Intro

Discover the 5 ways to define an invoice, including invoice templates, billing statements, and payment terms, to streamline invoicing processes and improve cash flow management with effective invoicing strategies.

In today's fast-paced business world, understanding the concept of an invoice is crucial for companies and individuals alike. An invoice is a document that plays a vital role in the financial transactions between buyers and sellers, serving as a request for payment for goods or services provided. The importance of invoices cannot be overstated, as they help businesses keep track of their sales, manage their cash flow, and maintain a record of their financial activities. In this article, we will delve into the world of invoices, exploring their definition, types, and significance in the business landscape.

The concept of an invoice has been around for centuries, with its origins dating back to the early days of trade and commerce. Over time, the format and content of invoices have evolved to accommodate the changing needs of businesses and the advancement of technology. Today, invoices can be created and sent electronically, making it easier for companies to manage their financial transactions and communicate with their clients. With the rise of digital invoicing, businesses can now track their payments, send reminders, and analyze their financial data with greater ease and accuracy.

As we navigate the complex world of invoices, it becomes clear that understanding their definition and purpose is essential for businesses to succeed. An invoice is more than just a document; it is a tool that helps companies manage their finances, build relationships with their clients, and stay competitive in the market. Whether you are a small business owner, a freelancer, or a large corporation, knowing how to create and use invoices effectively can make a significant difference in your financial performance and overall success. In the following sections, we will explore the different ways to define an invoice, examining its various aspects and characteristics.

Definition of an Invoice

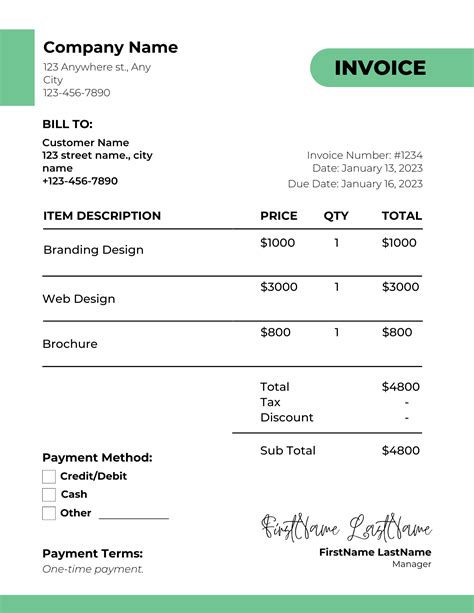

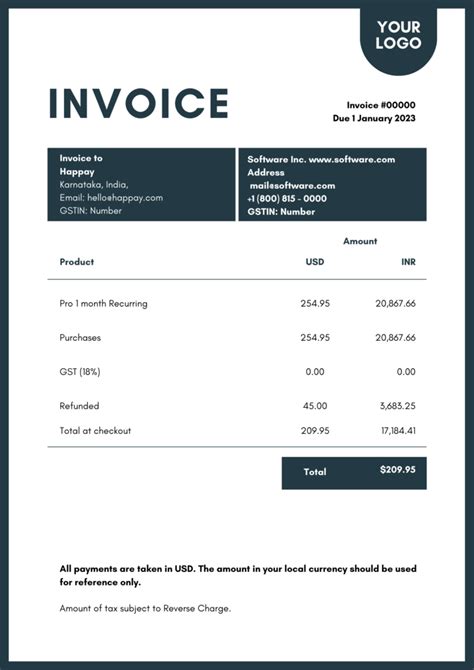

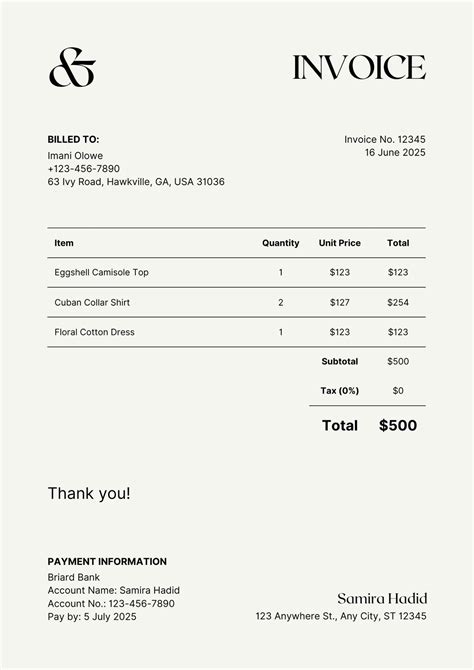

An invoice is a commercial document issued by a seller to a buyer, detailing the goods or services provided, their quantities, and the amount due for payment. It serves as a formal request for payment, outlining the terms and conditions of the sale, including the payment method, due date, and any applicable taxes or discounts. Invoices can be used for a wide range of transactions, from the sale of physical goods to the provision of services, such as consulting, freelancing, or contracting.

