Intro

Discover 5 ways ACH transactions simplify payments, offering secure, fast, and reliable electronic fund transfers, online banking, and payment processing solutions.

The world of financial transactions has undergone significant transformations in recent years, with the rise of digital payment systems and online banking. One of the most popular and efficient ways to transfer funds is through Automated Clearing House (ACH) transactions. ACH transactions have become a staple in the financial industry, offering a fast, secure, and cost-effective way to move money between accounts. In this article, we will delve into the world of ACH transactions, exploring their benefits, working mechanisms, and the various ways they can be utilized.

ACH transactions have revolutionized the way individuals and businesses manage their finances. With the ability to transfer funds electronically, ACH transactions have eliminated the need for paper checks, reducing the risk of lost or stolen payments. Moreover, ACH transactions are typically faster than traditional payment methods, allowing recipients to access their funds quickly. This has made ACH transactions an attractive option for businesses and individuals alike, as they can streamline their financial operations and improve cash flow.

The importance of ACH transactions cannot be overstated. They have become an essential tool for businesses, enabling them to pay employees, vendors, and suppliers efficiently. Additionally, ACH transactions have made it possible for individuals to pay bills, transfer funds between accounts, and receive direct deposits. The convenience and flexibility offered by ACH transactions have made them a popular choice for many, and their usage continues to grow as more people become aware of their benefits.

What are ACH Transactions?

