Intro

Discover 5 ways to calculate breakeven, including point analysis, margin-based methods, and more, to optimize financial performance, manage costs, and increase profitability in business operations and investment strategies.

The concept of breakeven analysis is crucial for businesses, investors, and individuals looking to make informed decisions about their financial investments. Understanding the breakeven point can help determine the viability of a project, the potential for profit, and the risks involved. In this article, we will delve into the importance of breakeven analysis, its applications, and provide practical examples to illustrate its usefulness.

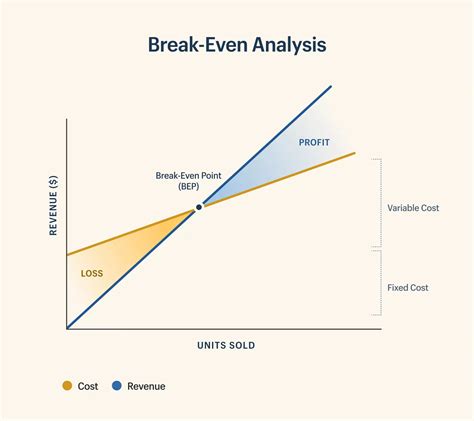

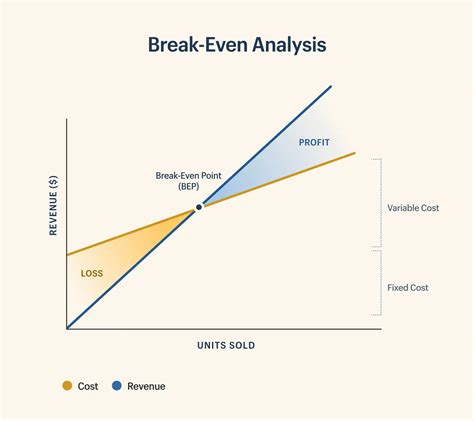

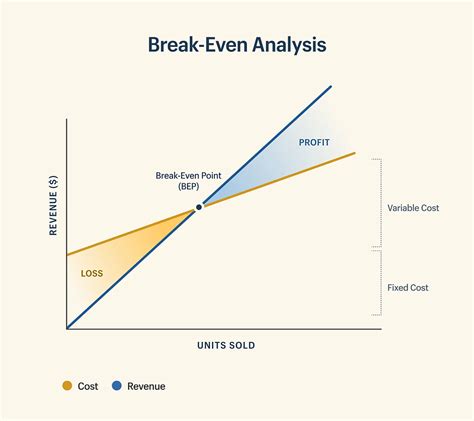

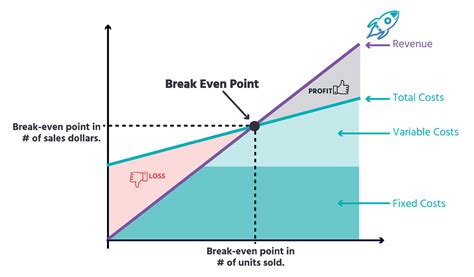

