Intro

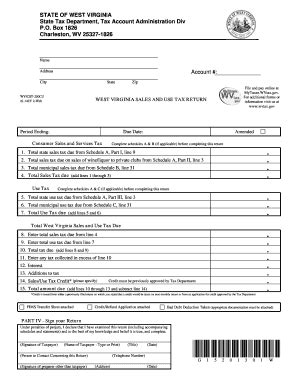

Download Wv State Tax Forms Printable for free, including income tax returns, withholding forms, and exemption certificates, to simplify tax filing and compliance in West Virginia.

Filing taxes can be a daunting task, especially when it comes to navigating the various forms and requirements. For residents of West Virginia, understanding the state tax forms and how to access them is crucial for a smooth and efficient tax filing process. In this article, we will delve into the world of WV state tax forms, exploring what they are, how to obtain them, and the benefits of using printable versions.

Tax season can be a stressful time, with deadlines looming and paperwork piling up. However, with the right tools and knowledge, individuals can take control of their tax filing and ensure they are in compliance with all state and federal regulations. West Virginia state tax forms are an essential part of this process, providing a means for residents to report their income, claim deductions, and pay any owed taxes.

For those who are new to filing taxes in West Virginia, it can be overwhelming to know where to start. The first step is to familiarize oneself with the various tax forms available, including the WV state tax forms. These forms are designed to be user-friendly, with clear instructions and guidelines to help individuals navigate the filing process. By understanding what each form is used for and how to complete it accurately, residents can avoid common mistakes and ensure their tax return is processed quickly and efficiently.