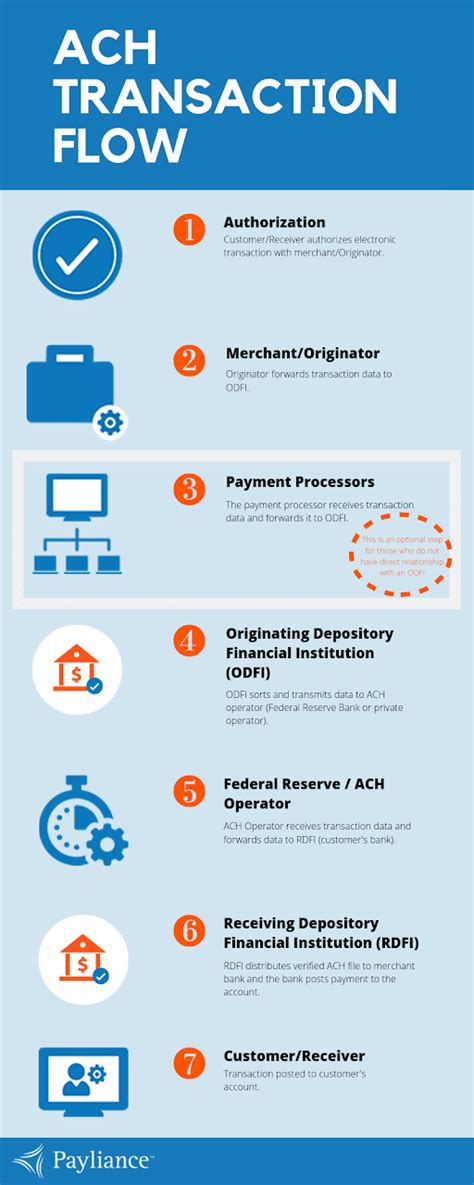

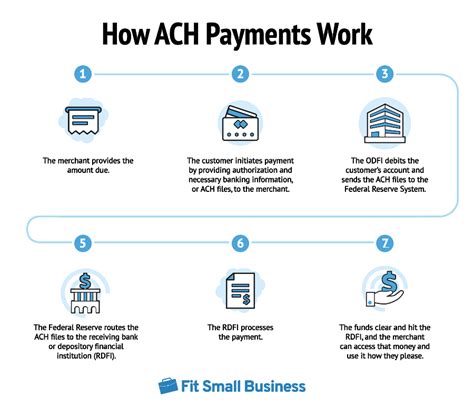

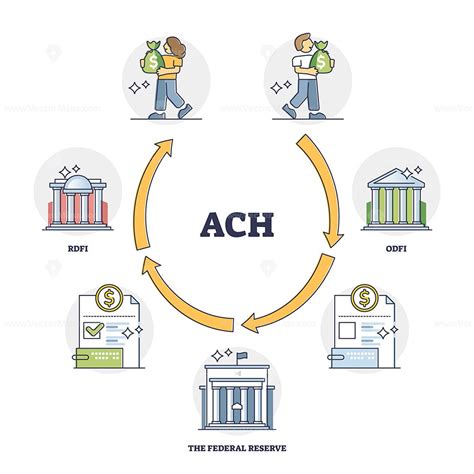

ACH transactions are a type of electronic payment that allows individuals and businesses to transfer funds between accounts. They are facilitated by the Automated Clearing House network, which connects financial institutions and enables the exchange of payment information. ACH transactions can be used for a variety of purposes, including direct deposit, bill payments, and business-to-business transactions. They are typically processed in batches, with transactions being collected and processed at specific times throughout the day.

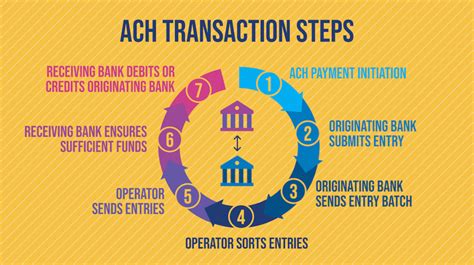

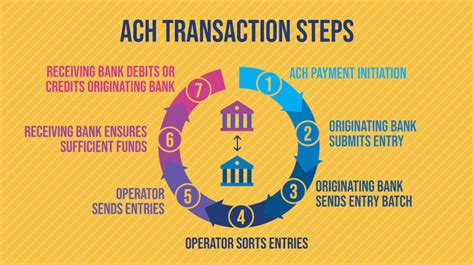

How ACH Transactions Work

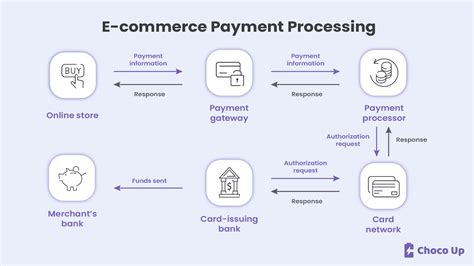

ACH transactions involve several steps, from initiation to settlement. The process begins when an individual or business initiates an ACH transaction, either through their bank's online platform or by submitting a payment request to their financial institution. The payment information is then collected and processed by the ACH network, which verifies the transaction details and ensures that the funds are available. Once the transaction is approved, the funds are transferred from the originating account to the receiving account, and the transaction is settled.Benefits of ACH Transactions

The benefits of ACH transactions are numerous. They offer a fast and secure way to transfer funds, reducing the risk of lost or stolen payments. ACH transactions are also cost-effective, eliminating the need for paper checks and reducing the costs associated with processing and mailing payments. Additionally, ACH transactions provide a high level of convenience, allowing individuals and businesses to manage their finances electronically and access their funds quickly.

Some of the key benefits of ACH transactions include:

- Fast and secure payment processing

- Cost-effective and efficient

- Convenient and accessible

- Reduced risk of lost or stolen payments

- Improved cash flow and financial management

Types of ACH Transactions

There are several types of ACH transactions, each with its own unique characteristics and uses. Some of the most common types of ACH transactions include: * Direct deposit: used to transfer funds from an employer to an employee's account * Bill payments: used to pay bills and invoices electronically * Business-to-business transactions: used to transfer funds between businesses * Person-to-person transactions: used to transfer funds between individuals * Government transactions: used to transfer funds for tax payments, benefits, and other government-related purposes5 Ways to Use ACH Transactions

ACH transactions can be used in a variety of ways, offering flexibility and convenience for individuals and businesses. Here are five ways to use ACH transactions:

- Pay Bills: ACH transactions can be used to pay bills and invoices electronically, reducing the need for paper checks and improving cash flow.