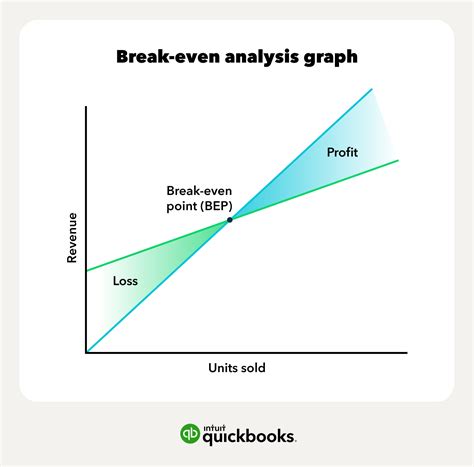

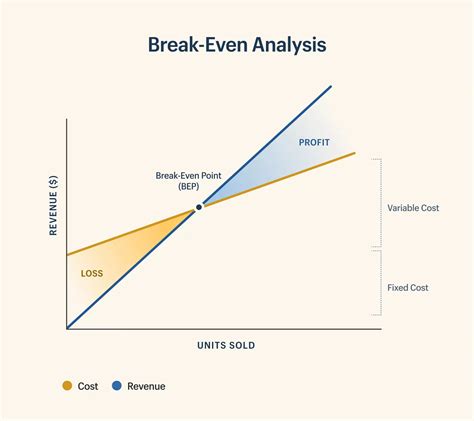

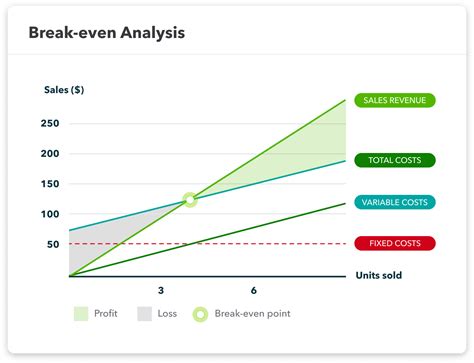

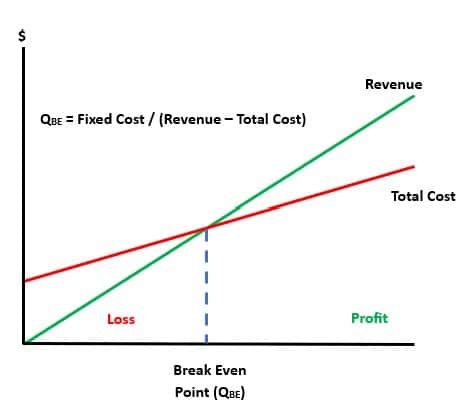

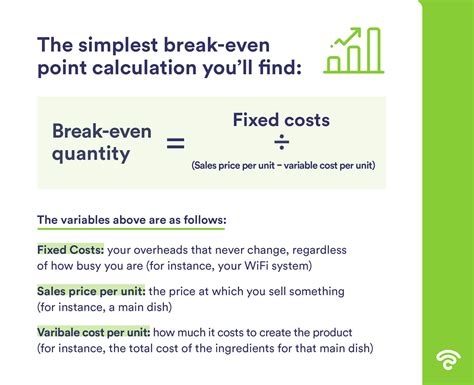

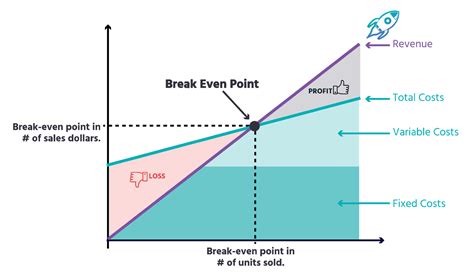

Breakeven analysis is a financial calculation that determines the point at which the total cost and total revenue of a project or investment are equal. At this point, the project is neither making a profit nor incurring a loss. The breakeven point is a critical metric that can help businesses and investors evaluate the potential of a project and make informed decisions about resource allocation. It is essential to understand the breakeven point to avoid making investments that may not generate sufficient returns or to identify opportunities that have the potential for significant profits.

