Intro

Discover 5 ways to ledgers, streamlining accounting with digital ledger tools, ledger templates, and ledger management systems for efficient financial record-keeping and bookkeeping.

The concept of ledgers has been a cornerstone of accounting and financial management for centuries. A ledger is a book or digital file that contains a record of all financial transactions, providing a clear and comprehensive picture of a company's or individual's financial situation. In today's digital age, ledgers have evolved to become more sophisticated and accessible, offering a range of benefits and advantages. In this article, we will explore five ways to ledgers, highlighting their importance, benefits, and best practices.

Ledgers are essential for any business or individual looking to manage their finances effectively. They provide a centralized location for recording and tracking financial transactions, making it easier to monitor income, expenses, and cash flow. With a ledger, you can quickly identify areas where costs can be reduced, optimize financial performance, and make informed decisions about investments and resource allocation. Whether you are a small business owner, entrepreneur, or individual looking to manage your personal finances, a ledger is an indispensable tool.

The use of ledgers has numerous benefits, including improved financial accuracy, enhanced transparency, and better decision-making. By maintaining a ledger, you can ensure that all financial transactions are recorded accurately and in a timely manner, reducing the risk of errors and discrepancies. Ledgers also provide a clear audit trail, making it easier to track and verify financial transactions. This transparency is essential for building trust with stakeholders, including investors, customers, and partners.

In addition to their practical benefits, ledgers also play a critical role in financial planning and strategy. By analyzing ledger data, you can identify trends and patterns in your financial performance, making it easier to forecast future income and expenses. This information can be used to inform business decisions, such as investments, pricing, and resource allocation. With a ledger, you can also track key performance indicators (KPIs) and metrics, providing valuable insights into your financial performance and helping you to stay on track with your goals.