Understanding WV State Tax Forms

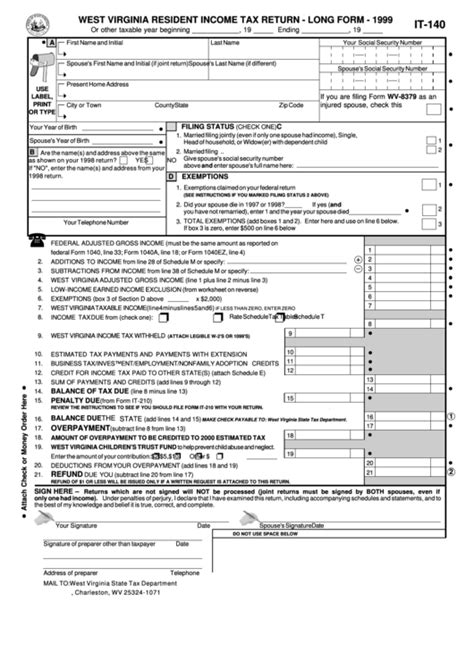

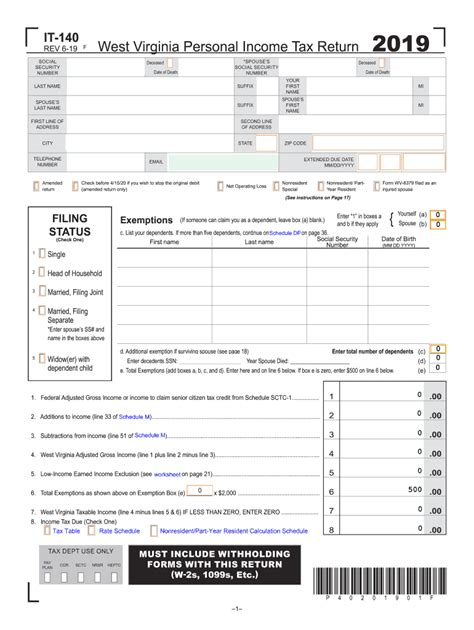

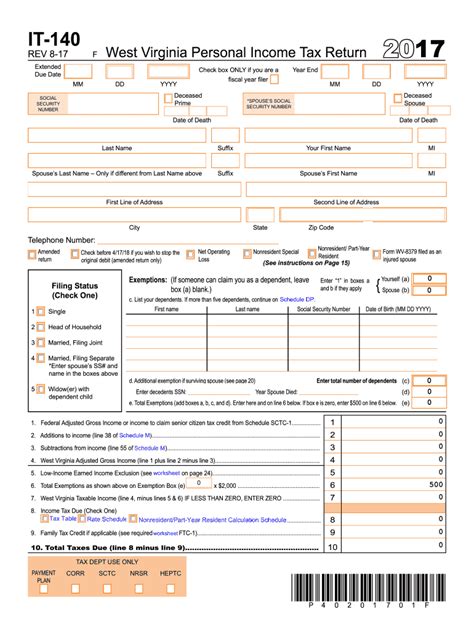

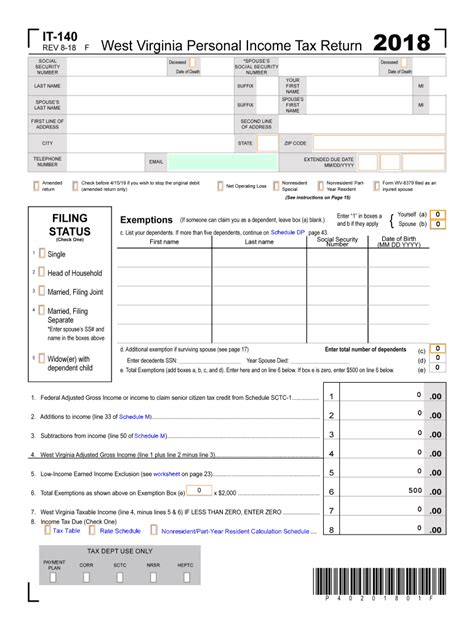

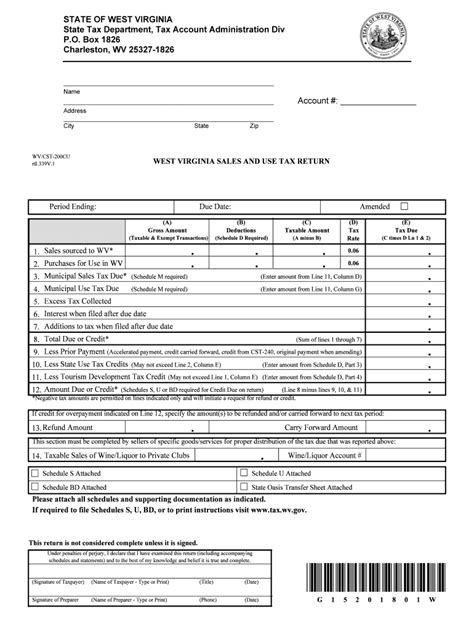

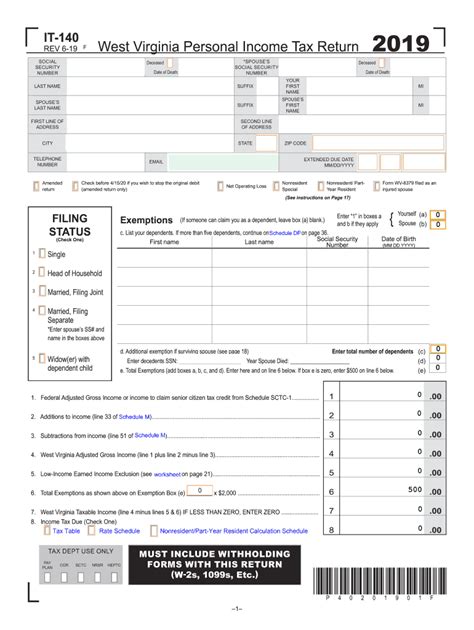

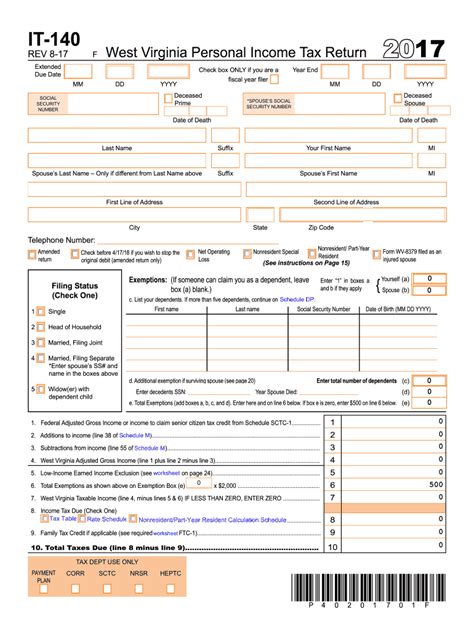

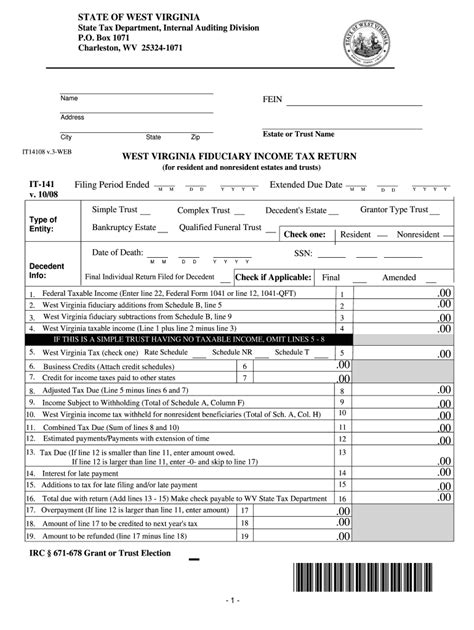

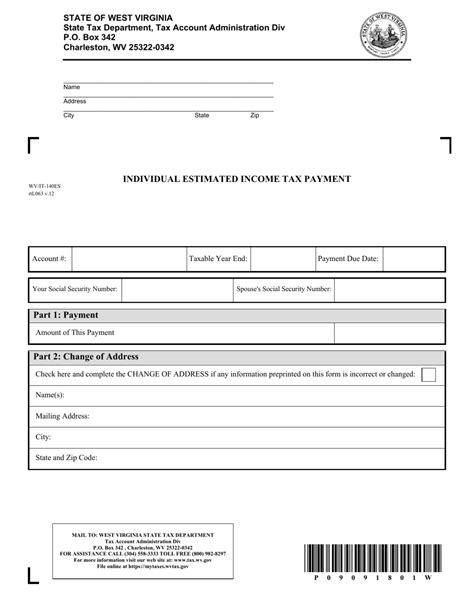

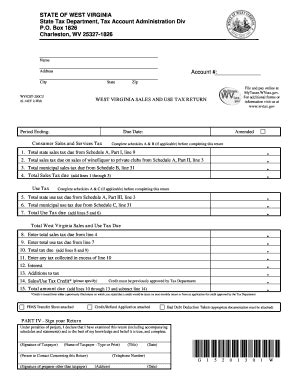

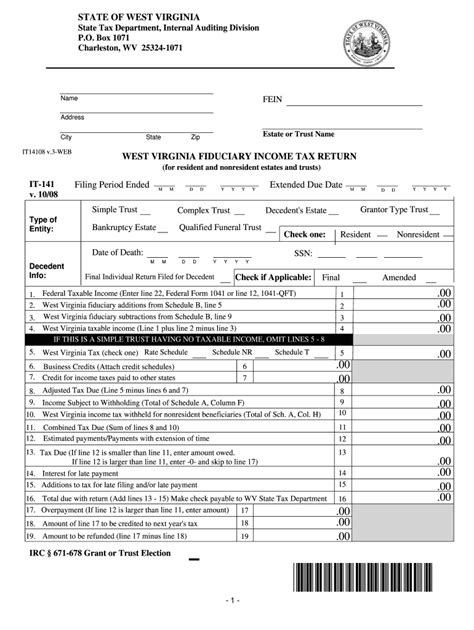

WV state tax forms are used to report income earned within the state, as well as to claim any deductions or credits that may be available. The most common form used for personal income tax is the IT-140, which is the West Virginia Personal Income Tax Return. This form is used to report income from various sources, including wages, salaries, and investments. Other forms, such as the IT-140ES, are used for estimated tax payments, while the IT-210 is used for underpayment of estimated tax.