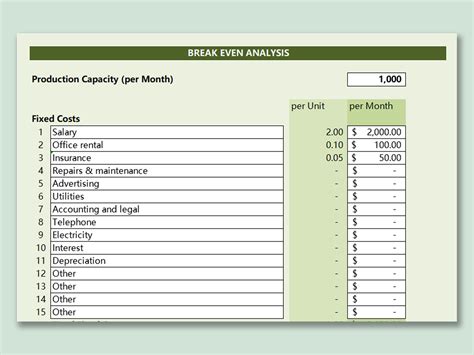

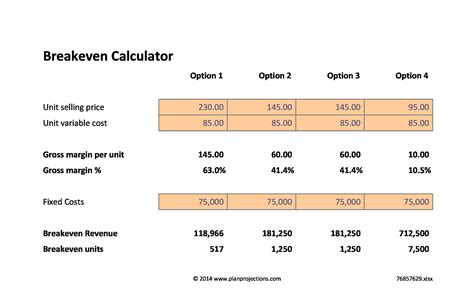

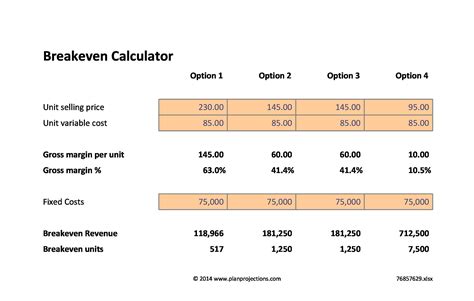

The breakeven analysis is widely used in various fields, including business, finance, and economics. It is a valuable tool for entrepreneurs, managers, and investors who need to evaluate the viability of a project or investment. The breakeven point can be calculated using various methods, including the contribution margin method, the equation method, and the graphical method. Each method has its advantages and disadvantages, and the choice of method depends on the specific needs and goals of the project.

What is Breakeven Analysis?

Types of Breakeven Analysis

There are several types of breakeven analysis, including: * Financial breakeven analysis: This type of analysis focuses on the financial aspects of a project, including the costs and revenues. * Operational breakeven analysis: This type of analysis focuses on the operational aspects of a project, including the production costs and capacity. * Strategic breakeven analysis: This type of analysis focuses on the strategic aspects of a project, including the market trends and competition.How to Calculate Breakeven Point

The equation method involves using a mathematical equation to calculate the breakeven point. This method is more complex than the contribution margin method but provides a more accurate calculation of the breakeven point. The graphical method involves using a graph to visualize the breakeven point. This method is useful for illustrating the relationship between the costs and revenues of a project.

Benefits of Breakeven Analysis

Breakeven analysis has several benefits, including: * Helps to evaluate the viability of a project * Provides a basis for making informed decisions about resource allocation * Helps to identify opportunities for cost reduction and profit improvement * Provides a benchmark for measuring the performance of a projectApplications of Breakeven Analysis

Limitations of Breakeven Analysis

Breakeven analysis has several limitations, including: * Assumes a linear relationship between costs and revenues * Does not take into account external factors that may affect the project * Does not provide a complete picture of the project's performanceReal-Life Examples of Breakeven Analysis

Best Practices for Breakeven Analysis

To get the most out of breakeven analysis, it is essential to follow best practices, including: * Use accurate and reliable data * Consider external factors that may affect the project * Use a combination of methods to calculate the breakeven point * Regularly review and update the breakeven analysisCommon Mistakes to Avoid in Breakeven Analysis

Future of Breakeven Analysis

The future of breakeven analysis is exciting, with new technologies and methods being developed to improve the accuracy and reliability of the analysis. For example, the use of artificial intelligence and machine learning can help to improve the accuracy of the breakeven point calculation. The use of cloud-based software can help to improve the accessibility and collaboration of the breakeven analysis.Breakeven Analysis Image Gallery

What is breakeven analysis?

+Breakeven analysis is a financial calculation that determines the point at which the total cost and total revenue of a project or investment are equal.

How to calculate breakeven point?

+The breakeven point can be calculated using various methods, including the contribution margin method, the equation method, and the graphical method.

What are the benefits of breakeven analysis?

+Breakeven analysis has several benefits, including helping to evaluate the viability of a project, providing a basis for making informed decisions about resource allocation, and identifying opportunities for cost reduction and profit improvement.

What are the limitations of breakeven analysis?

+Breakeven analysis has several limitations, including assuming a linear relationship between costs and revenues, not taking into account external factors that may affect the project, and not providing a complete picture of the project's performance.

How to avoid common mistakes in breakeven analysis?

+To avoid common mistakes in breakeven analysis, it is essential to use accurate and reliable data, consider external factors that may affect the project, use a combination of methods to calculate the breakeven point, and regularly review and update the breakeven analysis.

In conclusion, breakeven analysis is a powerful tool that can help businesses and investors make informed decisions about their financial investments. By understanding the breakeven point, individuals can evaluate the viability of a project, identify opportunities for cost reduction and profit improvement, and avoid common mistakes that can lead to financial losses. We hope this article has provided valuable insights into the world of breakeven analysis and has encouraged readers to explore this topic further. If you have any questions or comments, please do not hesitate to reach out to us. Share this article with your friends and colleagues who may benefit from learning about breakeven analysis. Together, we can make informed decisions and achieve our financial goals.