- Transfer Funds: ACH transactions can be used to transfer funds between accounts, making it easy to move money between checking and savings accounts.

- Receive Direct Deposits: ACH transactions can be used to receive direct deposits, such as payroll or government benefits, providing fast and secure access to funds.

- Make Business-to-Business Payments: ACH transactions can be used to transfer funds between businesses, streamlining financial operations and improving cash flow.

- Send Person-to-Person Payments: ACH transactions can be used to send person-to-person payments, making it easy to transfer funds between individuals.

Security and Compliance

ACH transactions are subject to strict security and compliance regulations, ensuring that transactions are processed securely and in accordance with industry standards. The ACH network is governed by the National Automated Clearing House Association (NACHA), which sets rules and guidelines for ACH transactions. Additionally, financial institutions are required to implement robust security measures to protect sensitive payment information and prevent unauthorized transactions.Best Practices for ACH Transactions

To ensure the secure and efficient processing of ACH transactions, it is essential to follow best practices. Some of the key best practices for ACH transactions include:

- Verify payment information: ensure that payment information is accurate and up-to-date to prevent errors and unauthorized transactions.

- Use secure payment systems: use secure payment systems and protocols to protect sensitive payment information.

- Monitor transactions: monitor transactions regularly to detect and prevent unauthorized activity.

- Implement robust security measures: implement robust security measures, such as encryption and firewalls, to protect payment information and prevent unauthorized access.

Common ACH Transaction Errors

Despite the many benefits of ACH transactions, errors can occur. Some of the most common ACH transaction errors include: * Insufficient funds: transactions may be rejected if there are insufficient funds in the originating account. * Incorrect payment information: transactions may be rejected if payment information is incorrect or outdated. * Unauthorized transactions: transactions may be unauthorized if payment information is compromised or if an individual or business is not authorized to initiate transactions.Future of ACH Transactions

The future of ACH transactions is promising, with ongoing innovations and advancements in payment technology. Some of the key trends and developments that are expected to shape the future of ACH transactions include:

- Increased adoption of real-time payments: real-time payments are expected to become more widespread, enabling faster and more efficient payment processing.

- Growing use of mobile payments: mobile payments are expected to become more popular, providing individuals and businesses with greater flexibility and convenience.

- Enhanced security measures: security measures are expected to become more robust, protecting sensitive payment information and preventing unauthorized transactions.

ACH Transaction Image Gallery

What is an ACH transaction?

+An ACH transaction is a type of electronic payment that allows individuals and businesses to transfer funds between accounts.

How do ACH transactions work?

+ACH transactions involve several steps, from initiation to settlement. The process begins when an individual or business initiates an ACH transaction, either through their bank's online platform or by submitting a payment request to their financial institution.

What are the benefits of ACH transactions?

+The benefits of ACH transactions include fast and secure payment processing, cost-effectiveness, convenience, and reduced risk of lost or stolen payments.

Can ACH transactions be used for international payments?

+ACH transactions are typically used for domestic payments within the United States. For international payments, other payment methods such as wire transfers or online payment platforms may be more suitable.

How secure are ACH transactions?

+ACH transactions are highly secure, with robust security measures in place to protect sensitive payment information and prevent unauthorized transactions.

In conclusion, ACH transactions have revolutionized the way individuals and businesses manage their finances. With their fast and secure payment processing, cost-effectiveness, and convenience, ACH transactions have become an essential tool for many. As the financial industry continues to evolve, it is likely that ACH transactions will play an increasingly important role in shaping the future of payments. Whether you are an individual or a business, understanding the benefits and uses of ACH transactions can help you streamline your financial operations and improve your overall financial management. We invite you to share your thoughts and experiences with ACH transactions in the comments below, and to explore the many resources available to help you make the most of this powerful payment tool.