Intro

Master budgeting with 5 cash envelope tips, including budget planning, expense tracking, and savings strategies to manage finances effectively and achieve financial stability.

The cash envelope system has been a game-changer for many individuals and families looking to manage their finances more effectively. By allocating cash for specific expenses and sticking to it, people can avoid overspending and make the most of their hard-earned money. In this article, we will delve into the world of cash envelope tips, exploring the benefits, strategies, and best practices for implementing this system in your daily life.

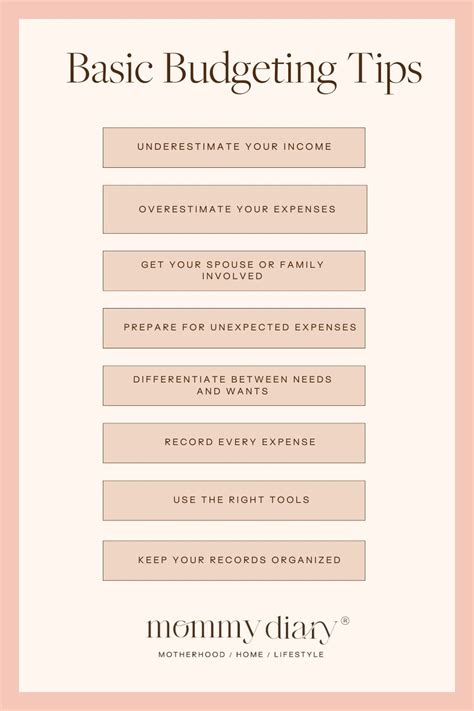

The cash envelope system is a simple yet powerful tool for taking control of your finances. It involves dividing your expenses into categories, such as groceries, entertainment, and transportation, and assigning a specific amount of cash to each category. This approach helps you prioritize your spending, avoid impulse purchases, and develop a healthier relationship with money. Whether you're a seasoned budgeter or just starting to explore the world of personal finance, the cash envelope system is definitely worth considering.

As you begin to explore the cash envelope system, you may wonder how to get started and make the most of this approach. The key is to be intentional and consistent in your spending habits, using the cash envelope system as a tool to guide your financial decisions. By doing so, you can experience the many benefits of this system, from reduced stress and anxiety to increased savings and financial stability. In the following sections, we will dive deeper into the world of cash envelope tips, providing you with practical advice and strategies for implementing this system in your daily life.

Cash Envelope System Benefits

Implementing the Cash Envelope System

To implement the cash envelope system, start by identifying your expense categories and assigning a specific amount of cash to each one. You can use envelopes, jars, or even digital tools to manage your cash allocations. The key is to be intentional and consistent in your spending habits, using the cash envelope system as a guide for your financial decisions. Some popular expense categories for the cash envelope system include: * Groceries * Entertainment * Transportation * Housing * Utilities * Debt repayment * SavingsCash Envelope Tips and Tricks

Common Challenges and Solutions

While the cash envelope system can be a powerful tool for managing finances, it's not without its challenges. Some common obstacles include: * Running out of cash: If you find that you're consistently running out of cash for a particular expense category, it may be necessary to adjust your allocations or explore ways to reduce spending in that area. * Emergency expenses: Unexpected expenses can be a challenge for the cash envelope system. Consider setting aside a small emergency fund to cover unexpected expenses, and be prepared to make adjustments to your cash allocations as needed. * Lifestyle changes: Significant lifestyle changes, such as a move or job change, can impact your expense categories and cash allocations. Be prepared to adjust your system as needed to reflect changing circumstances.Cash Envelope System Variations

Real-Life Examples and Success Stories

The cash envelope system has been used by countless individuals and families to manage their finances and achieve financial stability. Here are a few real-life examples and success stories: * A young couple used the cash envelope system to pay off $10,000 in debt and build a $10,000 emergency fund. * A single mother used the system to reduce her grocery bill by 30% and allocate more funds to savings and debt repayment. * A retiree used the cash envelope system to manage his expenses and ensure that he had enough cash for travel and entertainment.Cash Envelope System Tools and Resources

Conclusion and Next Steps

The cash envelope system is a powerful tool for managing finances and achieving financial stability. By implementing this system and using the tips and strategies outlined in this article, you can take control of your spending, reduce debt, and build wealth. Remember to be patient, flexible, and consistent, and don't be afraid to adjust your system as needed to reflect changing circumstances.Cash Envelope Image Gallery

What is the cash envelope system?

+The cash envelope system is a budgeting method that involves dividing expenses into categories and allocating a specific amount of cash for each category.

How do I get started with the cash envelope system?

+To get started with the cash envelope system, identify your expense categories, assign a specific amount of cash to each category, and use envelopes or digital tools to manage your cash allocations.

What are the benefits of the cash envelope system?

+The cash envelope system offers several benefits, including reduced overspending, increased savings, and improved budgeting and financial awareness.

Can I use the cash envelope system for all of my expenses?

+While the cash envelope system can be used for most expenses, it may not be practical for all expenses, such as rent or mortgage payments, which are typically paid electronically.

How do I adjust my cash allocations if my expenses change?

+If your expenses change, you can adjust your cash allocations by re-evaluating your budget and making adjustments as needed to ensure that you have enough cash for each expense category.

We hope that this article has provided you with a comprehensive understanding of the cash envelope system and its benefits. By implementing this system and using the tips and strategies outlined in this article, you can take control of your finances, reduce debt, and build wealth. Remember to be patient, flexible, and consistent, and don't be afraid to adjust your system as needed to reflect changing circumstances. Share your thoughts and experiences with the cash envelope system in the comments below, and don't forget to share this article with friends and family who may benefit from this powerful budgeting method.