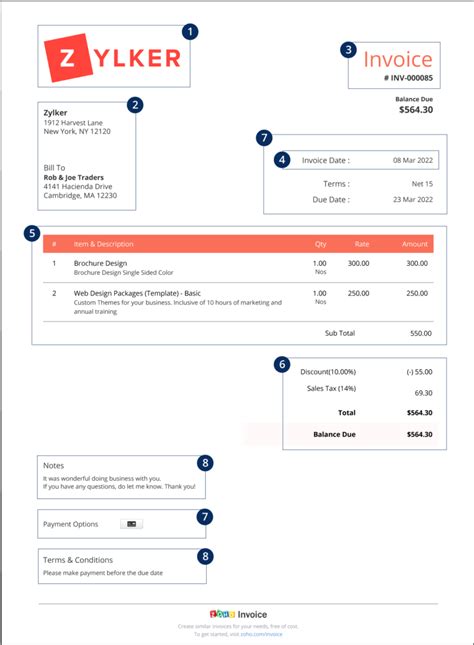

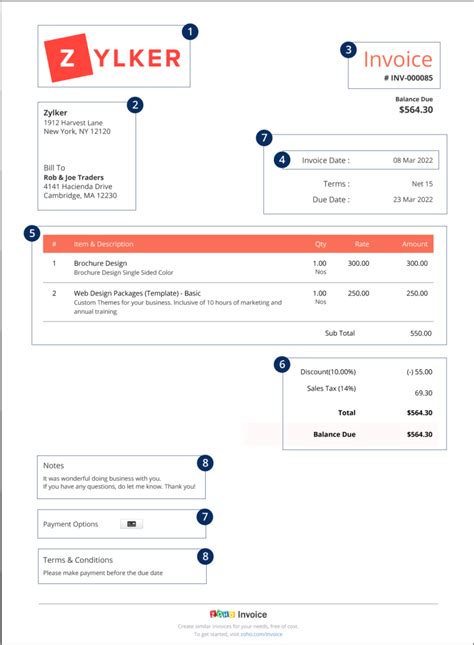

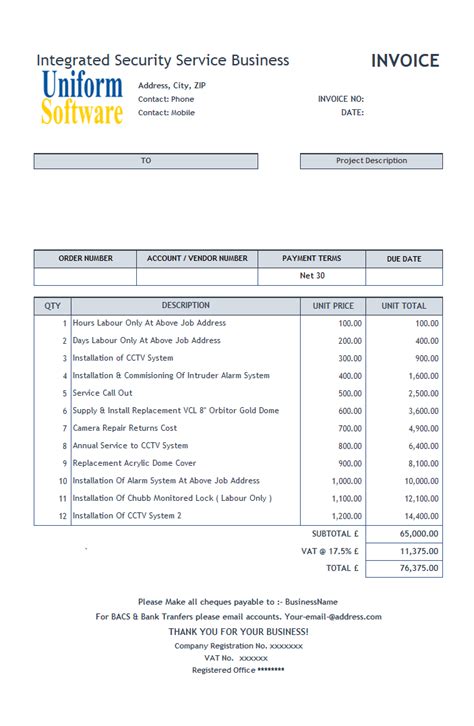

Key Elements of an Invoice

To be considered a valid invoice, a document must include certain key elements, such as: * The seller's name and contact information * The buyer's name and contact information * A unique invoice number * The date of the invoice * A description of the goods or services provided * The quantity and unit price of each item * The total amount due for payment * The payment terms and conditions * Any applicable taxes or discountsTypes of Invoices

Invoices can be categorized into different types, depending on their purpose, format, and content. Some common types of invoices include:

- Sales invoices: used for the sale of goods or services

- Service invoices: used for the provision of services, such as consulting or freelancing

- Pro forma invoices: used as a preliminary invoice, outlining the terms and conditions of a sale

- Commercial invoices: used for international trade, providing detailed information about the goods being exported