Types of WV State Tax Forms

There are several types of WV state tax forms, each with its own specific purpose. Some of the most common forms include: * IT-140: West Virginia Personal Income Tax Return * IT-140ES: West Virginia Estimated Income Tax Return * IT-210: Underpayment of Estimated Tax * IT-370: West Virginia Fiduciary Income Tax Return * IT-541: West Virginia Estate Tax ReturnBenefits of Using Printable WV State Tax Forms

Using printable WV state tax forms can be beneficial for several reasons. Firstly, it allows individuals to complete their tax return at their own pace, without the need to wait for forms to be mailed or picked up from a tax office. Additionally, printable forms can be easily saved and stored, reducing the risk of lost or misplaced documents. Furthermore, using printable forms can help reduce errors, as individuals can review and revise their return before submitting it.

How to Obtain Printable WV State Tax Forms

Printable WV state tax forms can be obtained from the West Virginia State Tax Department website. The website provides a range of forms and instructions, including the IT-140 and other commonly used forms. Individuals can also contact the tax department directly to request forms be mailed to them. Alternatively, many tax preparation software programs, such as TurboTax and H&R Block, offer printable WV state tax forms as part of their services.Completing WV State Tax Forms

Completing WV state tax forms requires careful attention to detail and accuracy. Individuals should ensure they have all necessary documentation, including W-2 forms, 1099 forms, and receipts for deductions. The forms should be completed in ink, using black or blue ink, and signed in the presence of a notary public, if required. It is also essential to review the forms carefully before submitting them, to ensure all information is accurate and complete.

Tips for Completing WV State Tax Forms

Some tips for completing WV state tax forms include: * Read the instructions carefully before starting * Ensure all necessary documentation is available * Complete the forms in ink, using black or blue ink * Review the forms carefully before submitting them * Consider seeking professional help, if neededSubmitting WV State Tax Forms

Once the WV state tax forms are completed, they must be submitted to the West Virginia State Tax Department. The forms can be mailed or filed electronically, using the department's online filing system. Individuals should ensure they keep a copy of their return, as well as any supporting documentation, in case of an audit or other inquiry.

Options for Submitting WV State Tax Forms

There are several options for submitting WV state tax forms, including: * Mailing the forms to the West Virginia State Tax Department * Filing electronically, using the department's online filing system * Using a tax preparation software program, such as TurboTax or H&R Block * Visiting a tax office, such as H&R Block or Jackson HewittWV State Tax Forms Image Gallery

What is the deadline for filing WV state tax forms?

+The deadline for filing WV state tax forms is typically April 15th, unless an extension is granted.

Can I file my WV state tax forms electronically?

+Yes, you can file your WV state tax forms electronically, using the West Virginia State Tax Department's online filing system.

What is the penalty for late filing of WV state tax forms?

+The penalty for late filing of WV state tax forms is typically 5% of the unpaid tax, plus interest and any additional penalties.

Can I get an extension on my WV state tax forms?

+Yes, you can get an extension on your WV state tax forms, by filing Form IT-140ES and paying any estimated tax due.

What is the contact information for the West Virginia State Tax Department?

+The contact information for the West Virginia State Tax Department is available on their website, or by calling (304) 558-3333.

In conclusion, WV state tax forms are an essential part of the tax filing process for residents of West Virginia. By understanding what each form is used for and how to complete it accurately, individuals can ensure they are in compliance with all state and federal regulations. Using printable WV state tax forms can be beneficial, allowing individuals to complete their return at their own pace and reducing the risk of errors. We encourage readers to share their experiences with WV state tax forms, ask questions, and provide feedback on how to improve the tax filing process. By working together, we can make the tax filing process smoother and more efficient for everyone.