Intro

Discover Merchant Cash Advance Loans, a flexible financing option for businesses, offering quick access to capital, bad credit acceptance, and daily repayment plans, ideal for small business owners and entrepreneurs seeking alternative funding solutions.

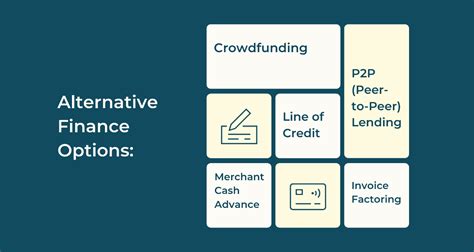

The world of small business financing can be complex and overwhelming, with numerous options available to entrepreneurs. One type of financing that has gained popularity in recent years is the merchant cash advance loan. This type of loan provides businesses with a quick and easy way to access capital, but it's essential to understand the ins and outs of merchant cash advance loans before making a decision. In this article, we'll delve into the world of merchant cash advance loans, exploring their benefits, working mechanisms, and key considerations for business owners.

Merchant cash advance loans are a type of alternative financing that allows businesses to receive a lump sum of cash in exchange for a percentage of their future sales. This type of loan is often used by businesses that have a high volume of credit card sales, such as restaurants, retail stores, and service-based businesses. The loan is typically repaid through daily or weekly deductions from the business's credit card sales, making it a flexible and manageable way to repay the loan.

The importance of understanding merchant cash advance loans cannot be overstated. With the rise of alternative financing options, business owners need to be aware of the various choices available to them. Merchant cash advance loans offer a unique solution for businesses that may not qualify for traditional bank loans or need quick access to capital. By understanding the benefits and drawbacks of merchant cash advance loans, business owners can make informed decisions about their financing options and choose the best path for their company's growth and success.

How Merchant Cash Advance Loans Work

Merchant cash advance loans work by providing businesses with a lump sum of cash in exchange for a percentage of their future sales. The loan is typically repaid through daily or weekly deductions from the business's credit card sales. The repayment amount is usually a fixed percentage of the business's daily or weekly sales, making it a flexible and manageable way to repay the loan. For example, if a business receives a $10,000 merchant cash advance loan with a repayment rate of 10%, the business would repay $100 per day if it has $1,000 in daily credit card sales.

The application process for merchant cash advance loans is typically quick and easy, with most lenders requiring minimal documentation and paperwork. Businesses can usually apply online or over the phone, and the approval process can take as little as 24 hours. This makes merchant cash advance loans an attractive option for businesses that need quick access to capital.

Benefits of Merchant Cash Advance Loans

The benefits of merchant cash advance loans are numerous, making them an attractive option for businesses that need quick access to capital. Some of the key benefits include: * Quick and easy application process * Flexible repayment terms * No collateral required * Bad credit is not a barrier to approval * Can be used for a variety of business purposes, such as expansion, marketing, or equipment purchasesThese benefits make merchant cash advance loans an attractive option for businesses that may not qualify for traditional bank loans or need quick access to capital. However, it's essential to carefully consider the terms and conditions of the loan before making a decision.

Types of Merchant Cash Advance Loans

There are several types of merchant cash advance loans available, each with its own unique features and benefits. Some of the most common types include:

- Traditional merchant cash advance loans: These loans provide businesses with a lump sum of cash in exchange for a percentage of their future sales.

- Split-funding merchant cash advance loans: These loans allow businesses to receive a lump sum of cash and repay it through a percentage of their daily or weekly sales, while also allowing them to keep a percentage of their sales.

- ACH merchant cash advance loans: These loans allow businesses to repay the loan through daily or weekly ACH deductions from their bank account.

Each type of merchant cash advance loan has its own advantages and disadvantages, and businesses should carefully consider their options before making a decision.

Key Considerations for Business Owners

While merchant cash advance loans can be a valuable source of financing for businesses, there are several key considerations that business owners should keep in mind. Some of the most important considerations include: * The cost of the loan: Merchant cash advance loans can be expensive, with factor rates ranging from 1.2 to 1.5 or more. * The repayment terms: Businesses should carefully consider the repayment terms, including the daily or weekly repayment amount and the length of the repayment period. * The impact on cash flow: Businesses should consider the impact of the loan on their cash flow, including the potential for reduced cash flow during the repayment period.By carefully considering these factors, business owners can make informed decisions about their financing options and choose the best path for their company's growth and success.

