calculation important?

+The total cost calculation is important because it helps businesses determine their overall expenses, make informed decisions about pricing and budgeting, and reduce waste.

How can I ensure accurate total cost calculations?

+To ensure accurate total cost calculations, regularly update costs, consider all costs, use accurate data, and review and revise the calculation regularly.

What are some common mistakes to avoid when using the total cost calculation formula?

+Common mistakes to avoid include failing to account for indirect costs, ignoring variable costs, not considering fixed costs, and failing to update costs.

In conclusion, the total cost calculation formula is a powerful tool that helps businesses determine their overall expenses and make informed decisions about pricing, budgeting, and resource allocation. By understanding the different types of costs, using the formula, and following best practices, businesses can optimize their operations, reduce waste, and increase profitability. We hope this article has provided you with a comprehensive guide to the total cost calculation formula and its applications. If you have any further questions or would like to share your experiences with total cost calculation, please don't hesitate to comment below.