Intro

Discover how prime cost works in 5 key ways, impacting construction projects, labor costs, and material expenses, to optimize budgeting and cost estimation with effective prime cost management techniques.

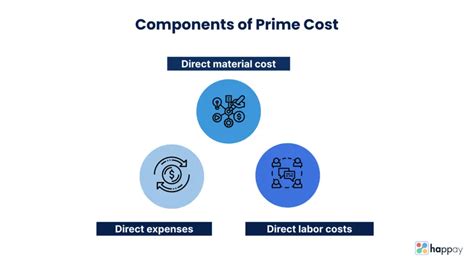

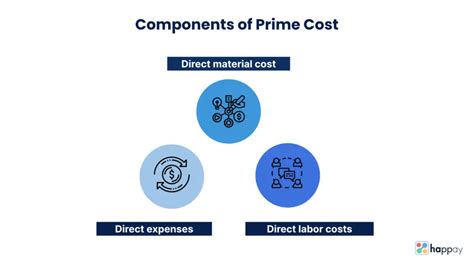

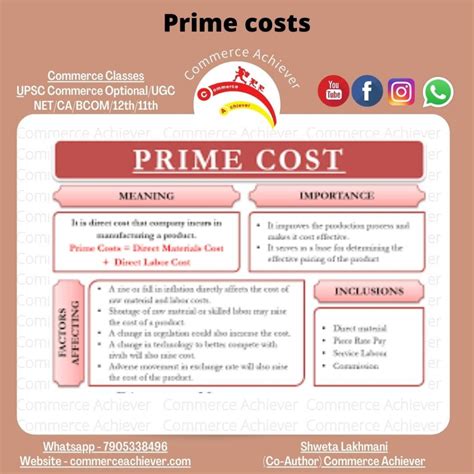

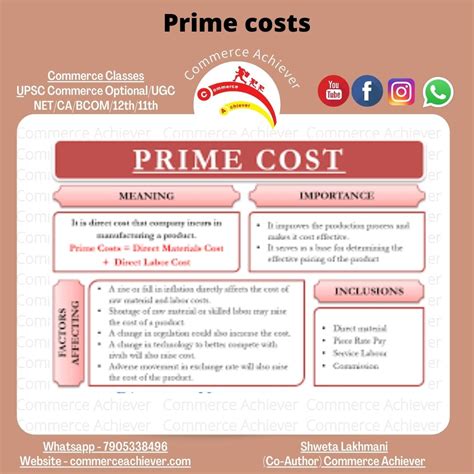

The concept of prime cost is a crucial aspect of business and economics, particularly in the context of production and manufacturing. It refers to the total cost of direct materials, direct labor, and overhead expenses that are directly tied to the production of a specific product or service. Understanding how prime cost works is essential for businesses to optimize their production processes, manage costs, and make informed decisions about pricing and profitability. In this article, we will delve into the world of prime cost and explore its significance, benefits, and applications in various industries.

Prime cost is a fundamental concept in accounting and finance, and its accurate calculation is critical for businesses to determine their product costs, set prices, and forecast profitability. The prime cost includes all the direct costs associated with producing a product, such as raw materials, labor, and equipment. By understanding the prime cost, businesses can identify areas where they can reduce costs, improve efficiency, and increase profitability. In the following sections, we will discuss the different ways prime cost works and its implications for businesses.

Introduction to Prime Cost

Calculating Prime Cost

Benefits of Prime Cost

Applications of Prime Cost

Challenges and Limitations

Gallery of Prime Cost

Prime Cost Image Gallery

What is the prime cost, and why is it important?

+The prime cost is the total cost of direct materials, direct labor, and overhead expenses that are directly tied to the production of a specific product or service. It is essential for businesses to calculate the prime cost to determine their product costs, set prices, and forecast profitability.

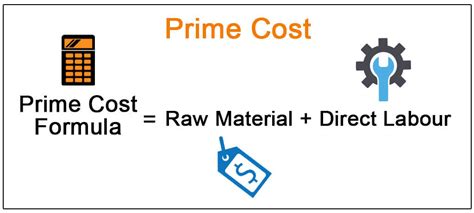

How is the prime cost calculated?

+The prime cost is calculated by adding direct materials, direct labor, and overhead expenses. The formula for calculating prime cost is: Prime Cost = Direct Materials + Direct Labor + Overhead Expenses.

What are the benefits of calculating the prime cost?

+The benefits of calculating the prime cost include improved cost management, accurate pricing, forecasting profitability, and benchmarking. By understanding the prime cost, businesses can identify areas where they can reduce costs, improve efficiency, and increase profitability.

What are the challenges and limitations of calculating the prime cost?

+The challenges and limitations of calculating the prime cost include difficulty in allocating overhead expenses, variability in direct costs, and complexity in calculating prime cost. These challenges can lead to inaccurate prime cost calculations, which can have significant implications for businesses.

How can businesses apply the prime cost in their operations?

+Businesses can apply the prime cost in their operations by using it to determine product costs, set prices, and forecast profitability. The prime cost can also be used to identify areas where costs can be reduced, improve efficiency, and increase profitability. Additionally, the prime cost can be used to benchmark a company's performance against industry averages and competitors.

In conclusion, the prime cost is a critical concept in business and economics, and its accurate calculation is essential for businesses to determine their product costs, set prices, and forecast profitability. By understanding the prime cost, businesses can identify areas where they can reduce costs, improve efficiency, and increase profitability. We hope this article has provided you with a comprehensive understanding of the prime cost and its applications in various industries. If you have any further questions or would like to share your thoughts on the topic, please feel free to comment below. Additionally, if you found this article informative, please share it with your network to help others understand the importance of prime cost in business.