Introduction to Ledgers

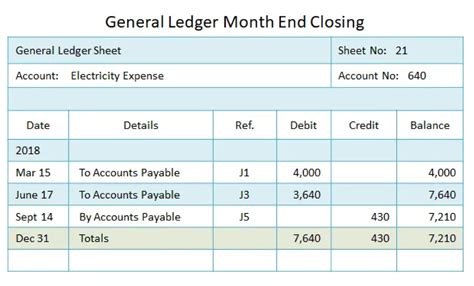

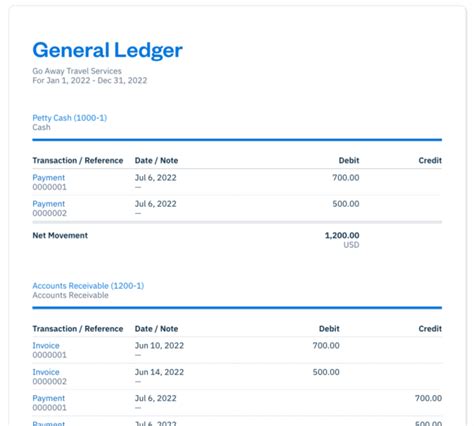

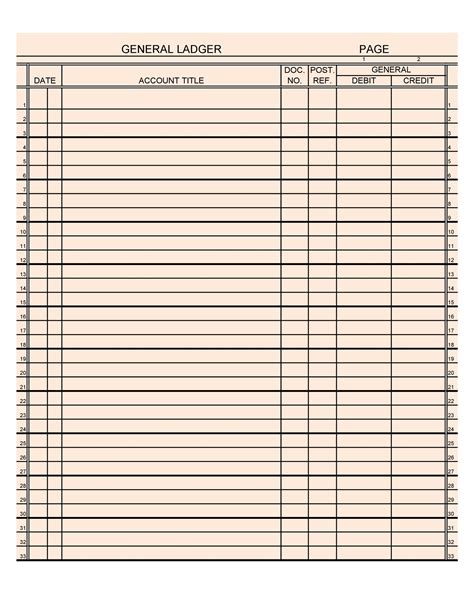

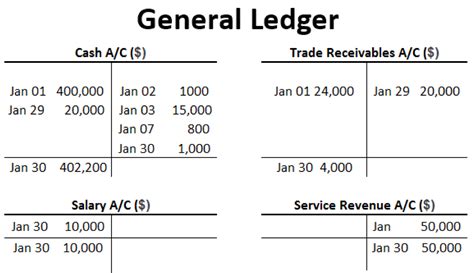

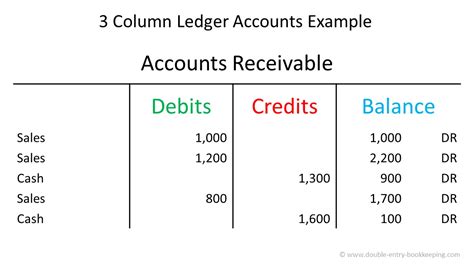

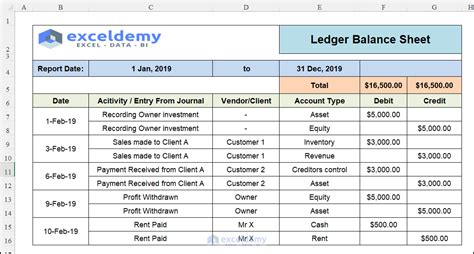

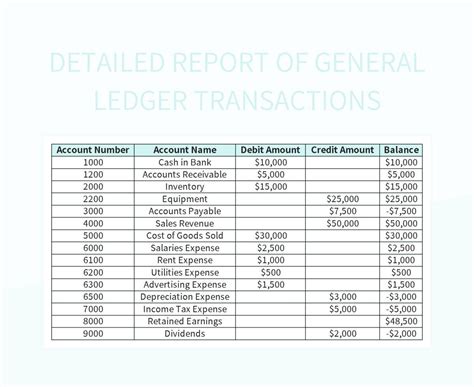

A ledger is a fundamental tool for financial management, providing a comprehensive record of all financial transactions. It is a centralized location for recording and tracking income, expenses, assets, liabilities, and equity. Ledgers can be maintained manually or digitally, using accounting software or spreadsheets. The key components of a ledger include accounts, transactions, and balances. Accounts refer to the individual categories or classifications of financial transactions, such as cash, accounts payable, or revenue. Transactions refer to the individual entries or records of financial activity, such as payments, receipts, or invoices. Balances refer to the current state of each account, reflecting the net effect of all transactions.

Benefits of Using Ledgers

The benefits of using ledgers are numerous and well-documented. Some of the key advantages include improved financial accuracy, enhanced transparency, and better decision-making. Ledgers provide a clear and comprehensive picture of financial performance, making it easier to identify areas for improvement and optimize resource allocation. They also provide a centralized location for recording and tracking financial transactions, reducing the risk of errors and discrepancies. Additionally, ledgers provide a clear audit trail, making it easier to track and verify financial transactions.

Types of Ledgers

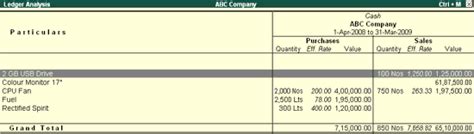

There are several types of ledgers, each designed to meet specific needs and requirements. Some of the most common types of ledgers include general ledgers, subsidiary ledgers, and special ledgers. General ledgers provide a comprehensive record of all financial transactions, including income, expenses, assets, liabilities, and equity. Subsidiary ledgers provide a detailed record of specific transactions or accounts, such as accounts payable or accounts receivable. Special ledgers provide a record of specific transactions or activities, such as payroll or inventory management.

Best Practices for Maintaining Ledgers

Maintaining a ledger requires attention to detail, accuracy, and consistency. Some best practices for maintaining ledgers include regular updates, accurate recording, and thorough reconciliation. Regular updates ensure that the ledger remains current and accurate, reflecting all financial transactions and activities. Accurate recording ensures that all transactions are recorded correctly, reducing the risk of errors and discrepancies. Thorough reconciliation ensures that the ledger is balanced and accurate, providing a clear and comprehensive picture of financial performance.

Common Challenges and Solutions

Maintaining a ledger can be challenging, especially for small businesses or individuals with limited accounting experience. Some common challenges include inaccurate recording, incomplete transactions, and lack of reconciliation. Inaccurate recording can lead to errors and discrepancies, while incomplete transactions can result in an incomplete or inaccurate picture of financial performance. Lack of reconciliation can lead to an unbalanced ledger, making it difficult to track and verify financial transactions. Solutions to these challenges include regular training, automated accounting software, and thorough review and reconciliation.

Gallery of Ledger Images

Ledger Image Gallery

What is a ledger and why is it important?

+A ledger is a book or digital file that contains a record of all financial transactions, providing a clear and comprehensive picture of a company's or individual's financial situation. It is essential for managing finances effectively, making informed decisions, and ensuring financial accuracy and transparency.

What are the different types of ledgers?

+There are several types of ledgers, including general ledgers, subsidiary ledgers, and special ledgers. General ledgers provide a comprehensive record of all financial transactions, while subsidiary ledgers provide a detailed record of specific transactions or accounts. Special ledgers provide a record of specific transactions or activities, such as payroll or inventory management.

How do I maintain a ledger effectively?

+Maintaining a ledger requires attention to detail, accuracy, and consistency. Best practices include regular updates, accurate recording, and thorough reconciliation. Regular updates ensure that the ledger remains current and accurate, while accurate recording ensures that all transactions are recorded correctly. Thorough reconciliation ensures that the ledger is balanced and accurate, providing a clear and comprehensive picture of financial performance.

What are the benefits of using ledgers?

+The benefits of using ledgers include improved financial accuracy, enhanced transparency, and better decision-making. Ledgers provide a clear and comprehensive picture of financial performance, making it easier to identify areas for improvement and optimize resource allocation. They also provide a centralized location for recording and tracking financial transactions, reducing the risk of errors and discrepancies.

Can I use ledger software to maintain my ledger?

+Yes, you can use ledger software to maintain your ledger. Ledger software provides a range of benefits, including automated accounting, accurate recording, and thorough reconciliation. It can also provide real-time reporting and analysis, making it easier to track and verify financial transactions.

In conclusion, ledgers are a fundamental tool for financial management, providing a comprehensive record of all financial transactions. By understanding the importance of ledgers, the different types of ledgers, and best practices for maintaining ledgers, you can ensure that your finances are managed effectively and efficiently. Whether you are a small business owner, entrepreneur, or individual looking to manage your personal finances, a ledger is an indispensable tool. We encourage you to share your thoughts and experiences with ledgers in the comments below, and to explore the resources and tools available to help you maintain a ledger effectively.