Intro

Boost security with 5 PCI compliance tips, ensuring data protection and payment card industry standards through vulnerability scans, encryption, and access control, for a secure online transaction environment.

The importance of PCI compliance cannot be overstated, especially in today's digital age where credit card transactions are the norm. As a business owner, ensuring the security of your customers' sensitive information is crucial, not only to avoid costly fines but also to maintain trust and credibility. In this article, we will delve into the world of PCI compliance, exploring its significance, benefits, and providing actionable tips to help you navigate the complex landscape of payment card industry security standards.

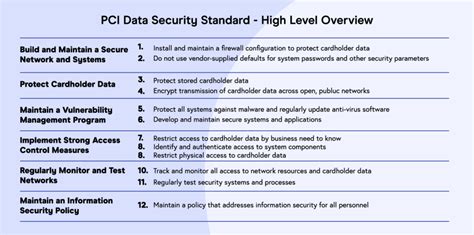

The Payment Card Industry Data Security Standard (PCI DSS) is a set of rules designed to ensure that companies handling credit card information maintain a secure environment for the protection of cardholder data. With the rise of e-commerce and online transactions, the risk of data breaches and cyberattacks has increased exponentially, making PCI compliance a top priority for businesses of all sizes. By implementing the necessary security measures, companies can significantly reduce the risk of a data breach, protect their reputation, and avoid the hefty fines associated with non-compliance.

As we explore the intricacies of PCI compliance, it's essential to understand the potential consequences of non-compliance. A data breach can result in significant financial losses, damage to a company's reputation, and even legal action. Furthermore, the loss of customer trust can be devastating, leading to a decline in sales and revenue. On the other hand, achieving and maintaining PCI compliance can have numerous benefits, including enhanced security, increased customer trust, and improved brand reputation. By prioritizing PCI compliance, businesses can demonstrate their commitment to protecting sensitive information and maintaining the highest security standards.

Introduction to PCI Compliance

Benefits of PCI Compliance

5 PCI Compliance Tips

Implementing a Robust Security Strategy

Common PCI Compliance Mistakes

Best Practices for Maintaining PCI Compliance

Gallery of PCI Compliance Images

PCI Compliance Image Gallery

What is PCI compliance?

+PCI compliance refers to the adherence to the Payment Card Industry Data Security Standard (PCI DSS), a set of rules designed to ensure the secure handling of credit card information.

Why is PCI compliance important?

+PCI compliance is important because it helps protect sensitive information, prevents data breaches, and maintains customer trust.

How can I achieve PCI compliance?

+To achieve PCI compliance, you should conduct regular security audits, implement a robust security strategy, and provide ongoing training and awareness programs for employees.

What are the consequences of non-compliance?

+The consequences of non-compliance can include significant fines, damage to reputation, and increased risk of data breaches and cyberattacks.

How often should I conduct security audits?

+Security audits should be conducted regularly, at least annually, to ensure the continued security and integrity of your system.

In conclusion, achieving and maintaining PCI compliance is crucial for businesses that handle credit card information. By understanding the importance of PCI compliance, implementing a robust security strategy, and following best practices, businesses can protect sensitive information, prevent data breaches, and maintain customer trust. We encourage you to share your thoughts and experiences with PCI compliance in the comments below and to take the necessary steps to ensure your business is meeting the highest security standards. By working together, we can create a safer and more secure environment for online transactions.