Advantages and Disadvantages of Merchant Cash Advance Loans

Like any type of financing, merchant cash advance loans have their advantages and disadvantages. Some of the key advantages include:

- Quick and easy access to capital

- Flexible repayment terms

- No collateral required

- Bad credit is not a barrier to approval

However, there are also some disadvantages to consider, including:

- High cost of the loan

- Potential for reduced cash flow during the repayment period

- Risk of default if the business experiences a downturn in sales

By carefully weighing the advantages and disadvantages, business owners can make informed decisions about their financing options and choose the best path for their company's growth and success.

Real-World Examples of Merchant Cash Advance Loans

Merchant cash advance loans have been used by a variety of businesses, from small restaurants to large retail chains. For example, a small restaurant might use a merchant cash advance loan to finance the purchase of new equipment or to expand their marketing efforts. A large retail chain might use a merchant cash advance loan to finance a major expansion or to purchase new inventory.In one real-world example, a small business owner used a merchant cash advance loan to finance the purchase of new equipment for their restaurant. The business owner received a $10,000 loan with a factor rate of 1.3, and repaid the loan through daily deductions from their credit card sales. The business owner was able to use the loan to purchase the equipment they needed, and was able to repay the loan quickly and easily.

Best Practices for Using Merchant Cash Advance Loans

While merchant cash advance loans can be a valuable source of financing for businesses, there are several best practices that business owners should follow to ensure they are using the loan effectively. Some of the most important best practices include:

- Carefully reviewing the terms and conditions of the loan

- Considering the cost of the loan and the potential impact on cash flow

- Using the loan for a specific business purpose, such as expansion or equipment purchases

- Repaying the loan quickly and easily, to minimize the cost of the loan

By following these best practices, business owners can use merchant cash advance loans to achieve their business goals and grow their company.

Common Mistakes to Avoid

While merchant cash advance loans can be a valuable source of financing for businesses, there are several common mistakes that business owners should avoid. Some of the most common mistakes include: * Not carefully reviewing the terms and conditions of the loan * Not considering the cost of the loan and the potential impact on cash flow * Using the loan for personal expenses, rather than business purposes * Not repaying the loan quickly and easily, which can increase the cost of the loanBy avoiding these common mistakes, business owners can use merchant cash advance loans effectively and achieve their business goals.

Merchant Cash Advance Loans Image Gallery

What is a merchant cash advance loan?

+A merchant cash advance loan is a type of financing that provides businesses with a lump sum of cash in exchange for a percentage of their future sales.

How do merchant cash advance loans work?

+Merchant cash advance loans work by providing businesses with a lump sum of cash in exchange for a percentage of their future sales. The loan is typically repaid through daily or weekly deductions from the business's credit card sales.

What are the benefits of merchant cash advance loans?

+The benefits of merchant cash advance loans include quick and easy access to capital, flexible repayment terms, and no collateral required. Additionally, bad credit is not a barrier to approval, making it an attractive option for businesses that may not qualify for traditional bank loans.

How do I apply for a merchant cash advance loan?

+The application process for merchant cash advance loans is typically quick and easy, with most lenders requiring minimal documentation and paperwork. Businesses can usually apply online or over the phone, and the approval process can take as little as 24 hours.

What are the common mistakes to avoid when using merchant cash advance loans?

+Common mistakes to avoid when using merchant cash advance loans include not carefully reviewing the terms and conditions of the loan, not considering the cost of the loan and the potential impact on cash flow, and using the loan for personal expenses rather than business purposes.

In final thoughts, merchant cash advance loans can be a valuable source of financing for businesses that need quick access to capital. By understanding the benefits, working mechanisms, and key considerations of merchant cash advance loans, business owners can make informed decisions about their financing options and choose the best path for their company's growth and success. Whether you're a small business owner or a large retail chain, merchant cash advance loans can provide the financing you need to achieve your business goals. We invite you to share your thoughts and experiences with merchant cash advance loans in the comments below, and to share this article with others who may be interested in learning more about this type of financing.