- Recurring invoices: used for ongoing services or subscriptions, such as monthly payments for software or membership fees

Benefits of Invoices

Invoices offer numerous benefits to businesses, including: * Improved cash flow management: by tracking payments and sending reminders, businesses can ensure timely payments and avoid late fees * Enhanced financial record-keeping: invoices provide a detailed record of financial transactions, making it easier to manage accounting and tax obligations * Better communication with clients: invoices can help businesses build relationships with their clients, providing a clear understanding of the terms and conditions of the sale * Increased efficiency: electronic invoicing can automate many tasks, such as payment tracking and reminders, freeing up time for more important activitiesCreating an Invoice

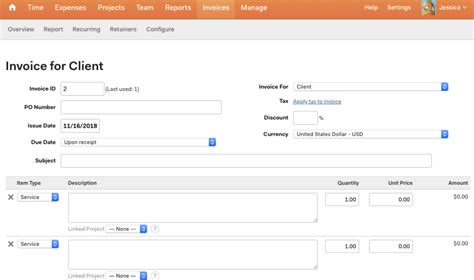

Creating an invoice can be a straightforward process, using a template or invoicing software. The key is to ensure that the invoice includes all the necessary information, such as the seller's and buyer's details, the description of the goods or services, and the payment terms. Businesses can choose from a variety of invoicing tools, ranging from simple spreadsheets to advanced accounting software, to create and manage their invoices.

Best Practices for Invoicing

To get the most out of invoicing, businesses should follow best practices, such as: * Using a unique invoice number for each transaction * Including a clear description of the goods or services provided * Specifying the payment terms and conditions * Sending invoices promptly, to ensure timely payments * Following up with clients, to resolve any disputes or issuesCommon Invoicing Mistakes

Despite the importance of invoicing, many businesses make mistakes that can lead to delayed payments, lost revenue, and damaged relationships with clients. Some common invoicing mistakes include:

- Incomplete or inaccurate information

- Failure to include payment terms and conditions

- Insufficient details about the goods or services provided

- Poor communication with clients

- Inconsistent invoicing practices

Resolving Invoicing Disputes

In the event of an invoicing dispute, businesses should take a proactive approach to resolve the issue, such as: * Communicating with the client, to understand their concerns * Providing additional information or documentation, to support the invoice * Offering a compromise or settlement, to avoid further conflict * Seeking professional advice, if necessary, to resolve the disputeFuture of Invoicing

The future of invoicing is likely to be shaped by technological advancements, such as artificial intelligence, blockchain, and the Internet of Things. As businesses increasingly adopt digital invoicing, we can expect to see greater efficiency, accuracy, and security in financial transactions. The rise of e-invoicing will also lead to increased transparency, reduced costs, and improved cash flow management.

Trends in Invoicing

Some trends that are likely to shape the future of invoicing include: * Increased adoption of digital invoicing * Greater use of automation and artificial intelligence * Improved security and authentication measures * Enhanced transparency and visibility in financial transactions * Growing demand for real-time payments and instant settlementsInvoice Image Gallery

What is an invoice?

+An invoice is a commercial document issued by a seller to a buyer, detailing the goods or services provided, their quantities, and the amount due for payment.

What are the key elements of an invoice?

+The key elements of an invoice include the seller's and buyer's details, a unique invoice number, the date of the invoice, a description of the goods or services, and the payment terms and conditions.

What are the benefits of invoicing?

+The benefits of invoicing include improved cash flow management, enhanced financial record-keeping, better communication with clients, and increased efficiency.

How can I create an invoice?

+You can create an invoice using a template or invoicing software, ensuring that it includes all the necessary information, such as the seller's and buyer's details, the description of the goods or services, and the payment terms.

What are some common invoicing mistakes?

+Common invoicing mistakes include incomplete or inaccurate information, failure to include payment terms and conditions, insufficient details about the goods or services, poor communication with clients, and inconsistent invoicing practices.

As we conclude our exploration of the world of invoices, it is clear that understanding the concept of an invoice is crucial for businesses to succeed. By grasping the definition, types, and significance of invoices, companies can improve their cash flow management, enhance their financial record-keeping, and build stronger relationships with their clients. Whether you are a small business owner, a freelancer, or a large corporation, knowing how to create and use invoices effectively can make a significant difference in your financial performance and overall success. We invite you to share your thoughts and experiences with invoicing, and to explore the many resources available to help you master the art of invoicing.